Corporation tax: NI's economic opportunity 'being eroded'

- Published

Martin Fleetwood is a senior partner at the leading management consultancy firm, PWC

The advantage Northern Ireland could gain by introducing a lower rate of corporation tax than the rest of the UK is being eroded, a tax expert has said.

Martin Fleetwood from PWC told the BBC's Inside Business show the UK-wide rate was reducing, meaning the proposed differential would not be as great.

Corporation tax - the tax firms pay on their profits - is now 20% in the UK.

The Northern Ireland Executive hoped to set its own lower rate but the plan has been held up by stalemate over welfare.

'Rethink needed'

Stormont's aim was to cut corporation tax by April 2017, in a bid to compete for business with the Republic of Ireland where the rate is 12.5%.

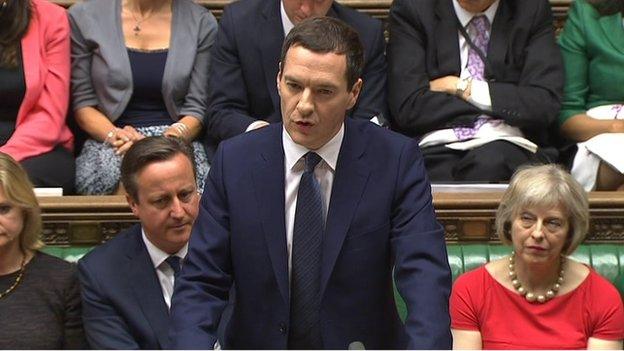

In his July budget earlier this week, Chancellor George Osborne confirmed that the UK-wide rate will fall to 19% in 2017 and will be reduced again to 18% by 2020.

Mr Fleetwood, a senior partner at the leading management consultancy firm, said Northern Ireland needs to rethink how it sells itself as a place to do business.

"The game-changer that was hoped to come from corporation tax in Northern Ireland, the benefit from that is being eroded because the differential between us and the rest of the UK is reducing," he told Inside Business.

"I think that what that means for Northern Ireland is that we have to be even clearer about enunciating what out compelling sales message is as a FDI [foreign direct investment] location."

Under last December's Stormont House Agreement, the Westminster government agreed to legislate to devolve corporation tax setting powers to Northern Ireland ministers.

However, the move is dependent on Stormont minsters' ability to balance their budget and implement welfare reform.

There has been stalemate over welfare since March, when Sinn Féin withdrew its support for the Stormont House Agreement.

Martin Fleetwood's interview will be broadcast on Inside Business on BBC Radio Ulster at 13:30 BST on Sunday, 12 July.

- Published8 January 2015

- Published8 July 2015

- Published23 June 2015