Cross-border workers call for home-working tax law

- Published

People who live in the Republic of Ireland but work in Northern Ireland are calling for changes to remote-working tax laws.

NI company employees who live in the Irish Republic have to pay tax in both states if they work from home.

They can claim relief, external against tax already paid in NI on their salary.

However, to qualify for that relief, that work must be carried out outside the Republic of Ireland, meaning they cannot work from home.

Cross-border workers were able to claim the relief while working from home as an emergency measure during the pandemic, and there are calls for that to continue.

Paul Quinn, co-chairman of the Cross-Border Workers' Coalition, said its members have written to Irish Finance Minister Paschal Donohoe to identify a "permanent, pragmatic solution" to the matter.

'It's just crazy'

Mr Quinn lives in Newtown Cunningham, County Donegal, eight miles from Northern Ireland's border and he works for a company in Londonderry.

Before the pandemic, he could not work from home without being subject to so-called double tax, but he wants the same flexible working conditions as his colleagues who live in Northern Ireland post-pandemic.

His job requires him to be on-call 24-7, meaning he would have to travel to his office to perform out-of-hours work duties to avoid being taxed twice for working at his home.

"It's just crazy if you're working in Derry you can work from home but if you're working five miles across the border you can't," he said.

"There are employees living 40 miles away who have some serious travelling to do if we have to take immediate urgent phone calls or meetings.

"It really hinders work-life balance."

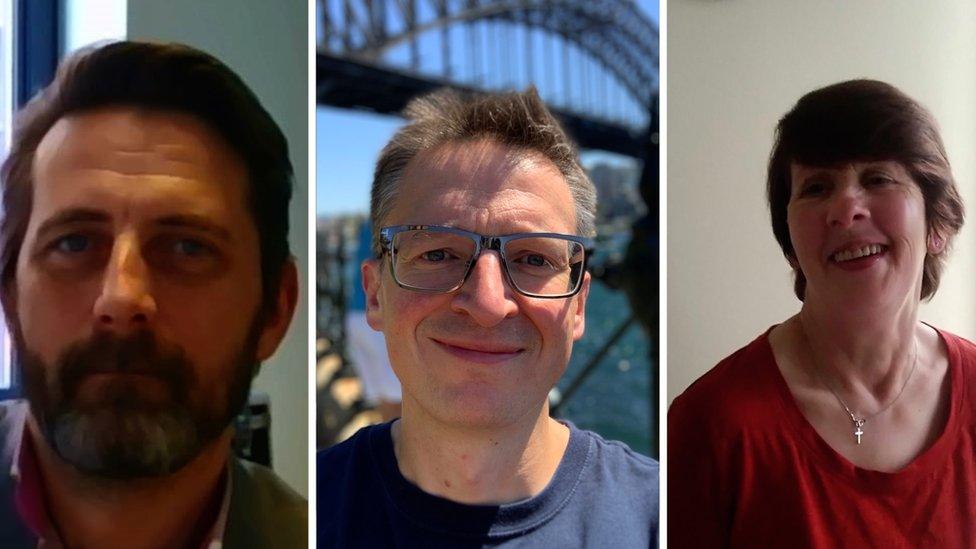

Paul Quinn is co-chairman of the Cross-Border Workers Coalition

Mr Quinn said he cannot attend work conferences or meetings in Dublin as this would count as taxable income.

The Irish government published a national Remote Working Strategy, external to allow employees the right to request remote working after the Covid-19 pandemic.

"Our old way of working was outdated and with the digital age there are clear benefits of remote working provisions and flexible working practices for businesses and employees alike," said Mr Quinn.

"So unless a pragmatic solution is found, cross-border workers that live on the border necklace area will be seriously impacted."

'Unfair penalty'

Sinn Féin MLA Martina Anderson said cross-border workers should not face the prospect of double tax if they are working from home.

"We need to see legislative change to remove this unfair penalty for cross border workers," she said.

"All workers should be able to enjoy the same conditions regardless of whether they live in Derry or Donegal.

"This has been brought into sharp focus by the Covid-19 pandemic, which has led to a huge increase in home working."

The Irish finance minister is aware of the issue and officials have been asked to look at it through the Tax Strategy Group 2021 process, said a Department of Finance spokesperson.

"A request for a meeting has been received and will be set up with senior officials on the minister's behalf," said the spokesperson.

People living in Northern Ireland who work in the Republic of Ireland can claim credit for tax paid in Ireland under the UK-Ireland Double Tax Convention (DTC).

If such an employee works from home instead of commuting to their work premises in the Republic of Ireland, less of their employment income will be taxable there, but there will also be less corresponding credit relief.

- Published12 April 2020

- Published20 June 2020