York records strongest house price rises in 2022

- Published

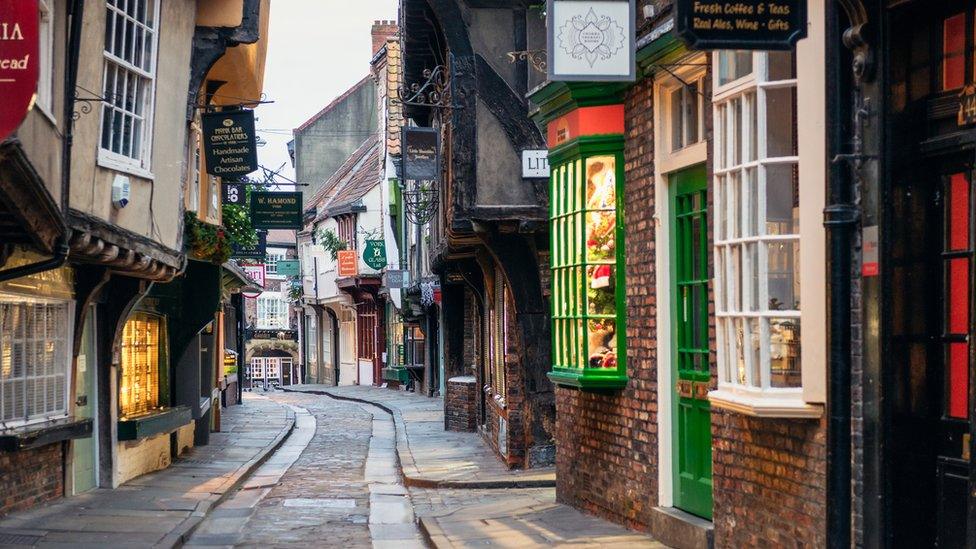

The Shambles is one of the city of York's most famous landmarks

House prices in York have surged more than anywhere else in England and Wales in the past year, figures have shown.

Prices in the city in 2022 grew by 23.1%, or £69,648 on average in cash terms, according to the Halifax bank.

A typical property in York was now worth £370,639, with Woking in Surrey and Swansea ranked second and third.

Meanwhile, Leicester saw the weakest annual growth in house prices, the bank said, with Hull - just an hour's drive from York - in second place.

Since March 2020, when the coronavirus lockdowns started in the UK, average house prices in York had risen by 41.9% or £109,457, the figures collated by the Halifax showed.

House prices in York rose by an average of 23.1% in 2022, the Halifax found

Over the past year, Woking, a commuter town with good links to London, saw the biggest average house price increase of any town or city in England and Wales in cash terms, with a rise of £93,626.

Kim Kinnaird, mortgages director for the Halifax bank, said: "Overall, 2022 was another year of rapid house price growth for most areas in the UK.

"And unlike many years in the past, the list isn't dominated by towns and cities in the South East.

"Nowhere is that more the case than in the cathedral city of York, which saw the highest property price inflation across England and Wales this year, rising by over a fifth."

London still had some of the highest property prices in the country, but recorded comparatively modest house price inflation over the past year, Ms Kinnaird added.

"This is partly due to pandemic-driven shifts in housing preferences as buyers sought bigger properties further from urban centres," she said.

Leicester recorded the weakest house price inflation in the past year, according to the Halifax

"We can see this clearly in commuter towns such as Woking, Chelmsford and Hove, which - with their more diverse range of properties perhaps offering better value - recorded much bigger increases over the last year."

Tom Bill, head of UK residential research at estate agent Knight Frank, said: "This year saw the 'escape to the country' trend wind down, while the return to towns and cities gathered pace.

"York captures the best of both of those worlds. Many people moved to Yorkshire during the pandemic due to family ties and the relative affordability compared to areas such as the Cotswolds.

"Meanwhile, the strength of south east England underlines the gravitational pull of the capital as the economy reopens."

The towns or cities with the strongest house price inflation in 2022:

1. York, North Yorkshire, with an average house price of £370,639, an increase in cash value of £69,648 (23.1%)

2. Woking, Surrey, with an average house price of £586,925, an increase in cash value of £93,626 (19.0%)

3. Swansea, Wales, with an average house price of £265,379, an increase in cash value of £39,450 (17.5%)

4. Chelmsford, Essex, with an average house price of £485,770, an increase in cash value of £69,775 (16.8%)

5. Kettering, Northamptonshire, with an average house price of £326,895, an increase in cash value of £44,731 (15.9%)

The towns or cities with the weakest annual growth in house prices in 2022:

1. Leicester, with an average house price of £271,092, a decrease of £10,212 (-3.6%)

2. Hull, with an average house price of £163,677, a decrease of £4,956 (-2.9%)

3. Maidenhead, Berkshire, with an average house price of £549,722, a decrease £12,326 (-2.2%)

4. Stoke-on-Trent, Staffordshire, with an average house price of £183,928, a decrease of £3,149 (-1.7%)

5. Islington, London, with an average house price of £712,843, a decrease of £3,059 (0.4%)

(Figures show change in 12 months to November 2022. Source: Halifax bank)

Follow BBC Yorkshire on Facebook, external, Twitter, external and Instagram, external. Send your story ideas to yorkslincs.news@bbc.co.uk, external.

- Published1 August 2023

- Published18 November 2022

- Published14 November 2022

- Published4 May 2022