DUP 'to cut public sector jobs for corporation tax cut'

- Published

The DUP is proposing to cut public sector jobs to pay for a tax reduction for companies, the BBC has learned.

A DUP paper submitted to the current inter-party talks suggests voluntary redundancies could save £400m a year.

It says Northern Ireland's public sector could be brought "into line with the reductions that have already taken place in the rest of the UK".

This would help to balance the budget and allow room to reduce corporation tax in NI, it says.

'Rebalancing'

The paper, seen by BBC Radio Ulster's Nolan Show, says the changes would take place over the next three to four years.

"If the government gives the NI Executive this power, it will take 24 months to prepare the systems before the executive could commence the reduced corporation tax level.

"This will demonstrate 'the rebalancing of our economy' in action."

The party says the voluntary redundancies must be "planned and phased to ensure the least possible disruption to services".

"We expect the proposal coming from officials for the immediate roll-out of the scheme to be less ambitious, but we want to allow for advanced understanding of our intended longer-term direction of travel," it adds.

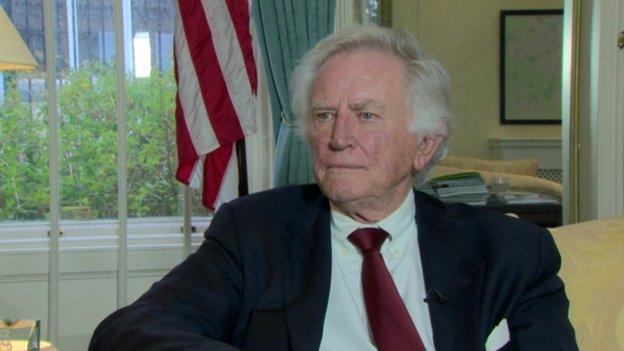

Analysis: BBC NI economics editor John Campbell

The number of public sector jobs in Northern Ireland has fallen in recent years - but the fall has been greater elsewhere in the UK.

The official Quarterly Employment Survey shows public sector employment fell by 10% in the UK between 2010 and 2013.

The reduction in Northern Ireland was less than 4%, while in Scotland it was almost 8%.

The latest figures show that just over 212,000 people in Northern Ireland are public sector employees.

If 14,000 jobs were lost, that would equate to a cut of about 6.5%.

Bumper Graham of the public service union Nipsa said: "I'm not surprised, as we've known for some time that the assembly parties, particularly the DUP, want to cosy up to big business and destroy ordinary people's lives.

"It's the loss of 14,000 salaries to the local economy, it's the loss of business to the local economy and it is the loss of essential public services.

"How can you boost the private sector if you are taking out of Northern Ireland 14,000 jobs?"

Business commentator and former NI Conservatives chairman Irwin Armstrong said: "It's fairly common knowledge that our public sector here is overmanned - we can privatise all sorts of things to raise money.

"A corporation tax cut, even if we did it next April, would not make any meaningful impact until 2017 because it would take some time to bring in new businesses.

"Countries that have cut corporation tax, from Hong Kong and Canada to the Republic of Ireland, so far outperform us in terms of attracting inward investment - you take one step across the border and save 7.5%."

While the Republic of Ireland's 12.5% corporation tax rate has been a cornerstone of the economy for many years, the current rate paid by businesses in Northern Ireland is 21%.

Last month, DUP Enterprise Minister Arlene Foster told the assembly that a lower rate of corporation tax could produce "in the region of 50,000 jobs" over a relatively short period.

- Published2 November 2014

- Published31 October 2014

- Published30 October 2014

- Published30 October 2014