North Norfolk: The place where one in 10 homes is largely unused

- Published

Polly Robins and her five-year-old dog Django rent a bright, pleasant one-bedroom flat. She says she will never be able to buy her own home

"I will never be able to buy my own home here," says Polly Robins, a third-generation resident of Wells-next-the-Sea, a North Norfolk town sitting in an area of outstanding natural beauty.

She is philosophical rather than bitter about her property prospects.

"I would want to own my place, but only because it would give me some security," the 50-year-old says.

And yet Ms Robins, who works 50 hours a week, counts herself lucky.

She, and her five-year-old dog Django, live in a bright, one-bedroom flat close to the town centre which she rents from a community organisation called Homes for Wells.

"Loads of people I know have had to leave Wells - and their jobs - because they just cannot get housing here."

"There isn't anywhere really to rent and the places that are here are too expensive," says Ms Robins

Beyond the City of London, North Norfolk has the highest level of homes either lying empty or infrequently used in England.

Of its 55,000 homes, nearly 6,000 are either second homes or long-term empty homes, which are defined as unoccupied and largely unfurnished.

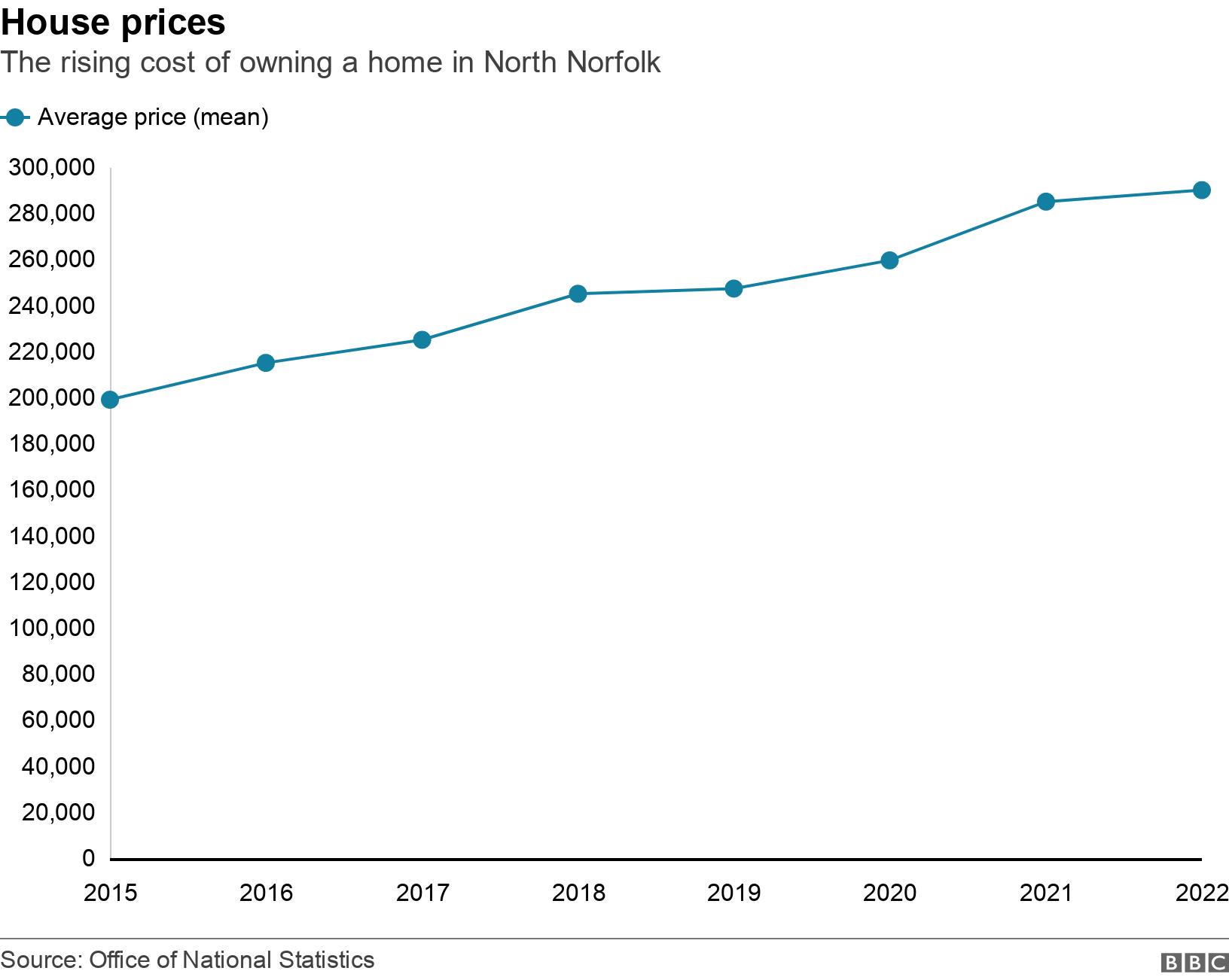

Yet despite this, more than 2,500 households are on the council's waiting list, external for a home in a place where the average cost of a house is £290,000, external and the average gross weekly earnings for full time workers is £587, external.

