Apostle Accounting: Hundreds face tax demands in rebate scandal

- Published

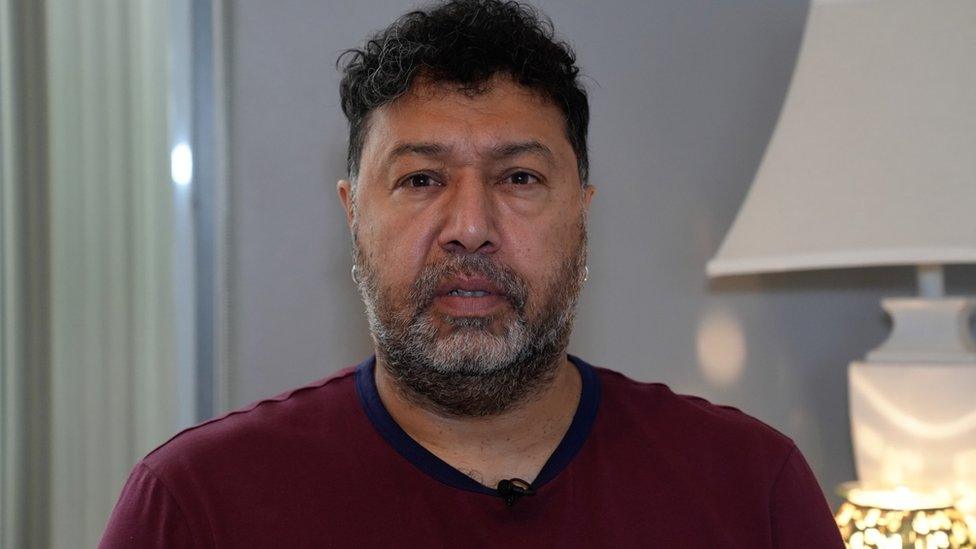

Former Apostle client Q Martin said a £30,000 repayment demand off HMRC would change her life

A police investigation into allegations made by workers facing huge tax bills may involve hundreds of cases.

People who used Suffolk-based Apostle Accounting to claim tax rebates have been told to repay the cash.

One woman told to repay £30,000 said it would change her life and was "devastating".

Apostle has denied any wrongdoing, while HMRC said it could not comment. Police confirmed officers were investigating alleged fraud.

Correspondence, documents and social media messages analysed by the BBC has identified at least 200 individuals who said they were facing payment demands.

An email from Suffolk Police sent to one stated that it was looking at"191 victims", with new reports being added.

A former client, Lee Osborne, said he had separately identified 362 people who had contacted him stating they owed or had already paid HMRC more than £1.6m between them.

He said: "HMRC needs to either write this off, or deal with it case by case, show empathy and cancel all interest and come to a payment plan that doesn't disrupt people's lifestyles."

Another, Q Martin from Eye in Cambridgeshire, has had to repay more than £30,000 back to HMRC.

In a letter, it said work expenses claims she had lodged via the firm "had been disallowed".

The senior commercial manager for pork producer Pilgrim's Pride said: "My whole life is going to have to change. The lowest point for me was when my son overheard me talk about it and come in in tears and ask me, 'Mummy, are we going to lose our house?'."

Becky Burris and her husband Mike have had to take out a loan to repay HMRC

Former Apostle clients Becky Burris, from Thetford, and her husband Mike both received demands and have had to take out a £9,000 loan to cover their liability to HMRC.

The couple work as a senior team leader and a senior chemist for pharmaceutical company Baxter Healthcare.

Mr Burris heard about the service Apostle was offering via colleagues.

Mrs Burris said: "We were bickering, we were arguing, not sleeping very well. It totally affected my mental health.

"It's been an absolutely horrific time. I didn't tell anybody in my family. I honestly felt so embarrassed and ashamed."

Five Suffolk and Norfolk MPs have written to the chief executive of HMRC, Jim Hirra, requesting that it investigates.

They have also asked the agency to end its final payment demands while any inquiry takes place, and to deduct the 24% fee Apostle charged customers from any demands for repayment.

HMRC said it would not comment on individual cases nor would it address an accusation from Apostle that its actions appeared to be "wrong, outside the law and its own guidance".

Apostle Accounting owner Zoe Goodchild has described herself as a "disruptor" of accountancy

The firm had previously denied allegations that it had sent off tax rebate claims on behalf of clients without informing them first what expenses were being claimed for.

"The allegations, if any, that individuals were not provided breakdowns as to the expenses is unfounded - Apostle has breakdowns for each of its former clients, with the individuals fully aware of how such sums were calculated," it said in a previous statement.

However, the BBC has obtained emails Apostle sent to clients from a former employee which appeared to contradict this.

One stated the firm "don't give breakdowns out to clients as previously, clients have then used this information to file themselves which is essentially work we have completed and can possibly lead to fraudulent claims being processed without our knowledge".

Apostle has declined to comment further, but in an earlier statement it denied any allegations of "non-compliance issues and/or fraudulent tax claims" and said "it is entirely confident that it will demonstrate its compliance with the applicable rules and regulations".

Its own tax advisers point the finger at HMRC, saying the taxman had reviewed Apostle's approach in 2019 and found it to be acceptable.

The BBC has also made repeated requests to the Institute of Certified Bookkeepers, which Apostle is a member of, for comment, but it has not responded.

Previously HMRC issued a statement, saying: "You should treat promises of easy money with real caution - if it sounds too good to be true, it probably is."

Find BBC News: East of England on Facebook, external, Instagram, external and Twitter, external. If you have a story suggestion email eastofenglandnews@bbc.co.uk

Related topics

- Published27 April 2023

- Published26 April 2023

- Published19 April 2023