Real-life Bridgerton treasures revealed in insurance papers

- Published

A family well-pleased having insured their horse fodder and "personal use" liquor

The most treasured belongings of Regency London's high society have been revealed in archive insurance documents.

The Hand in Hand Fire & Life Society was set up in 1696 - one of three insurance companies established in the wake of the Great Fire of London.

Its descendent company, Aviva, has released details of the hand-written policies issued more than 200 years ago.

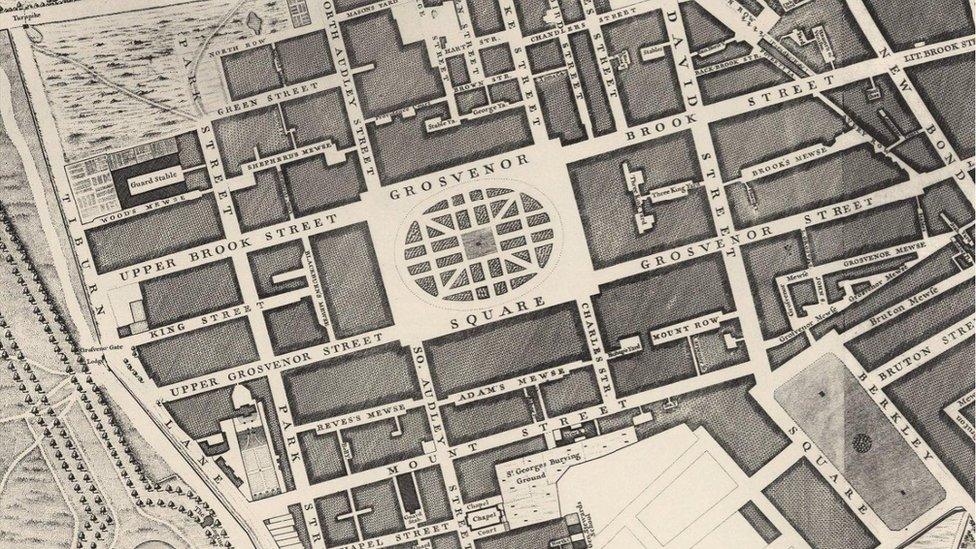

Looking at the layout of the square, it's little wonder residents appreciated their "mathematical instruments"

Many relate to residents of Grosvenor Square in Mayfair, the setting for TV drama Bridgerton - and still one of the country's most exclusive (and expensive) addresses.

Perhaps unsurprisingly, jewellery is one of the most insured items - but so are horses' harnesses, horse fodder, liquor "for private use" and mathematical instruments.

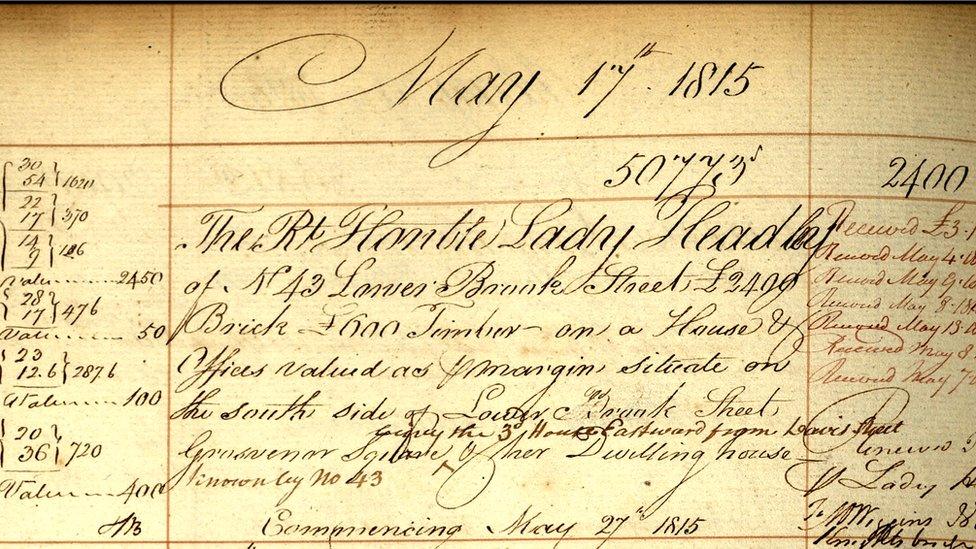

In 1815, the Rt Hon Lady Headley insured her four-storey house in Lower Brook Street, Grosvenor Square, for £3,000 (the equivalent of more than £3m today), while the Duke of Norfolk insured his home, on nearby St James's Square, for £8,000 (now about £8.1m).

Lady Headley sensibly insured her house for the equivalent of £3m

Many of the policies were taken out by people close to King George III and his wife Queen Charlotte, including the king's official watchmaker, musician, gunmaker and glasscutter.

Kew Palace and Hayes Palace were also insured with Hand in Hand on behalf of the king.

The documents reveal that Dorney Court in Buckinghamshire, which doubled as the coaching inn where Daphne Bridgerton and the Duke of Hastings stayed on their wedding night, was also in Hand in Hand's books, providing cover for seven rooms with wainscoting, two marble and six Portland stone chimneypieces, a woodhouse, coach-house and stables.

Wrotham Park, near Barnet, which doubled as the Bridgertons' ancestral home, Aubrey Hall, was originally insured for £5,000 (£13.3m) in June 1755 by its then-owner Admiral John Byng.

The Hand in Hand company was one of three insurance fims established in the wake of the Great Fire of London

Follow BBC London on Facebook, external, Twitter , externaland Instagram, external. Send your story ideas to hellobbclondon@bbc.co.uk, external

Related topics

- Published25 December 2020

- Published28 January 2021

- Published25 March 2022