Irish Cabinet meeting about Apple tax ruling adjourned until Friday

- Published

The Irish Cabinet met on Wednesday to discuss the issue

The Republic of Ireland's Cabinet meeting to discuss the European Commission's decision that Ireland granted undue tax benefits of up to €13bn (£11bn) to Apple has been adjourned.

Finance Minister Michael Noonan said the Irish government will appeal the ruling.

Independent ministers have sought the recall of the Irish parliament if they are to back an appeal.

The meeting was adjourned until Friday.

After Wednesday's meeting, the Irish government said it had a "thorough discussion" on the European Commission's decision based on Mr Noonan's proposal that an appeal be lodged.

It said the cabinet had received a "detailed briefing" from Mr Noonan.

"Following the discussion, it was agreed to adjourn the meeting to allow further time to reflect on the issues and to clarify a number of legal and technical issues with the Attorney General's Office and with officials," the statement added.

"The government meeting will resume on Friday at 11am to make a decision on the matter."

Irish broadcaster RTÉ reports that independent ministers also sought a strong statement on tax policy if they are to back any government appeal.

Independent minister Katherine Zappone welcomed the adjournment and said it was important to allow time for the issues to be further explored.

Another independent minister Shane Ross said there had been a frank exchange of views at the meeting.

He said they had difficulties with taking any of the courses proposed at the meeting and did not know if those concerns would be met. He confirmed that the recall of the Irish parliament had been discussed.

The Irish government has said it "disagrees profoundly with the commission's analysis".

"Ireland did not give favourable tax treatment to Apple," it added.

"Ireland does not do deals with taxpayers. No fine or penalty has been levied against the Irish State.

"This decision has no effect on the 12.5% rate of corporation tax and is not about Ireland's wider corporation tax regime."

Speaking ahead of the meeting, Irish Prime Minister Enda Kenny said time was needed to absorb the European Commission's decision, which runs to 150 pages.

He said the decision created an "unprecedented situation" and it was important people had the opportunity to have any anxieties addressed and to raise questions that they may have.

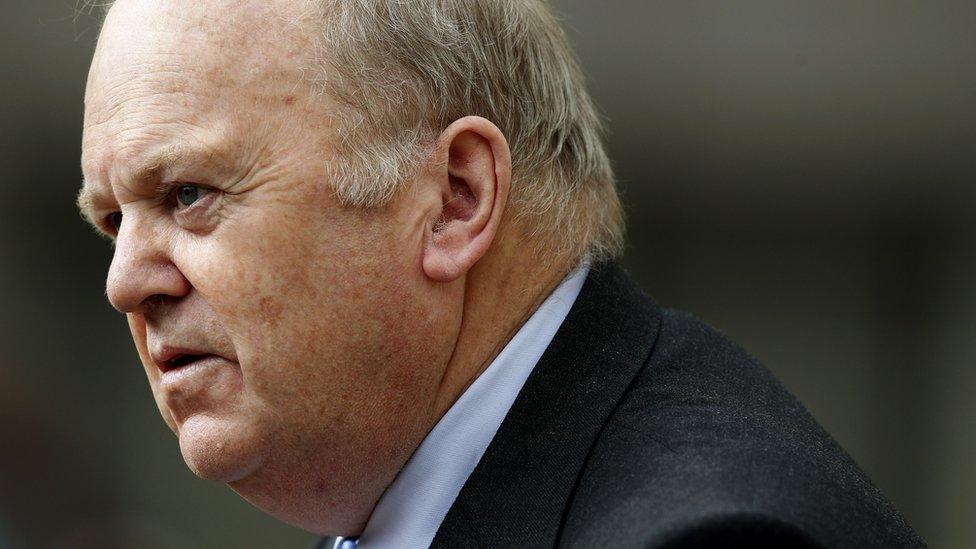

Irish Finance Minister Michael Noonan wants to appeal the European Commission decision

"The government has made its position very clear as outlined by Mr Noonan so we will have a good discussion with our colleagues around the table about it," he said.

Minister for Public Expenditure Paschal Donohoe rejected appeals for an early recall of the Irish parliament to discuss the Apple case.

The Independent Alliance said it is reviewing the commission's decision.

Office 'existed on paper'?

The European Commission said Ireland's tax rulings had allowed Apple to pay substantially less tax than other businesses.

The Irish system had allowed profits to be attributed to a head office that "only existed on paper", said Margrethe Vestager, the European Commissioner for Competition.

Enda Kenny said the decision created an 'unprecedented situation'

Analysis: BBC Ireland Correspondent Shane Harrison

It all comes down to Ireland's reputation.

The Irish government has been criticised, particularly in the US, for almost being a tax haven similar to the Cayman Islands, something it strongly denies.

But €13bn is a huge amount of money: It would go a long way towards solving the housing crisis in the Republic for example.

Fine Gael, Fianna Fáil and Labour are more or less of the view that the government should appeal against the ruling.

But Sinn Féin are calling for an independent assessment of whether or not Apple did get unfair treatment, whether it was human error or whether the system colluded to create this situation as the European Commission seems to believe.

It believes the government should not appeal and should spend the money.

The left-wing parties also believe the money should be spend in citizens' interests.

For them, it is a moral issue as to whether or not Apple are being getting unfair treatment given the amount of money ordinary people pay in their taxes.

Thirteen billion euros is approximately equivalent to a quarter of what the Irish government spends per year, and what it spends on health in total.

The Republic of Ireland's government is a minority one, with Fine Gael being propped up by independents.

It is not clear whether the Independent Alliance cabinet members will vote to appeal the decision.

Apple itself is appealing against the decision, saying: "The European Commission has launched an effort to rewrite Apple's history in Europe, ignore Ireland's tax laws and upend the international tax system in the process.

Apple intends to appeal the European Commission's ruling demanding it pays €13bn in taxes to Ireland

"The commission's case is not about how much Apple pays in taxes, it's about which government collects the money. It will have a profound and harmful effect on investment and job creation in Europe.

"Apple follows the law and pays all of the taxes we owe wherever we operate. We will appeal and we are confident the decision will be overturned."

The appeal will be made first to the General Court of the European Union in Luxembourg and then to European Court of Justice.

Apple chief executive Tim Cook has said the company is committed to Ireland and plans to continue investing.

Mr Cook has published a message on the company's website reiterating the organisation's commitment to Ireland.

- Published30 August 2016

- Published30 August 2016

- Published30 August 2016

- Published30 August 2016

- Published18 July 2018

- Published30 August 2016