King's Lynn car parks: Council owes VAT for machine overpayments

- Published

Tribunal judges agreed that the council entered into a contract with the driver by accepting more money

A council has lost an appeal over how it charges drivers for parking.

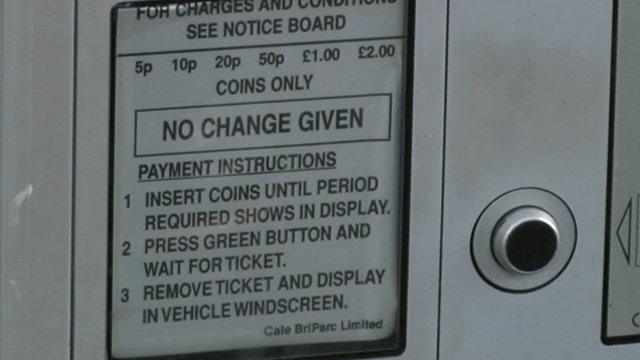

Off-street car park machines provided by the Borough Council of King's Lynn and West Norfolk do not give change if customers overpay for a tariff.

The council argued these overpayments were not taxable because customers could "recover" the money back.

The Upper Tribunal at the Royal Courts of Justice disagreed however and said these customer overpayments should be subject to VAT, external.

The council runs 29 car parks across its district, external in Burnham Market, Heacham, Hunstanton and King's Lynn.

The First-tier Tribunal originally ruled in January 2021 that the council should pay VAT.

The Borough Council of King's Lynn and West Norfolk had argued customers could retrieve their overpayments

It heard how the tariff for an hour's parking at one of the sites was £1.40, but that if a customer paid £1.50, they would not receive 10p change from the ticket machine.

The council said it did not have the power to vary its tariff in order to suit drivers and argued that customers could ask the council to reimburse them.

However, the First-tier Tribunal agreed with His Majesty's Revenue and Customs (HMRC), which argued that the council "entered into a contract with the driver" by accepting a counter-offer of more money for tariffs.

'Exact change'

The council appealed against the decision at the Upper Tribunal and in its decision Mr Justice Miles and Judge Greenbank once again ruled in favour of HMRC.

"There is a direct link between the entire £1.50 and the supply of parking with the result that that 10p 'overpayment' should be treated as consideration for the supply of parking services and therefore subject to VAT," the judgement said.

A spokeswoman for the council said: "This appeal was brought by the council as a test case, in order to clarify an important legal principle that concerns a number of local authorities nationwide.

"The council has not incurred any legal costs in making this appeal and, because the council has been paying the VAT pending the outcome of this case, this decision has no new financial consequences.

"The council welcomes the certainty that the court's decision now brings to an important area of VAT law for public bodies."

An HMRC spokesperson said: "HMRC welcomes this ruling which clarifies that VAT is liable to local authorities when customers overpay on their off-street car parking charges."

Find BBC News: East of England on Facebook, external, Instagram, external and Twitter, external. If you have a story suggestion email eastofenglandnews@bbc.co.uk

Related topics

- Published29 September 2022

- Published1 October 2017

- Published24 February 2015