Apostle Accounting: MPs intervene over tax rebate scandal

- Published

Apostle Accounting is owned by Zoe Goodchild, who set it up in 2012

A group of MPs has called for an investigation after constituents were told by HM Revenue and Customs (HMRC) they had wrongly been paid rebates.

They want HMRC to look into the practices of Suffolk firm Apostle Accounting.

An undisclosed number of people are facing four and five-figure bills because HMRC said they were paid money they were not entitled to.

Apostle maintained it had done nothing wrong and blamed HMRC.

HMRC has previously said it could not comment on individual cases.

Conservative MPs Dr Dan Poulter (Central Suffolk and Ipswich North), Liz Truss (South West Norfolk), George Freeman (Mid Norfolk), Tom Hunt (Ipswich) and Duncan Baker (North Norfolk) have all signed the letter to HMRC boss Jim Harra.

In it, they also called for HMRC not to apply back-dated interest on the money owed and to exclude Apostle's fee from these amounts.

The MPs said they had been contacted by many people in recent weeks, with the letter adding: "This case has caused significant concern locally, and a great deal of anxiety and stress among many of our constituents".

They also requested that HMRC tell them the estimated number of people affected.

The Conservative MP for Bury St Edmunds in Suffolk, Jo Churchill, added her voice calling for HMRC to meet with MPs.

In a post on Twitter, external, she described a response she had previously received from the department as as "inadequate".

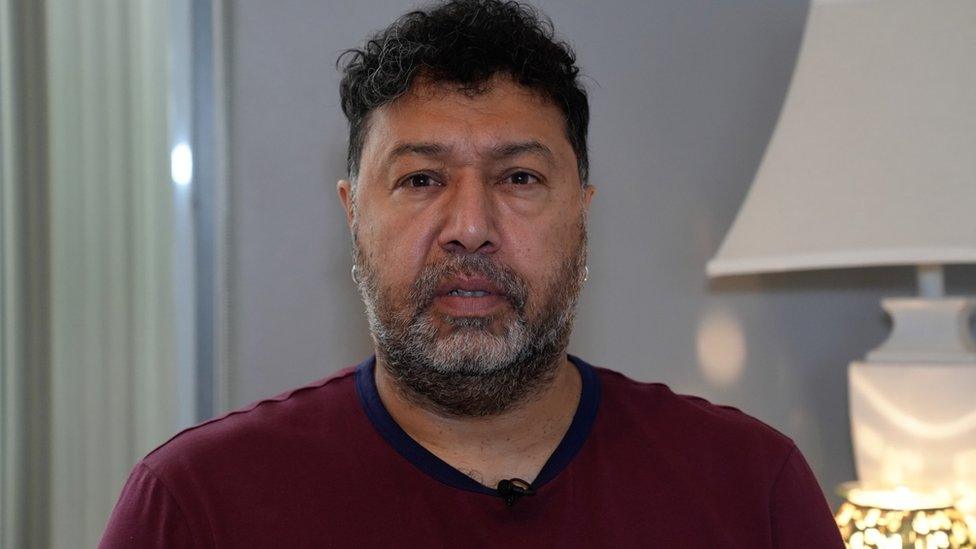

The Conservative MP for Central Suffolk and North Ipswich, Dan Poulter, initiated the MPs' letter to HMRC

A Facebook group, set up in March by people who stated they were aggrieved clients of the accountancy firm, now has more than a thousand members.

Apostle has stated that not all of these people were former clients of theirs.

Last week the BBC revealed how clients of the Stowmarket-based company had received bills amounting to thousands of pounds from HMRC.

They had submitted claims via Apostle to recover tax they had paid based on work-related expenses with many receiving pay-outs.

But the taxman subsequently issued notices that these sums had been wrongly claimed for and has issued repayment notices, with interest added.

'Unfounded'

The BBC also spoke to Apostle clients who alleged that the firm did not provide detailed breakdowns of the expenses being claimed for when it asked them to sign off on their applications.

Through its lawyers, Apostle denied any errors and said these claims were "unfounded".

It said it sought its own independent tax advice, which found no evidence that claims were made on behalf of customers without their knowledge.

They added HMRC had reviewed Apostle's approach to these expense claims in 2019 and found it to be acceptable.

Apostle said its advisers also felt the HMRC's actions appeared to be wrong, outside the law and its own guidance.

Previously HMRC said: "You should treat promises of easy money with real caution - if it sounds too good to be true, it probably is."

Find BBC News: East of England on Facebook, external, Instagram, external and Twitter, external. If you have a story suggestion email eastofenglandnews@bbc.co.uk

- Published19 April 2023