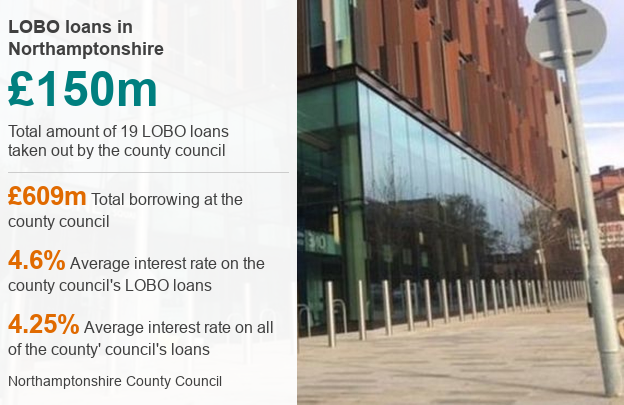

Northamptonshire County Council repaying £150m in LOBO loans

- Published

The county council is currently paying £68m per year on all of its loans, including 19 LOBO loans

A cash-strapped council which has banned all new spending is currently repaying £150m in "toxic" loans.

Northamptonshire County Council has invoked the ban on expenditure as it faces a £21m overspend for 2017-18.

It said it would cost more than a quarter of a billion pounds to immediately repay the LOBO - or Lender Option Borrower Option - loans, described by critics as "risky".

A council spokesman said "interest rate risk is inherent" in all borrowing.

The county council has a total of 19 LOBO loans, which are unregulated and typically spread over 40 to 70 years.

They were used to meet expenditure on highways, infrastructure, schools and other such assets.

The authority said said it would cost £256m to repay them straight away.

Critics say the repayments would be better spent on under threat services such as bus subsidies and Trading Standards.

Joel Benjamin, from campaign group Debt Resistance UK, called the loans "toxic".

He said the county council has "fallen victim to a lethal cocktail of cuts", poorly run shared-services and "high interest, risky LOBO borrowing."

Financial expert Abhishek Sachdev said LOBOs "contained huge quantifiable risk at the outset".

Mr Sachdev, who gave evidence about LOBOs to the Communities & Local Government Select Committee in 2015, external, added: "There is a reason why none of our large PLC corporate clients would ever enter into such a loan."

Freedom of Information requests by Debt Resistance UK, external show around 1,000 LOBO loans have been taken out across 240 local authorities.

The figures show these have a face value of £15bn, while Mr Sachdev estimated it would cost about £26bn to exit them straight away.

Northamptonshire County Council is currently consulting on cuts to library services, bus subsidies and to Trading Standards

Many councils took out LOBOs between 2003 and 2011 as they had a lower starting interest rate than Public Works Loan Board (PWLB) loans, the government organisation that provides loans to public bodies.

Interest rates are initially fixed, but lenders can impose new fixed rates at pre-determined periods.

Northamptonshire County Council sits 21st out of 240 local authorities for the highest level of LOBO loans on Debt Resistance UK's list.

A Local Government Association spokesman said councils manage "a range of borrowing" and LOBOs are "a legitimate financial instrument".

He added they should be viewed "in the context of a council's entire debt profile" and "not on the basis of hindsight".

The government ordered a review into the county council's finances last month

The council imposed a so-called section 114 notice earlier this month, believed to be the first such notice issued by a local authority in more than 20 years.

It has previously launched a campaign for fairer funding as it says it doesn't get enough money from central government.

It also faces increasing costs in adult social care and children's services.

One source within local government said: "I can't see the problems Northampton has have anything to do with simply having LOBO loans."

A county council spokesman said the authority has a range of products to mitigate against "interest rate risk".

He added it is "impossible to determine" how much the council would be paying per month if it had taken out PWLB loans instead of LOBOs "without further in-depth analysis".

- Published6 February 2018

- Published6 February 2018

- Published5 February 2018

- Published3 February 2018