Apostle Accounting: Why were hundreds left in debt over tax claims?

- Published

Hundreds of clients of Apostle Accounting say they have received repayment demands off HMRC

Hundreds of people across the country have been left owing significant sums of money after trusting their tax claims with just one company.

It is a decision they now sorely regret.

Rumours spread across workplaces that a Suffolk firm called Apostle Accounting was promising to help people claim tax relief for work expenses.

They contacted Apostle, which sent off their claims, and thousands of pounds in rebates were paid out.

But HM Revenue and Customs (HMRC) say these clients were not entitled to the money and it wants the cash back.

A police inquiry is now under way.

BBC One's Rip Off Britain has recapped what happened in its programme broadcast earlier.

How did these tax claims work?

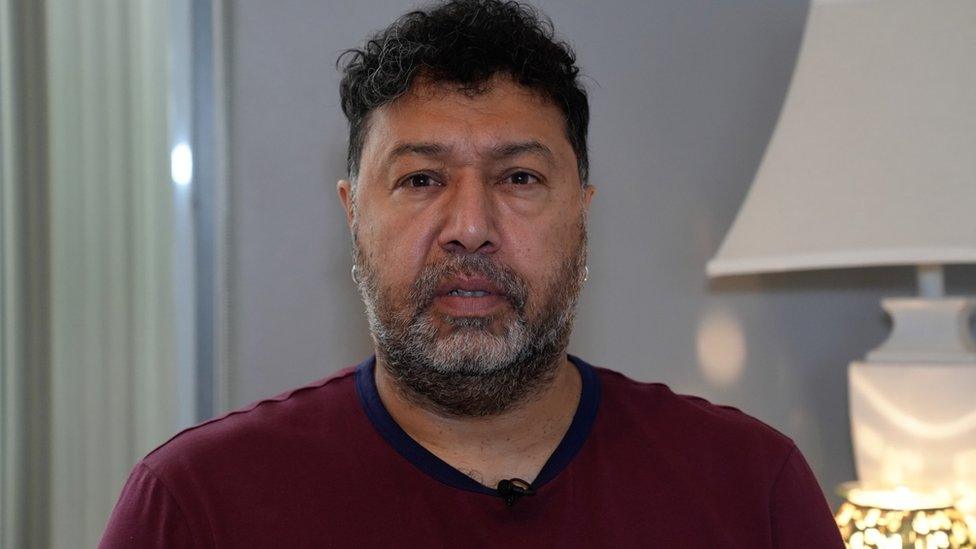

Lee Osborne, who was left owing thousands of pounds, has been gathering information about the number of Apostle clients who now owe money

Lee Osborne found out about the service offered by Apostle through a friend at work in 2020.

Apostle asked him to fill in some forms and send over information about his job in the food industry along with copies of his previous P60 tax statements.

Mr Osborne said that he never sent details of his expenses, but when Apostle sent back its calculations, rather than itemising his entitlements there was just one catch-all title: "allowable expenses".

Apostle told him he was owed £19,000 and after deducting their 24% fee, he was paid £14,000.

But two years later, Mr Osborne, from Sawtry in Cambridgeshire, said he received a letter off HMRC.

"I got this letter which said 'we are opening a compliance check into your self-assessment tax return. This is because you have claimed job-related expenses which you may not be entitled to get'."

Apostle told him that there was little it could do unless they argued he was entitled to the allowances and had the receipts.

"How can I have receipts of something when I do not know what they have claimed for on my behalf?" Mr Osborne said.

With the interest charged by HMRC, he now owes them £21,000.

How many people have been caught out?

