Budget 2015: Osborne says NI parties must deliver on Stormont House Agreement

- Published

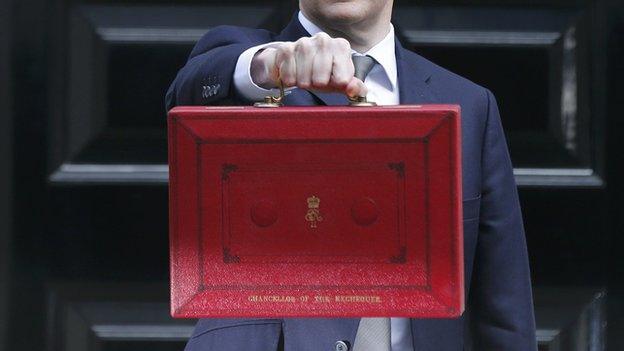

George Osborne unveiled his budget on Wednesday, but what will it mean for people in Northern Ireland

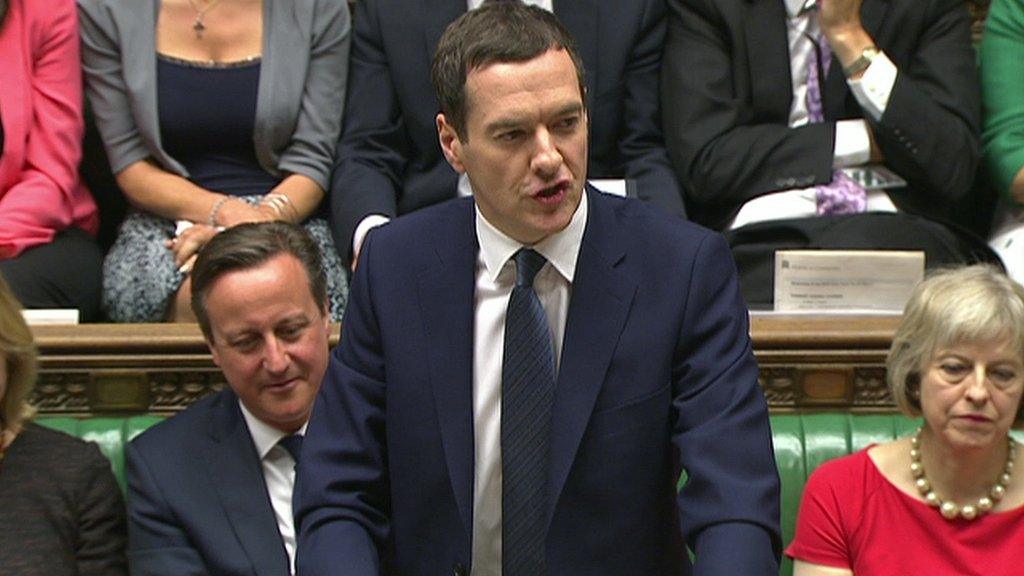

It "is critical" that Northern Ireland parties deliver on the Stormont House Agreement to help bring about economic recovery, the chancellor has said.

In his Budget speech, George Osborne only made a passing reference to Northern Ireland.

But in the full Budget paper published by the Treasury, it said it and the executive was committed to rebalancing the economy.

It added that the agreement was part of targeted support for Northern Ireland.

Mr Osborne's cutting of UK corporation tax to 19% in 2017 and 18% in 2020 has implications for the executive's main economic recovery policy lever.

The executive - which has devolved powers to vary the rate - wants to introduce a 12.5% rate in 2017.

But PwC's chief economist in Northern Ireland Esmond Birnie said a falling UK cut "will significantly reduce the potential impact in Northern Ireland".

But he added: "It will also reduce the cost to the block grant, which the government has estimated as £300m annually."

Focus

Secretary of State Theresa Villiers said 700,000 people in Northern Ireland would be paying £82 a year less in income tax.

She added 15,000 people would be lifted out of paying any income tax altogether, with the threshold lifting to £11,000.

Of the Budget overall, she said: "It is another step on the road away from a low-wage, high tax, high welfare economy towards a higher wage, lower tax, lower welfare country, not least through the introduction of our national living wage."

Theresa Villiers said the Stormont House Agreement gives Northern Ireland "the most generous welfare system in the UK"

However, trade unions preferred to focus on changes to tax credit system.

Unite's Jimmy Kelly said: "Cuts to tax credits will be implemented automatically in Northern Ireland through HM Revenue.

"It will be a devastating blow to those households who rely on tax credits to make ends meet.

"Proposals for the adoption of a living wage of £9 per hour by 2020 fall short of making up for these cuts."

Regionalisation

At present, proposals to cut the £26,000 household limit of working age benefits to £20,000 will not apply in Northern Ireland because welfare reform has not been implemented here.

Sinn Féin MLA Conor Murphy described the Budget "as a further attack on low paid workers and families".

The DUP's Sammy Wilson criticised the government's plan to have a lower benefits cap for areas outside London, saying it was the "first step towards regionalisation of benefits".

Ulster Unionist MP Danny Kinahan welcomed aspects of the Budget, but said that more detail was needed "on how many families would be affected" by the lowering of the benefit cap.

SDLP leader Alasdair McDonnell said he was disappointed that the chancellor had made "little reference to Northern Ireland" in his Budget.

Alliance MLA Stephen Farry said Northern Ireland was "facing financial meltdown" in the absence of implementation of the local version of welfare reform.

"The parties need to return to the negotiating table," he said.

- Published8 July 2015

- Published8 July 2015

- Published8 July 2015

- Published7 July 2015