NI firms to use EU subsidy rules for Covid recovery loans

- Published

- comments

Northern Ireland firms applying for new government-backed Covid recovery loans will have to do so within EU subsidy rules.

Some firms in Great Britain may also be covered by EU rules depending on the extent of their business in NI.

Under the Recovery Loan Scheme, external (RLS) UK firms can borrow between £25,001 and £10m.

The money will be lent by banks with the government guaranteeing 80% of the loan.

The terms of the NI Protocol mean Northern Ireland is still in the EU single market for goods and so is still subject to EU subsidy rules for trade in goods. This mostly affects manufacturers.

It means that firms in Northern Ireland applying for the RLS will have to comply with what is known as the EU's Undertaking in Difficultly (UID) test.

These are EU rules setting out the circumstances in which state support can be given to a firm which is in financial trouble.

Previous UK Covid loan schemes were covered by the UID test because they were introduced during the Brexit transition period.

The Recovery Loan Scheme will have a UK version of a UID test, but it will be simpler than the EU rules.

For example, only GB businesses in collective insolvency proceedings (with the exception of businesses that have entered into a Company Voluntary Arrangement since 16 March 2020) will be excluded from the RLS.

The Recovery Loan Scheme also has the potential to act as a test of one of the most controversial elements of the NI Protocol - the extent to which EU subsidy rules will apply to GB businesses.

This is covered by Article 10 of the protocol which essentially says the UK as a whole has to follow EU rules if a UK-wide subsidy could have an impact on trade in goods between Northern Ireland and the European Union.

For example, if a UK-wide subsidy was to give NI firms an unfair advantage over other companies in the EU single market.

Months after agreeing the protocol, the UK government became concerned Article 10 could leave significant parts of the UK economy under EU subsidy rules.

The UK and EU reached further agreement on this issue in December with the EU stating that it would only apply if a UK subsidy would have "real and foreseeable" impact on NI-EU trade.

But guidance published since then still suggests the two sides have different interpretations of what this means.

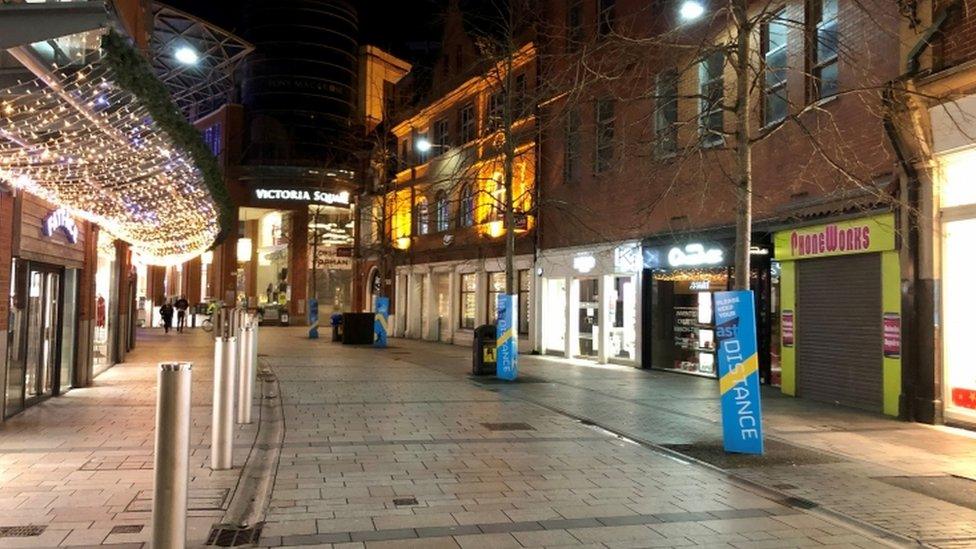

NI firms applying for new government-backed Covid recovery loans will have to do so within EU subsidy rules

In December, the UK's Department for Business, Energy and Industrial Strategy (BEIS) said, external: "The starting assumption for subsidies granted to recipients outside of Northern Ireland should be that the NI Protocol does not apply.

"Where a subsidy is provided, and a company then simply places goods on the NI market alongside other markets then this subsidy will not be in scope of Article 10."

However, European Commission guidance published in January, external said an example of a circumstance where Article 10 might apply is: "Aid to a manufacturer in difficulty if its goods are available for sale in Northern Ireland."

George Peretz QC, an expert in state aid law, said this present challenges: "Any business, or business lender, taking a cautious view is going to assume that the Commission could well be right and may well not want to rely on BEIS's assurances - particularly as it is the commission and the ECJ that have the final say, here."

However he thinks it unlikely that RLS is the issue which will lead to a test of Article 10: "It may well be that the commission does not want to pick a fight here, particularly as most of these subsidies are going to be have little real impact on EU businesses.

"A fight over the scope of the NI Protocol will probably happen over a subsidy that the Commission feels really does have an adverse impact on the EU."

Related topics

- Published13 January 2021