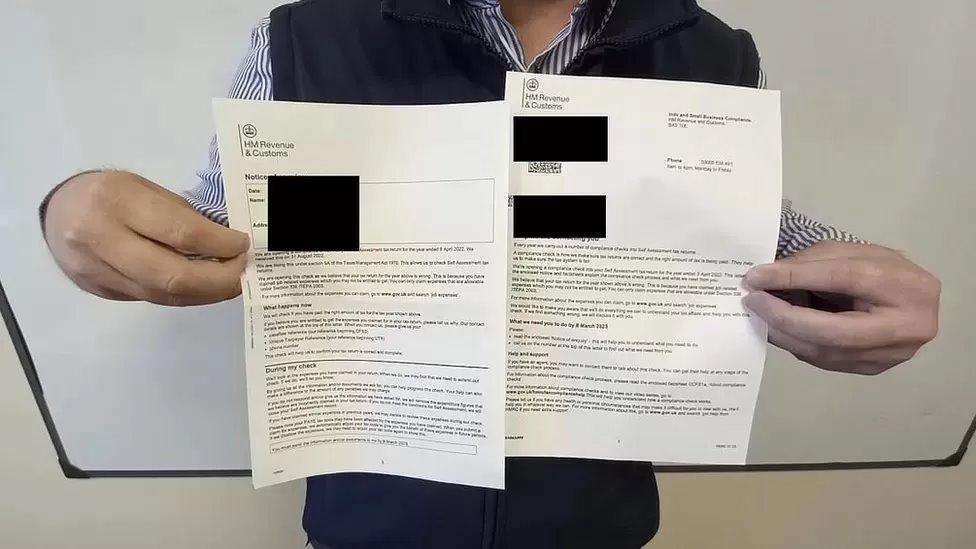

Former Apostle client Q Martin received a £30,000 repayment demand off HMRC

One MP has described the number of constituents coming to him with complaints about Apostle as 'unprecedented'.

Mr Osborne has been collating the number of people facing repayment demands who he is in touch with.

"On the list currently there are 800," he said.

Between them these people have been told by HMRC they must pay back more than £1.8m.

Among them is Q Martin from Eye near Peterborough. She previously told the BBC she owed HMRC more than £30,000.

"My whole life is going to have to change," she said.

Apostle Accounting had said 1,400 people had taken up the service since 2016.

What does Apostle Accounting have to say?

Apostle Accounting is owned by Zoe Goodchild, who set the company up in 2012

In a statement to Rip Off Britain, the company, based in Stowmarket in Suffolk, said it rejected any accusation of wrongdoing "in the strongest possible terms".

It stressed "this is not solely an issue that former Apostle Accounting clients are dealing with".

The company said it had provided a breakdown of claims "based on the figures received and the conversations held with the clients".

When Apostle were repeatedly asked for evidence of such breakdowns none was provided.

It also said it was "unequivocally clear" to clients that the information they provided to Apostle had to be "honest, complete and accurate and that failing to do this could lead to HMRC adjusting tax codes, seeking payments or the threat of penalties".

They continued that they had "no reason to believe that rebate claims were submitted when a client was not entitled to such expenses claimed".

Apostle Accounting was incorporated in 2012 by Zoe Goodchild who ceased to be the person with significant control (PSC) in May 2023.

The PSC is currently listed as a company called LSHE Holdings Ltd, which is owned by Ms Goodchild and her husband Martin.

Have HMRC commented?

HMRC's Angela MacDonald says if nobody is asking you lots of questions about your tax affairs before submitting a claim then think twice

HMRC's deputy chief executive Angela MacDonald said she could not speak about individual cases.

But she told Rip Off Britain: "A customer is always responsible for their tax affairs and we recognise that in some instances customers will ask a third party, a tax agent, to help them.

"But legally, no matter what actions somebody takes on their behalf, a customer is always responsible for claims which are submitted on their behalf."

Last year, HMRC ran a consultation , externalto address concerns about so-called tax or repayment agents.

"We have stepped up the requirement for tax agents to register with us so that we can do more due diligence checks on who they are," said Ms MacDonald.

"The government is consulting on going even further in questions about membership of professional bodies and qualifications - the kind of things which give the kind of oversight which customers might experience when buying financial services products."

What is the expert's view?

Lawyer Arun Chauhan, who specialises in fraud and financial crime, said the real issue was Apostle customers saying they hadn't seen the detail of their claims

Lawyer Arun Chauhan told Rip Off Britain the "kicker' was Apostle clients saying they had not been told what was claimed for on their behalf.

"What we have got here is, at best, Apostle not being diligent. At worst, my fear is that this is dishonesty," he said.

"If Apostle are going to HMRC and saying 'these are claims that are genuine' but they actually haven't checked themselves or they just don't care if they're correct, that could potentially be dishonest action.

"There are lots of good companies that advise clients on tax rebates. After my own research what I have found is that getting a tax rebate on employment income is quite tight. There are only a few limited areas and the good ones out there will tell you that."

He said the Apostle clients featured on the programme had not had enough explained to them and now they were finding they owe HMRC thousands of pounds.

You can watch the report in full on Rip Off Britain on BBC One on Wednesday, 4 October, and available on the BBC iPlayer after broadcast.

Follow East of England news on Facebook, external, Instagram, external and X, external. Got a story? Email eastofenglandnews@bbc.co.uk, external or WhatsApp us on 0800 169 1830

Related topics

- Published10 July 2023

- Published11 May 2023

- Published28 April 2023

- Published27 April 2023

- Published26 April 2023

- Published19 April 2023