Sirius Minerals: Yorkshire investor loses £24k of pension

- Published

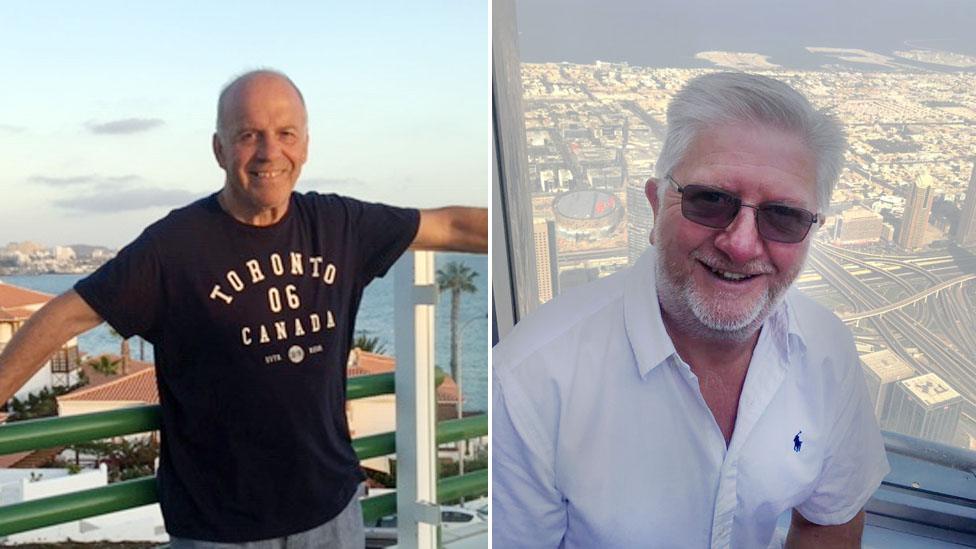

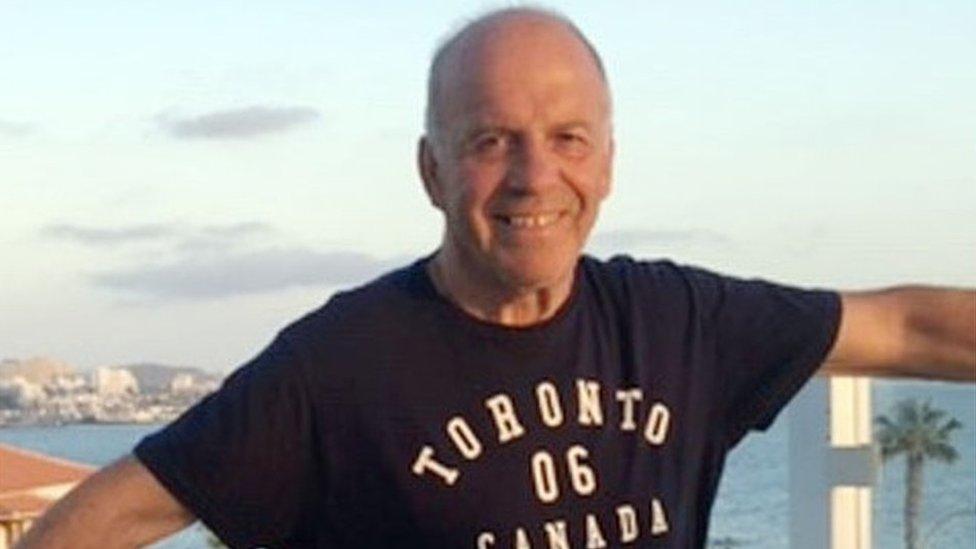

Nigel Howard said his children had also bought shares and lost money

Small investors who took a gamble on backing a mining development in North Yorkshire have been left facing huge financial losses after a takeover.

Nigel Howard, 75, wanted to support a potential lifeline for his local economy when he cashed in his entire £30,000 pension pot to buy shares in Sirius Minerals, the company behind the project.

But his financial hopes were shattered after a rescue takeover by Anglo American was agreed with a big drop in share value.

A retired property developer, Mr Howard, from Northallerton, put his money into Sirius when the company was growing and shares were trading at 24p.

However, the company was forced to seek a takeover to continue work on its polyhalite mine south of Whitby after failing to secure vital funding last year.

The plans for the under-construction mine include a minehead at Dove's Nest Farm, Sneaton, in North Yorkshire

The deal was agreed on Tuesday with a 5.5p share offer meaning big losses for the 85,000 investors - many of whom live near the development.

Mr Howard said: "I'm going to walk away with about £6,000 so I'm devastated.

"Buying stocks and shares is a gamble and I knew there were risks but the reason I put so much in was because it's in my area and it was good to think I was supporting something which would create a lot of jobs."

So convinced that the project was a "good bet" Mr Howard's children also invested.

"There's an awful lot of people around here who put money in and an awful lot of them have lost it.

"My wife had considered putting some of her money in but thankfully she didn't and we still have her pension, plus my state pension."

Another shareholder Luke Faichney, who has also lost money, said he knew of people who had remortgaged their homes and borrowed large amounts of cash to invest.

Polyhalite can be used as a fertiliser for crops

The 40-year-old, from Robin Hood's Bay, said many people felt Sirius Minerals had "mis-sold" them an impression that the project would make money.

"The company came into town and targeted the local community with their flashy brochures and an offer to be part of something great.

"Although there are obvious risks with this kind of thing, they didn't really highlight them to people, especially to those inexperienced investors."

"We're all feeling pretty hard done by."

'Clearly disclosed risks'

Sirius said it was confident it had complied with legal and regulatory requirements, including setting out all the potential risks of investing in its 500-page prospectus.

"Investors should be taking professional financial advice with regards to investment decisions," the company said in a statement.

"The company is bound by the high standards of the London Stock Exchange and is confident it has acted in accordance with these.

"We recognise that shareholders are disappointed with the current situation, but the company has clearly disclosed the risks associated with the business, which is a single asset development project requiring billions of pounds of investment to reach production."

- Published4 March 2020

- Published20 September 2019