Surrey Council tax rise of 15% approved before public vote

- Published

Surrey County Council said there was a 'huge gap' in its budget but its proposed council tax increase is five times last year's average

A 15% increase in council tax has been approved in Surrey - before a referendum on the issue has been held.

Authorities are legally required to hold a vote on increases above 2%, but the council's cabinet gave the go-ahead on Tuesday.

If it is rubber-stamped by full council, residents could be landed with the tax hike in April - a month before May's ballot on the issue.

The Conservative-led council said government cuts were to blame.

'More for less'

It is expected to approve the new rates - which would add £200 a year to the bill for a Band D property - at a meeting next week.

Waiting until the referendum - to be held alongside local elections on 4 May - would prevent the council from starting "vital" work to identify areas for spending cuts, it said.

The ballot would cost up to £300,000, plus a further £630,000 to send out new bills if the rise was rejected, according to council documents, external.

It has drawn up an alternative budget in case it loses the referendum.

What next?

Government legislation says the council tax bills must be issued as usual in March and then amended if the rise is rejected in the referendum.

If paying by direct debit, council tax payers would be debited for April and May, including the increase, and if the rise is rejected their remaining monthly debits would be recalculated for the remaining months.

Those paying annually would receive a new bill and a refund if the budget is rejected in the public vote.

Highest average bills

Surrey County Council's planned 15% rise only affects its portion of the bill. The district councils, police and crime commissioner, fire authority and parish councils all set their own and add it to the overall charge.

However, when these are taken into account, council taxpayers across Surrey already have some of the highest bills in England.

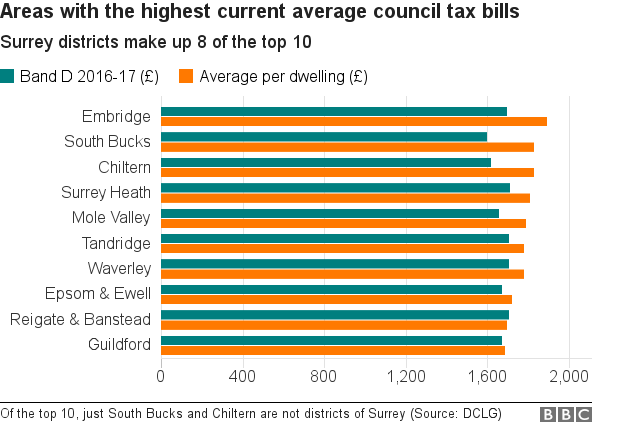

Districts of Surrey account for 8 of the 10 largest average annual bills per home, according to figures from the Department for Communities and Local Government.

The average council tax in Elmbridge, taking into account property of every value, was £1,893 for 2016-17.

In Surrey Heath it was £1,810.

This is because the Band D rate (£1,696 in Elmbridge), often referred to as the "average", is not the average in areas with larger numbers of more valuable homes.

Claire Kober, chairman of the Local Government Association's resources board, said: "After years of striving to keep council tax as low as possible or frozen, many town halls have found themselves having to ask residents to pay more council tax over the next few years, particularly to try and offset some of the spiralling costs of social care.

"Services supporting the elderly and disabled are at breaking point. It cannot be left to council taxpayers alone to try and fix them.

"Only genuinely new additional government funding for social care will give councils any chance of protecting the services caring for our elderly and disabled."

Analysis: BBC Surrey political reporter Jack Fiehn

I have been going to cabinet meetings at county hall for several years now, but the mood at this one was particularly solemn.

Conservative councillors said that such a large tax rise went "against the grain", was "counter intuitive" and done with a "heavy heart".

But, in the end, the vote in favour was unanimous.

Councillors also approved an alternative budget, based upon a 5% tax rise, in case the referendum in May is lost. However, they argued that this is not a sustainable option and would mean "draconian" cuts to services if it happened.

Will there be a last minute deal which leads to the referendum being cancelled? The council leader David Hodge said that if the government does make an offer of extra funding over the next few days, he will make a decision about bringing it to the full council meeting on 7 February. If an offer were to happen after that date, he said he would call an emergency meeting.

So there are negotiations taking place and it is still not certain that this tax increase will go ahead.

Councillor Hazel Watson, leader of the Lib-Dem opposition on the council, said: "The Conservative administration at County Hall is asking Surrey residents to pay more for less - an unreasonable and unaffordable 15% council tax increase and £93m of unspecified cuts in council services.

"It is time for the Tories at County Hall to end their secrecy and to spill the beans about the £93 million of cuts which are coming down the pipeline."

The council said the alternative budget would lead to cuts of £30m in 2017-18, rising to £73m in 2019-20.

The council said: "Because a referendum on the proposed council tax would not happen until 4 May 2017, the council would lose time beginning the extra work to achieve the additional £30m service reductions it would need to find within 2017/18."

- Published2 February 2017

- Published19 January 2017

- Published6 January 2017

- Published14 December 2016

- Published13 December 2016

- Published12 December 2016

- Published12 December 2016