Paradise Papers: Invest NI and the Mauritian giveaway

- Published

A number of business owners in Northern Ireland have been involved in aggressive tax avoidance schemes, an investigation by the BBC's Nolan Show has revealed.

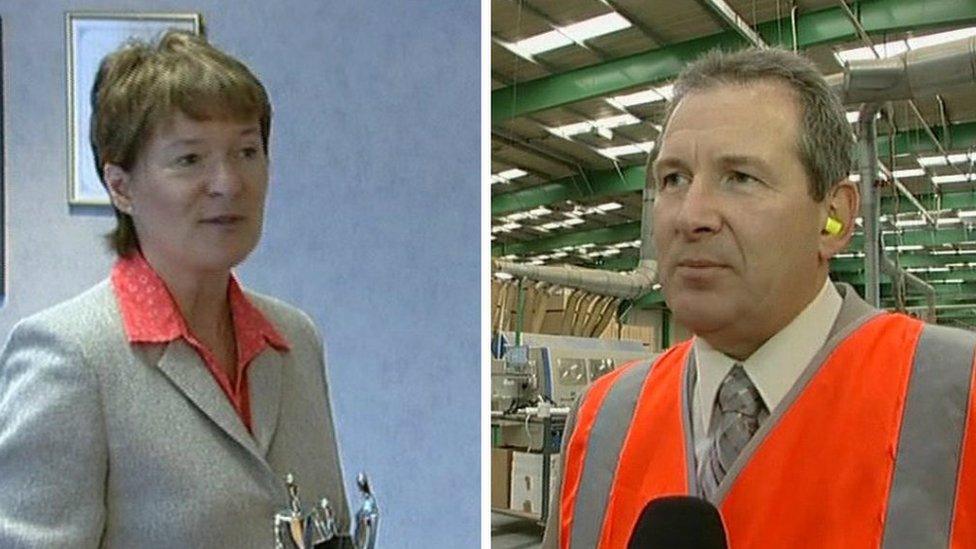

Sam McCrea MBE and his wife, Julienne, are owners of Springfarm Architectural Mouldings Ltd (SAM Mouldings) in Antrim.

The couple were involved in a Mauritian tax avoidance scheme.

The McCreas have said they have fully complied with their tax obligations.

Over a quarter of the people signed up to that scheme were from NI.

Julienne McCrea and her husband, Sam McCrea MBE, are owners of Springfarm Architectural Mouldings Ltd in Antrim

The Paradise Papers are a huge batch of leaked documents mostly from offshore law firm Appleby, along with corporate registries in 19 tax jurisdictions, which reveal the financial dealings of politicians, celebrities, corporate giants and business leaders.

The 13.4 million documents were passed to the German newspaper Süddeutsche Zeitung, external and then shared with the International Consortium of Investigative Journalists, external.

The Nolan Show team worked alongside colleagues in BBC Panorama, the Guardian and nearly 100 media organisations worldwide.

Multi-million pound property given away

In 2000, SAM Mouldings bought land from Stormont's Department of Enterprise for £280,000. The company built their business on the site. By 2014, the property, with its factory and offices, was valued on its balance sheet at £4m.

But the following year, SAM Mouldings gave the multi-million pound property away for just one pound to what the company described as an 'unconnected third party'. The beneficiary was a company in Mauritius.

Documents seen by the Nolan Show reveal that the McCreas had control of the Mauritian company - they had given the multi-million pound property to themselves in all but name. The couple were listed as 'investment advisors' to the company - but the leaked files suggest they were doing much more than just advising.

