Norton Motorcycles: Victims of missing pensions to be compensated

- Published

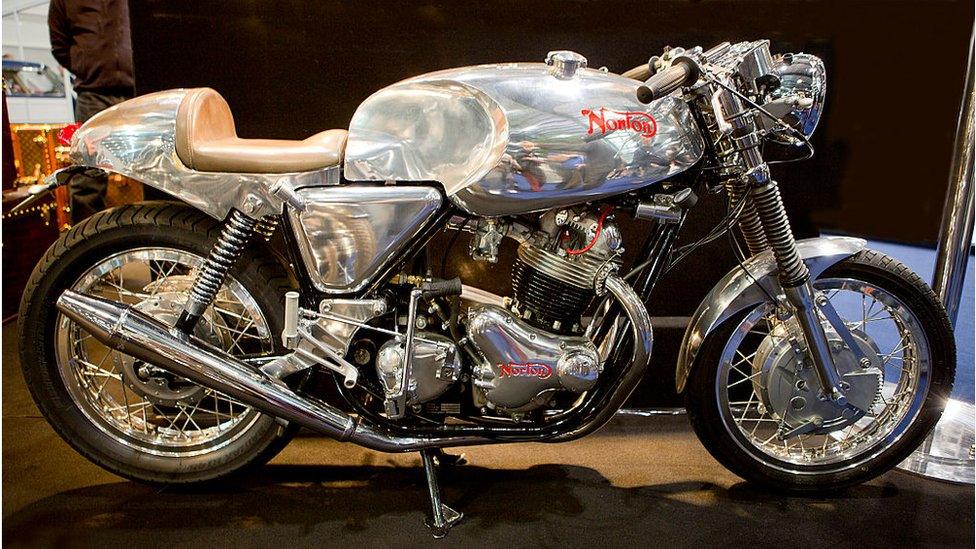

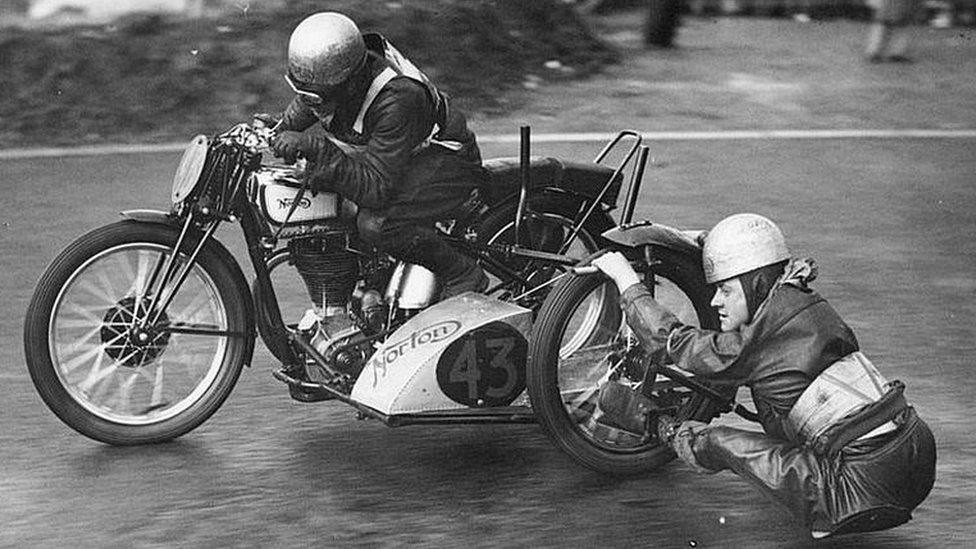

Stuart Garner appeared to have successfully revived the Norton brand, but it went into administration

People who lost their life savings in the Norton Motorcycles pensions scandal will be paid back in full, the Pension Protection Fund has said.

The announcement comes more than a decade after £11m of people's pensions were illegally invested into a business run by Stuart Garner.

He breached pensions regulations by investing all of their money into his business, when he should not have used more than 5%.

People are set to be paid this year.

Garner ran the Leicestershire-based firm from 2008 until it went bust in January 2020.

His business was given millions of pounds by the government and was endorsed by MPs, but people lost money after investing in three pension schemes, of which Garner was trustee.

Norton Motorcycles was bought out of administration in April 2020, and is now a separate business under new ownership.

Former chancellor George Osborne once visited Norton Motorcycles to announce a £4m government investment

The Pensions Ombudsman said Mr Garner "acted dishonestly and in breach of his duty".

He was given a suspended sentence over the missing pensions cash in 2022.

Two years on, Mr Garner says he has been unable to work since due to media coverage of the collapse of Norton, and that he had faced a "difficult personal bankruptcy".

"We had 12 strong years at Norton, generating £40m of revenue and creating hundreds of jobs," Garner told the BBC.

"Myself and the team at Norton were responsible for that. I never profited in any shape or form from the pension schemes."

He said it was "really good news" people were due to receive money they had lost. He said he had been working with officials to help those left out of pocket.

He added: "There were a huge amount of issues that led to those circumstances and I wish it hadn't played out as it had."

Sally Holmes said Mr Garner had taken money from vulnerable people like her father, Robert Dewar

Among the 227 members of the failed schemes was Robert Dewar, who transferred his £120,000 pension in 2012, and died in October 2019 aged 64.

His daughter, Sally Holmes, then spent five years trying to release her father's money.

She said her family were pleased the money would eventually be returned, even though her dad did not live long enough to receive it.

Ms Holmes said: "Especially for my mum, whom my dad wanted the money to go towards, will be over the moon.

"There were so many rules that [Garner] broke. Nobody was there making sure that somebody doesn't set up a scheme to scam hundreds of people out of money."

'Long time for redress'

Sara Protheroe, chief customer officer for the Pension Protection Fund, said she expected people would be "fully compensated" later this year.

Most of the money has come from the Fraud Compensation Fund (FCF), set up to help people when an act of dishonesty leads to a financial loss.

She said: "I'm really conscious they've been waiting a long time for redress.

"I'm pleased to say that on 7 March we made a payment of £9.4m to the trustees of the Norton pension schemes for them then to distribute to members."

She said the investors should soon be hearing from the trustees of their pension asking how much money they may have already received from the scheme.

Ms Protheroe added: "Members should be compensated to the full extent of their loss. Once the trustees have received that information, we will then provide a further top-up payment.

"We are keen to make sure that happens as quickly as possible."

She also revealed the FCF received £36,400 in January from Mr Garner, as a result of his bankruptcy, and the fund was "open to any future recoveries".

On Wednesday, she and a colleague will give evidence to the work and pensions select committee as part of an ongoing review.

She said: "We expect to be talking to them about the progress we have made on the Norton case and we want to talk about future safeguards to ensure members don't experience fraud like this in future.

"Additionally, should fraud take place, that there are a few tweaks to the rules of the FCF so that it is more straightforward to get payments to members as quickly as possible."

Follow BBC East Midlands on Facebook, external, on X, external, or on Instagram, external. Send your story ideas to eastmidsnews@bbc.co.uk, external or via WhatsApp, external on 0808 100 2210.

Related topics

- Published31 March 2022

- Published7 February 2022

- Published17 March 2021

- Published25 June 2020

- Published17 April 2020

- Published9 March 2020

- Published30 January 2020

- Published29 January 2020