Corporation tax cut unlikely in 2017 - Arlene Foster

- Published

The Northern Ireland executive wants to be able to match the tax rate in the Republic of Ireland

Finance Minister Arlene Foster has conceded it is unlikely that Stormont will be able to introduce a reduced rate of corporation tax in 2017.

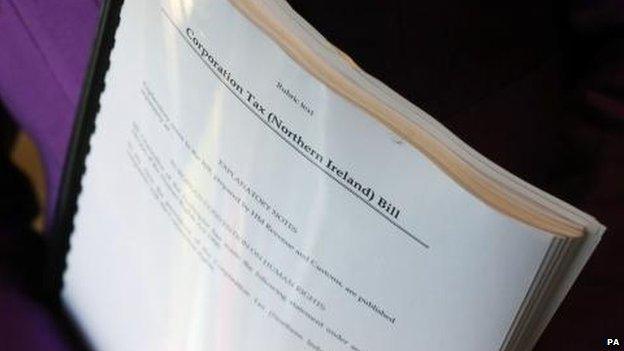

The legislation allowing the tax power to be devolved to Stormont was passed at Westminster in January.

However, it included a "commencement clause".

This means the power will not be devolved until the Treasury assesses that the Northern Ireland Executive's finances are on a sound footing.

On Monday, Mrs Foster told the Northern Ireland Assembly that it was "probably not going to be the case" that it would be introduced in April 2017.

The main Stormont parties supported the devolution of the tax, but in recent weeks Sinn Féin has warned that the NI Executive may be unable to afford the cut.

The block grant would fall if the tax is cut because it would mean less revenue is collected for the Treasury, and under European rules Stormont would have to make up the shortfall.

Sinn Féin's chairperson Declan Kearney said that in current circumstances "the regional economy will not be able to afford the introduction of corporation tax, even if a date and rate were to be agreed."

The business community is increasingly concerned that the lack of "a date and a rate" will cause foreign companies to defer investment.

Corporation tax is the tax that companies pay on their profits. The current UK rate is 20%, whereas in the Republic of Ireland firms pay 12.5%.

The executive wants to be able to match the tax rate in the Republic of Ireland

- Published17 March 2015

- Published27 January 2015

- Published8 January 2015

- Published3 December 2014

- Published20 November 2014

- Published30 November 2014