Minister expresses concerns about Warrington Council's debt levels

- Published

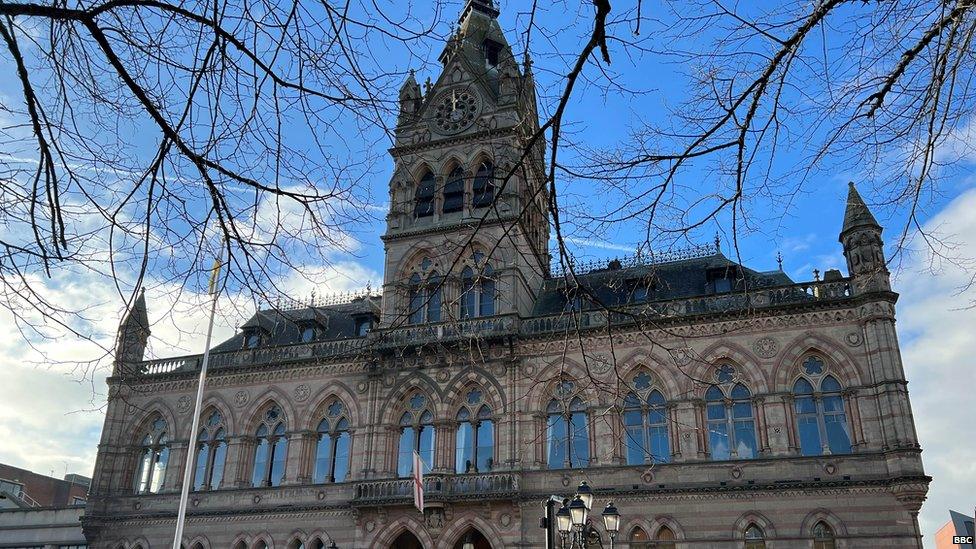

Warrington Council said it took "the findings of this report extremely seriously"

A local government minister has told Warrington Council that the findings of a review of its finances were "very serious", a letter has revealed.

Lee Rowley's letter to the authority, which has been seen by the BBC, said he was "concerned" that the council did not "fully appreciate" the level of risk it was exposed to.

As of July, the Labour-led council's investments had created £1.8bn of debt.

The council said it takes the finding of the report "extremely seriously".

It added that supported and accepted the recommendations of a draft copy of the review by the Chartered Institute of Public Finance and Accountancy (CIPFA), which has not been made public.

The council's Labour administration has come under pressure from opposition councillors over its investments, which include the ownership of supermarkets in Greater Manchester, solar farms in York, Hull and Cirencester, a BT development being built in Salford and a third share of Redwood Bank.

An energy firm part-owned by the council collapsed in 2022.

Returns 'not delivered'

In the letter, Mr Rowley said the council had the second highest level of debt owed by a unitary authority in England and its levels were more than double that of Slough, which effectively went bankrupt in 2021.

He said such levels of debt presented "significant risk to the council and public finances" and the review had highlighted that the authority's debt-funded investments were "large, uniquely complex and carry significant inherent risk".

He said the council lacked "clarity of the purpose of the investments" and that the quality of "scrutiny arrangements" was "disputed".

He added that he was "concerned" the council did not "fully appreciate the level of risk it is exposed to and has not taken adequate measures to mitigate and manage these risks".

The council owns a number of supermarkets in Manchester, including Asda in Hulme

Andy Carter, the Conservative MP for Warrington South, said he was concerned.

"What we've seen... is an increasing desire to move into almost hedge fund opportunities of speculative investments into organisations and businesses that are not based in Warrington," he said.

He said the investments had "promised a great return, but really have not delivered".

"I don't disagree that there are challenges around funding for all local government, [but] the solution is not to borrow £1.8bn and invest it into risky operations," he added.

A Warrington Borough Council representative said it had been in discussions with CIPFA on behalf of the government.

It said CIPFA's draft report had contained "a series of recommendations, which we support and accept".

"We take the findings of this report extremely seriously," they added.

"We await further discussion with officials, and look forward to working at pace on developing and implementing the recommendations.

"We welcome the final report being completed and published as soon as possible."

Why not follow BBC North West on Facebook, external, X, external and Instagram, external? You can also send story ideas to northwest.newsonline@bbc.co.uk

Related topics

- Published7 September 2023

- Published1 April 2022

- Published1 October 2021