"There isn't anywhere really to rent and the places that are here are too expensive," says Ms Robins.

She charts the impact of second and holiday home buying on Wells, she says, through her mother's home in Chapel Yard.

When her mother moved there 25 years ago she was surrounded by neighbours who worked in the area.

She sold up and bought a bungalow in nearby Fakenham recently. When she left Chapel Yard, her mother was one of just two full-time residents in the street.

"All of the other homes were holiday lets," says Ms Robins. "So they were either empty, or there would be different people coming in each week."

Lynne Burdon bought her house in Wells in 2018 with a view to retiring to the town from her home in London in 2021

Like most people who buy a second home, Lynne Burdon fell in love both with the prospective property and its location.

She bought her house in Wells in 2018 with a view to retiring to the town from her home in London in 2021. The coronavirus pandemic forced her to bring forward her plans and she moved to Wells the day before the first lockdown in 2020.

"When I moved here I didn't understand the housing problem here at all," she says. "I saw this wonderful house by the sea with all of the things that I wanted. I just thought it looked amazing and I wanted to go there."

Ms Burdon is now more aware than most about the acute shortage of housing for those brought up both in Wells and the wider North Norfolk area.

As prices continue to rise, former council homes are being bought up as second homes, says Ms Burdon

A lawyer, she chairs Homes for Wells, a charitable community benefit society set up by locals who were deeply concerned about the town's housing crisis.

The organisation, itself modelled on similar groups in North Norfolk, currently has 31 properties it is letting out to key workers in Wells. It has 46 individuals and families on the waiting list of whom six are currently classed as homeless.

"The problem here is extreme because of the difference between the average wage and the average house price.

"I hear so many stories and it is just such a shame that families who have lived here all of their lives can't stay here because of the house prices.

"The reason the prices are pushed up so high is because of people like me - recent retirees - who come from places like London or Cambridge with money from the city, second home owners and holiday lets.

"There are big differences between them," she says. "Second home owners often plan to live here one day and can make a very valuable contribution to the community while others only come now and again and just use it as a holiday home.

"The holiday lets are good for local businesses, some would say, but they are all taking properties out of the market and pushes up the prices."

As prices continue to rise, former council homes are being bought up as second homes.

"At one time," says Ms Burdon, "those wouldn't have been attractive at all to second home buyers."

While Wells still has a vibrant and busy town centre, the impact of second home buying and the holiday rental market can be extreme.

Your device may not support this visualisation

"When you drive through some of the smaller villages in winter they are pitch black," says Heacham resident Tracy Raby. "There's nobody there at all."

She bought her bungalow in 2014 for £157,000. A similar home nearby recently sold for £350,000.

"It is like a perfect storm - there's a lack of social housing, a lack of affordable homes, rising prices, not enough well-paid jobs.

"People are moving into the area so the demand is there but they are second home buyers or those buying to let out."

When you drive through some of the smaller villages in winter they are pitch black - there's nobody there at all."

Mrs Raby, in her former role as a councillor, played a crucial role in developing Heacham's new local plan which stipulates new homes built in the area must be sold to those who intend to occupy them year-round.

Whether it will work, she says, remains to be seen, because there is nothing to prevent who those homes will be sold on to in the future.

Mrs Raby, who fears for the future of schools in the area, given the dearth of young couples staying in the area, says: "We've got an aging population.

"My biggest fear for Heacham is not that it will become a ghost town but a retirement village."

Action on Empty Homes advocates taxing second homes more and increased regulation on holiday and short-term lets

"The number of people under 35 with a mortgage has dropped by a half in the last 20 years," says Chris Bailey, national campaign manager at Action on Empty Homes. "It takes a hell of a long time to save for a deposit."

He claims the true picture in North Norfolk is probably worse than outlined because the figures do not include short-term vacant homes or other council tax exemption categories.

Action on Empty Homes advocates taxing second homes more and increased regulation on holiday and short-term lets.

"We need to get our existing empty housing stock back into use," says Mr Bailey. "The vast majority of them need retrofitting and that process becomes cheaper when more people are doing it."

The answers lie in investing in our housing stock to incentivise getting property back into use."

North Norfolk is far from alone in having a combination of under-used property and rising prices are often out of reach of the local population.

Other areas struggling include Cornwall, Hampshire, Suffolk, Devon and the north east.

"I spoke to somebody recently who told me when they bought their second home in Cornwall it was such a lovely village but now there were hardly any shops open there," he says.

"It was ironic, because that is what happens.

"The answers lie in investing in our housing stock to incentivise getting property back into use."

A government spokesperson said: "We are already taking action to combat the adverse impact that second homes can have on local communities - particularly in tourist areas - by closing tax loopholes, introducing higher rates of stamp duty and empowering councils to apply a tax premium of up to 100% on second homes.

"Councils have a raft of powers to bring empty properties back into use and we are clear they should be using them to deliver new homes for communities."

Find BBC News: East of England on Facebook, external, Instagram, external and Twitter, external. If you have a story suggestion email eastofenglandnews@bbc.co.uk

Have you been affected by the issues raised in this story? Please email us: haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803, external

Tweet: @BBC_HaveYourSay, external

Or fill out the form below

Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.