RHI heat fell by 44% since subsidy rate cut in 2017

- Published

A biomass boiler, similar to those owned by some RHI scheme claimants

The amount of heat generated under the non-domestic RHI scheme fell by about 44% after subsidies were cut, the head of the Audit Office has said.

Kieran Donnelly said it was evidence that, in some cases, heat was not required but was produced "only with a view to increasing RHI payments".

A 2017 rate cut saw payments halve from £42m in 2016/17 to £21m in 2018/19.

The Renewable Heat Incentive (RHI) scheme was set up to encourage a switch to greener fuel but was controversial.

A public outcry over the level of payments made to claimants in the so-called "cash-for-ash" scheme led to the collapse of the power-sharing executive at Stormont in January 2017.

The rate of subsidy paid to RHI claimants was sharply reduced in April that year.

A report from the judicial inquiry into the handling of the RHI scheme is expected to be published later this year.

Mr Donnelly's remarks on the RHI scheme are contained in a report on the financial audit work undertaken by his office, which has been examining the accounts of government departments and other public sector bodies.

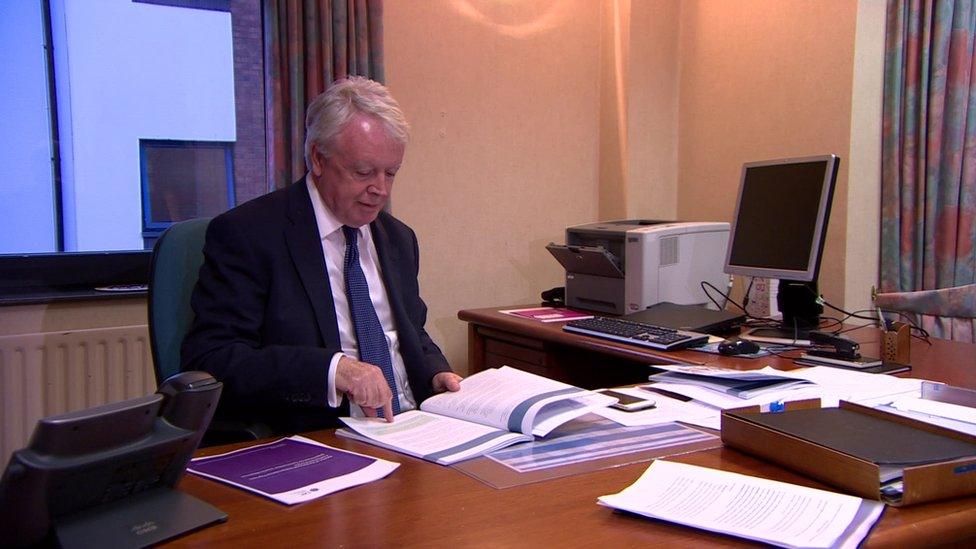

Kieran Donnelly is comptroller and auditor general at the Audit Office

The Audit Office said part of his report focused on the "change in behaviour of scheme applicants following the reduction in subsidy rate on 1 April 2017".

"The significant reduction provides evidence that in some cases, heat produced before April 2017 was not actually required for business purposes but rather some of it may have been produced only with a view to increasing RHI payments," he said.

Mr Donnelly has also expressed his concern about the level of overpayments and underpayments to welfare benefit claimants.

In 2018-19, there were estimated overpayments to claimants of £92.3m (1.5% of all benefit expenditure) and underpayments of £30.5m (0.5% of all benefit expenditure).

Fraud and error

The level of overpayments was similar to previous years but the level of underpayments nearly doubled.

Mr Donnelly said that "overpayments increase costs to the taxpayer and reduce public resources that could be made available for other purposes".

"In contrast, underpayments mean that individuals may not be getting the support that they are entitled to."

The head of the Audit Office described the overall value of fraud and error in benefit expenditure as "unacceptably high".

However, he acknowledged that the Department for Communities has put "considerable effort and resources into reducing the fraud and customer error, through additional training and funding into error reduction".

- Published30 June 2019

- Published19 March 2019

- Published7 November 2017