Apostle Accounting: Regional crime squad takes over

- Published

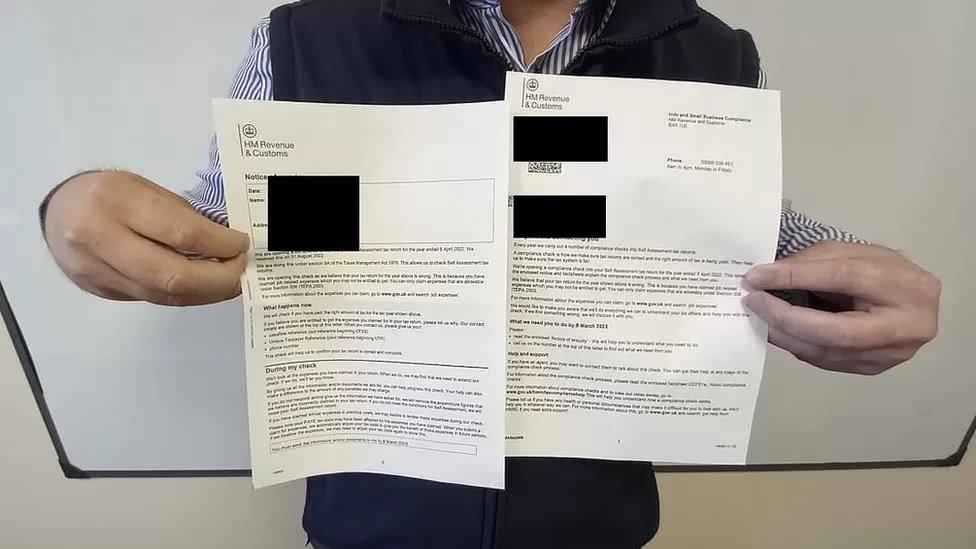

An anonymous Apostle Client holds up a repayment notice from HMRC

An investigation into a tax rebate scandal which has left hundreds of people facing large bills has been taken over by a regional fraud squad.

Specialists from the East Region Special Operations Unit (ERSOU) are now looking into Apostle Accounting.

Former clients of the Suffolk firm received demands from HM Revenue and Customs (HMRC) after being wrongly paid rebates for work expenses.

Apostle said it would co-operate with any investigation.

Figures compiled by a former client indicate more than 600 people have now come forward to say they had received rebates after making claims via Apostle totalling more than £2.7m.

The police have been made aware of two hundred people who have made complaints to the National Fraud Investigation Bureau, via Action Fraud, according to correspondence seen by the BBC.

ERSOU's main remits are tackling organised crime and counter terrorism policing.

The statement from the unit said: "Officers from the Eastern Region Special Operations Unit are investigating, after being made aware of allegations of fraud involving a business in Stowmarket, Suffolk.

"Investigators are liaising partner agencies, and enquiries are ongoing to establish if any offences have been committed."

Prosecutions assurances

Meanwhile a Suffolk MP has said he has received assurances from HMRC that the former clients will not be prosecuted or fined after receiving bills.

Dan Poulter MP said he had received assurances from HMRC over former Apostle clients

Dan Poulter attended a meeting with HMRC and parliamentary colleagues earlier this month.

He said: "In what has undoubtedly been a very distressing situation facing many people across Suffolk and further afield, I am pleased that HMRC have agreed they will not be taking action to prosecute or fine individuals who were clients of Apostle Accounting.

"Whilst I understand that HMRC will not comment regarding individual investigations, I am hopeful that they will give due consideration to thoroughly investigating this matter" Dr Poulter added.

In a new statement, Apostle Accounting welcomed HMRC's decision.

A representative said: "With HMRC having previously closed its own investigations into these matters, having found our approach to be acceptable, today's reports that they will not be pursuing any prosecutions or adding any extra fines onto our former clients represent another step forward.

They continued: "However, we share the view that investigations must continue in order to reach a positive outcome for our former clients, and we welcome the opportunity to work with MPs and other relevant authorities and stakeholders, in pursuit of that"

The firm stressed it had not been contacted by police "or any other authorities regarding any formal investigations".

In an earlier statement, the Stowmarket based company said it followed HMRC rules when rebate claims were made and awarded and it denied any allegations of "non-compliance issues and/or fraudulent tax claims".

HMRC had previously said it could not comment on individual cases.

Find BBC News: East of England on Facebook, external, Instagram, external and Twitter, external. If you have a story for us, email eastofenglandnews@bbc.co.uk, external or get in touch via WhatsApp on 0800 169 1830