UK budget: Stormont core funding rise 'only £4m', says Murphy

- Published

Core day-to-day funding for Stormont departments will only rise by £4m as a result of the budget the NI Finance Minister says.

The chancellor said it would mean an extra £410m but Conor Murphy said most of that was Covid-related.

Rishi Sunak also announced the extension of many pandemic-related business and household support schemes.

The furlough scheme, which started last March, will be extended until the end of September.

Though companies will have to increase their contributions from July.

Conor Murphy said it was disappointing that there were no extra capital money to spur economy recovery.

"Almost all of this money is one-off funding for the Covid response which is welcome as we look to the recovery phase, however, it still leaves us with a flat-cash budget for mainstream public services," said Mr Murphy.

"An investment-led approach is absolutely critical given we have never fully emerged from years of austerity measures."

Furlough extension

More than 100,000 people in NI currently have their wages paid through the furlough scheme.

The furlough scheme involves the government paying the wages of people who can not work due to the coronavirus pandemic.

The scheme pays employees placed on leave up to 80% of their salary, up to a maximum of £2,500 a month.

Employers will be expected to pay 10% towards the hours their staff do not work in July, increasing to 20% in August and September, as the economy reopens.

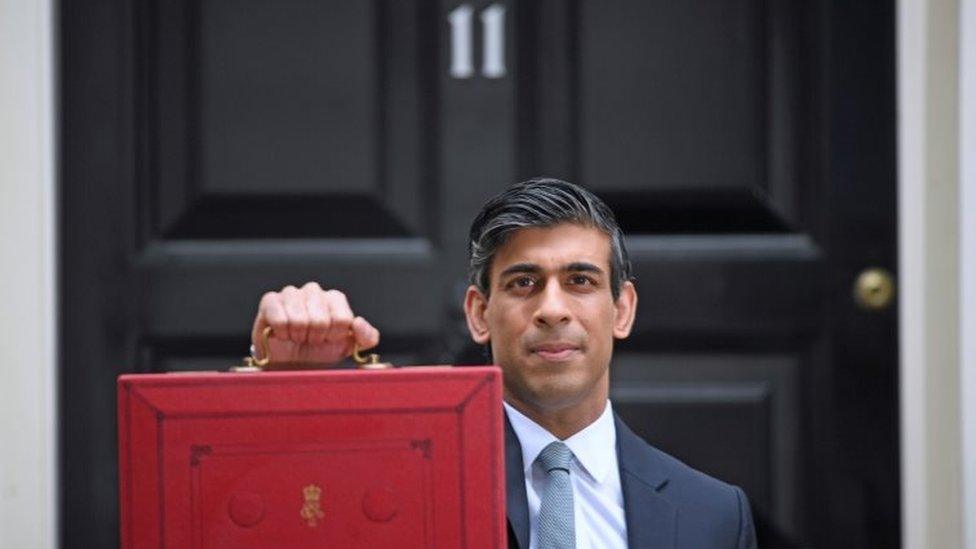

The chancellor announced his budget plans on Wednesday

Mr Murphy said the extension to furlough was good news for "workers, families and businesses".

"However, I am concerned that asking employers who may not be fully operational to find the cash for these wage costs could lead to redundancies.

"It's also welcome that the chancellor will support newly self-employed people," he added.

'I had to find another way to earn money'

Jordan Simpson was working as a commis chef in a five-star hotel in Belfast, but has been on furlough now for almost a year.

He welcomed the government's job retention scheme being extended to September, but said this was not enough to live off, which is why he has had to get a second job in a call centre.

The job retention scheme pays 80% of workers wages up to a cap of £2,500 a month.

But Jordan said that, as a 20-year-old who was earning a low wage, 80% of his wages was not enough to live on.

He has had to find another way to earn money which, he said, had been difficult at times.

"I'm happy that I'm more financially stable but, then again, not being in the kitchen, it's all enjoyment and I want to get back to that."

Jordan said being on furlough had also taken its toll on his mental health.

"Obviously, being a chef, it's long hours work and coming into furlough and having a whole day off was weird at first. But I really don't want to be sitting at home all the time.

"It is quite tough when you get up and you know you're seeing the same four walls every day.

"It's really boring."

The budget also means the NI Housing Executive will become exempt from corporation tax.

The Housing Executive was established in such a way that it did not meet the definition of 'local authority' for corporation tax purposes and has been paying the tax for a number of years.

The government said the move would save the he Northern Ireland Executive around £10m annually.

The main corporation tax move in the budget is to increase it from 19% to 25% in in April 2023.

The rate to be kept at 19% for about 1.5 million smaller companies with profits of less than £50,000.

Corporation tax is the tax that companies pay on their profits.

The NI Executive has since 2015 had the power to set its own rate of corporation tax but has never used it because it would also lead to a cut in the block grant.

- Published3 March 2021

- Published2 March 2021

- Published3 March 2021

- Published3 March 2021