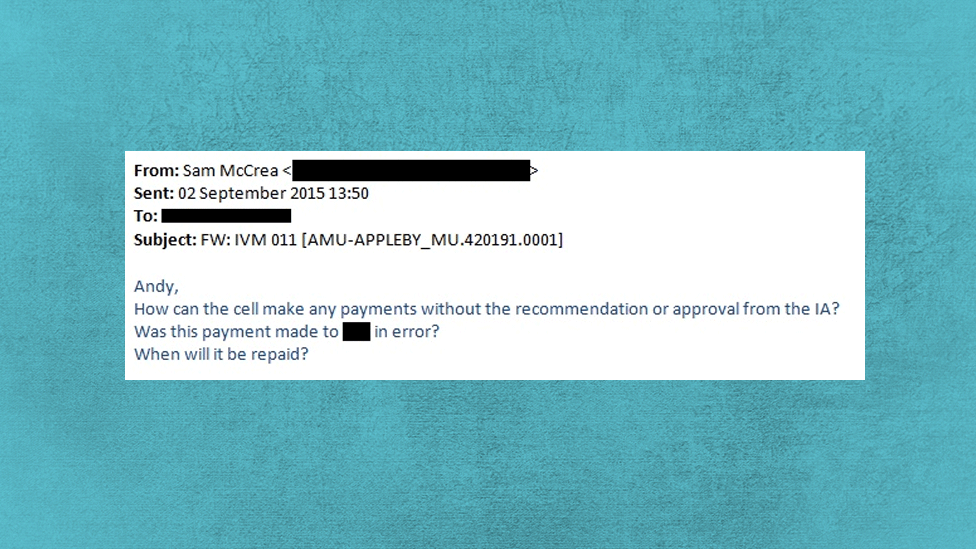

At one stage, Sam McCrea wrote to the company in Mauritius questioning why a payment was made without his or his wife's permission.

He asked how the company could make any payments without the approval of the IA or 'investment advisor' - meaning either himself or his wife Julienne.

In other documents Sam McCrea advises that the Mauritian company buys shares from himself.

Invest NI

Since 2008, SAM Mouldings has received over £431,000 in financial assistance from Invest NI - who are a preferential shareholder in the company.

After the Antrim property SAM Mouldings operated from was given to the McCreas' company in Mauritius, SAM took on a £270,000 annual rent bill. This rent was sent through various intermediaries - and ended up in the McCreas' Mauritian company - where the income tax rate is just 3%.

This tax avoidance mechanism was promoted by the McCreas' tax advisors who set up the Mauritian scheme as a form of 'rent factoring' - that's where in exchange for a lump sum, a company diverts future rents from property to a financier.

Under this system, SAM Mouldings paid £270,000 annual rent to the Mauritian firm but Sam McCrea received a £200,000 loan from the firm. As a loan, it was not liable for tax.

Invest NI told the BBC in a statement that as part of their project monitoring and approval procedures of SAM Mouldings Ltd they "were aware of the property transfer in question and this was taken into consideration when approving their most recent project."

"SAM Mouldings has continued to grow in terms of both exports and employment targets and is meeting the agreed repayment schedule for the preference shares.

"A company's tax planning is a matter between it and HMRC. If it transpires that information provided to us as part of our approval process has been misleading and would have resulted in a different decision being made, we will review the specific case, as would be normal practice.

When asked about their involvement in tax avoidance schemes, the McCreas' lawyers said their clients "are not going to enter into a course of correspondence concerning this sensitive and confidential funding arrangements of their business, with the BBC".

They added: "Our clients have fully complied with their obligations to HMRC, specifically with regard to the Mauritian companies.

They also said "there will be no loss to the UK exchequer as a result of the Mauritian companies".

They said the allegations were "untrue, defamatory and are particularly unpleasant slurs on two people who have brought prosperity and employment to the Antrim area", adding "Mr McCrea holds a public honour for his services to business and he guards his reputation carefully".

The Nolan Show will be focusing on stories from the Paradise Papers across the week.

Paradise Papers: Full coverage, external; follow reaction on Twitter using #ParadisePapers; in the BBC News app, follow the tag "Paradise Papers"

Watch Panorama or listen back to the Nolan show on the BBC iPlayer (UK viewers only)

- Published6 November 2017

- Published6 November 2017

- Published6 November 2017

- Published7 November 2017

- Published6 November 2017