Libya-IRA compensation 'could be funded by taxing assets'

- Published

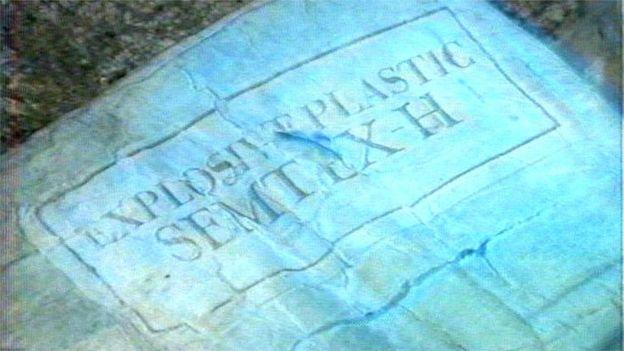

Libyan-supplied Semtex was used in many IRA attacks, such as the Harrods bombing of 1983

The government is coming under pressure to use tax collected on £12bn in frozen Libyan assets to compensate IRA victims.

The NI Affairs Committee said the money should be used to set up a fund for victims of Libyan-supplied Semtex.

It claims the government could be levying a significant amount of tax on frozen Libyan assets.

The committee said there was a chain of "revealing correspondence" with the Foreign Office, Treasury and HMRC.

The government said it took the issue "extremely seriously".

Chairman of the House of Commons Northern Ireland Affairs Committee, Dr Andrew Murrison, said: "My committee is disappointed our government has been less successful in securing compensation for UK victims of (Muammar) Gaddafi-sponsored IRA Semtex attacks than other governments have been for their nationals."

"We now find that HMRC may have been scooping up big tax receipts from frozen Libyan assets, a small part of which could help victims pending reparations being negotiated with the Libyan government."

Muammar Gaddafi supplied weapons to the IRA during the Troubles

The government has yet to reveal publicly if it had collected tax on the assets which were frozen in 2011 under under UN sanctions.

Former Libyan leader Muammar Gaddafi supplied weapons, including Semtex explosives, to the IRA during the Troubles.

Libya compensated US victims of terrorism, but UK victims were left out of the deal.

No details

In a report published on Tuesday, the Northern Ireland Affairs Committee warned that time was running out for victims and criticised the government's "continued inaction".

It called on the government to enter direct negotiations with the Libyan authorities to seek a compensation deal and to reveal whether any tax has been collected on the frozen assets.

The committee also claimed the government has revealed that several licences have been issued to make funds or economic resources from the Libyan assets available.

But there are no details on what or to whom the licences were issued.

Conservative MP Dr Andrew Murrison chairs the cross-party committee

"For victims, the possibility that the government has been collecting tax on frozen Libyan assets and making funds available to others will make for difficult reading." said Dr Murrison.

"It is essential that the government adopts a transparent approach by revealing what tax has been collected, and what licences were issued to make funds available.

"If the government is collecting tax, I would encourage it to use some of the proceeds to finance a compensation fund for victims pending extraction of compensation from the Libyan government."

A government spokesperson said: "We take this issue extremely seriously and want to see a just solution for all victims of Qadhafi-sponsored IRA terrorism.

"In accordance with international law, when assets are frozen, they continue to belong to the sanctioned individual or entity. Sanctions can only be lifted by the EU or UN.

"We do not comment on individuals' tax affairs. Generally, where taxable income or gains are made in relation to frozen assets, a tax liability will arise, regardless of the assets' frozen status."

- Published18 December 2018

- Published15 September 2017

- Published21 December 2018