Former Apostle Accounting staff member 'ashamed'

- Published

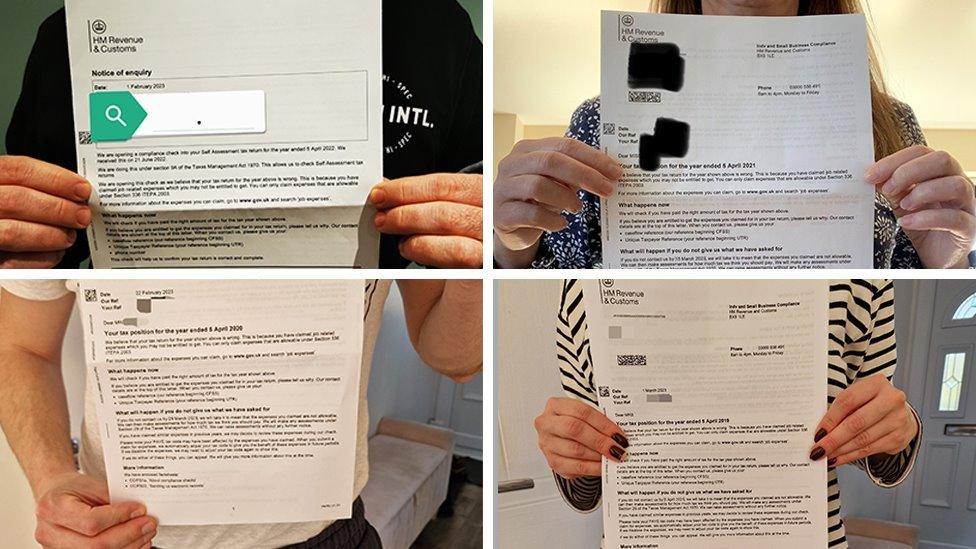

About 800 people were left with large bills after claiming tax back for work related expenses which they discovered they weren't entitled to

An ex-employee of a company at the centre of a tax rebate scandal has spoken of being "heartbroken and ashamed".

More than 800 people were left with large tax bills after Suffolk-based Apostle Accounting submitted claims on behalf of clients which they were not entitled to.

The former staff member described their shock at what had happened.

Apostle did not comment when approached by the BBC.

The worker, speaking on condition of anonymity, recalled their distress at learning hundreds of former clients had started to receive demands from HM Revenue and Customs (HMRC) for repayment.

They said they now felt "awful, absolutely awful".

Emails also appear to contradict statements from Apostle that it provided clients with breakdowns of items it claimed for on their behalf.

Previously the company said it had done so.

Apostle Accounting had previously stated it did provide clients with breakdowns of expenses items being claimed on their behalf

The East Region Special Operations Unit (ERSOU), which is funded by local police forces and investigates serious and organised crime, said it is now contacting about 300 people to update them and obtain statements.

Some individuals now face bills of tens of thousands of pounds with total repayment demands from HMRC running to more than £3.5m according to figures compiled by Lee Osborne, a former client.

"We thought it would be a thing we could claim for as well but obviously we couldn't," the former Apostle worker said.

When asked how they felt about the predicament many clients now found themselves in, they said they were "heartbroken and ashamed" and that it "breaks my heart they've been left in the lurch to deal with this".

The company, previously based in Stowmarket, was controlled by husband and wife Martin and Zoe Goodchild and ceased trading in October when a liquidator was appointed.

Word of the service Apostle was offering spread swiftly around workplaces.

People who then approached the firm were asked to fill in some forms and send over information about their employment along with copies of their previous P60 tax statements.

The company is then accused of sending back its calculations under one catch-all title, "allowable expenses", and clients received their tax rebates.

Dean Hutley was told by Apostle Accounting that it could not provide a breakdown of the individual expenses it claimed on his behalf

Apostle previously said it provided clients with specific details of what was being claimed for on their behalf.

The company told the BBC 1's Rip Off Britain programme in October: "Clients received a breakdown based on the full figures, which itself was based on the figures received and the conversations held with the clients".

However in correspondence to some clients who had asked what exactly had been claimed for on their behalf, the company said that it could not share this information.

In an email from April 2021, Apostle told Craig Bedford from Ipswich: "We don't give breakdowns out to clients as previously, clients have then used this information to file themselves which is essentially work we have completed and can possibly lead to fraudulent claims being processed without our knowledge."

The following July Dean Hutley, who lives in Thetford in Norfolk and now owes HMRC £13,000, was told in an email: "We can't give you a full breakdown of expenses as this is not available to the public."

He said: "I was told in no uncertain terms that I was not allowed to be made aware of what these claims were. I've never actually had a breakdown of what the claims were that's been added on in my name.

"I had numerous phone calls and numerous emails with Apostle and now it's just radio silence."

The ex-staff member said: "When some clients did start asking for breakdowns after they signed the documents, Zoe told myself and the other members of staff at the time to respond saying 'we do not provide breakdowns'. Obviously I've seen Zoe's comments about that they do which is quite laughable really."

A voluntary liquidator has been appointed for the company and a 'Declaration of Solvency' uploaded to the Companies House website which identified assets of £275,000 with liabilities of just over £35,000.

The document also stated the company would be able to pay its debts in full.

Prior to that control of Apostle Accounting was transferred to another entity owned by Mrs Goodchild and her husband Martin, called LSHE Holdings.

Apostle did not respond when approached by the BBC about the former employee's comments and the emails.

It had previously denied any wrongdoing.

Find BBC News: East of England on Facebook, external, Instagram, external and Twitter, external. If you have a story suggestion email eastofenglandnews@bbc.co.uk