Budget 2021: Murphy disputes chancellor's £1.6bn boost for NI

- Published

- comments

Finance Minister Conor Murphy says the budget allocation will amount to £1.9bn over three years

Finance minister Conor Murphy has disputed a claim by the chancellor that Northern Ireland will get an extra £1.6bn per year for public services.

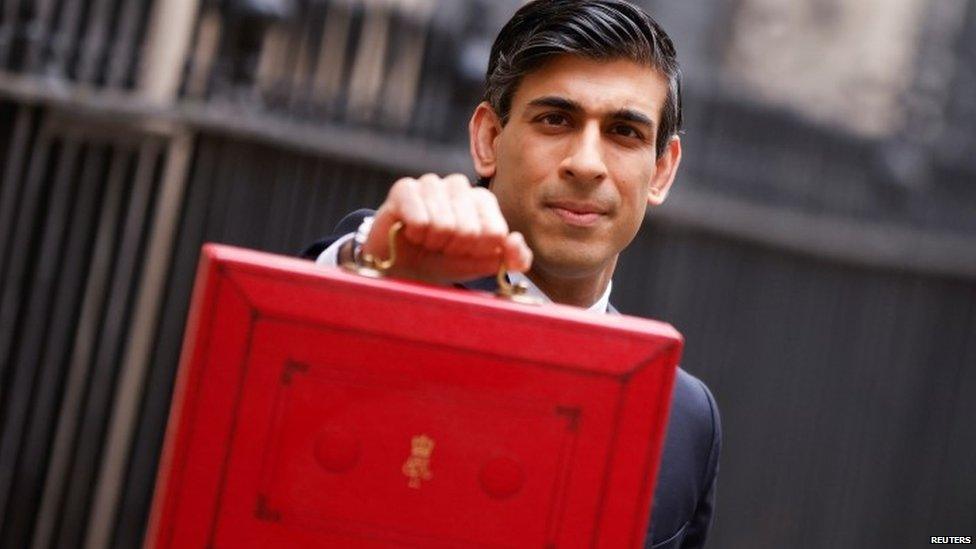

Rishi Sunak said his budget allocation represented the largest annual funding settlement for devolved governments since 1998.

But Mr Murphy said it would create "significant challenges".

He said it would amount to £1.9bn for day-to-day spending over three years - "nowhere near" what is required.

Treasury figures show the budget allocation will mean day-to-day spending in Northern Ireland will increase by an average of 2.1% in real terms each year up to 2025.

Infrastructure spending will increase by an average of 2.5% a year over the same period.

The Treasury said this gave the Northern Ireland Executive "sufficient funding certainty" to plan in-year spending and to provide additional future investments in areas such as health, social care and education.

But Mr Murphy said when compared to the executive's 2021-22 budget, there will be an additional £450m, £670m and £866m over the next three years for day-to-day spending "against growing demand for public services".

This, he added, represented a 0.9% real term increase to the executive's budget next year, turning to zero real terms change by 2024-25.

"This spending review was the opportunity to deliver a budget which would have enabled the executive to rebuild public services and spur economic recovery," Mr Murphy said.

"However it provides a marginal real terms increase in funding next year which will be far outweighed by increased demands on public services, particularly in light of the ongoing pandemic."

Mr Murphy said a multi-year budget enables the executive to better plan and prioritise its finances.

He said his priority was supporting the health service and tackling waiting lists.

Separately, there is an initial budget allocation of £50m from the government's levelling up fund.

It is for 11 projects including redeveloping the Dundonald Ice Bowl and extending cycle routes across the Belfast City Region.

Mr Sunak also said he will cut Air Passenger Duty (APD) by half on internal UK flights.

A cut in APD is a long standing request of Northern Ireland politicians and business leaders.

It will mean a new domestic band for APD set at £6.50.

The rate will apply to all flights between airports in England, Scotland, Wales and Northern Ireland (excluding private jets).

The government has also announced a proposal to solve a NI Protocol related issue, external concerning the VAT paid on second cars coming into Northern Ireland from Great Britain.

Mr Murphy has previously already played down expectations that the spending review would mean significant extra resources.

Earlier this week, he said there was "little indication" the government would "provide the investment needed to rebuild public services and spur economic recovery".

However, he said the ability to produce a multi-year budget would provide an opportunity to "better plan and prioritise finances".

Stormont has not had a multi-year budget since 2011-2015.

That has made it difficult for public sector managers to plan services, particularly in health.

The finance minister is trying to build consensus among his executive colleagues that the bulk of any additional funds should go to health even if other departments lose out.

He aims to publish a draft budget before Christmas which would then go out to consultation before being finalised early next year.

How have others reacted?

The Institute of Directors Northern Ireland said the additional money will be a "shot in the arm for the local administration".

"It is incumbent now on ministers to deliver on the incredible potential it presents, with a focus, through targeted investment in key services and infrastructure, on ensuring this region is fit to capitalise on the green recovery as we continue to emerge from the coronavirus pandemic," said national director, Kirsty McManus.

Retail NI said the chancellor's 50% rates discount for retailers in England was welcome. The organisation added it was "absolutely vital" that Conor Murphy ensures this also applies to small traders in Northern Ireland.

Matthew Hall, George Best Belfast City Airport chief executive, said the airport had for many years been lobbying government for the abolition of APD.

"A 50% reduction in APD is a half-way house in terms of solving a problem which has placed the aviation sector in Northern Ireland at a competitive disadvantage with other regions in attracting new airlines and routes," he said. "Today's announcement by the chancellor will not take effect until April 2023 and does little in the short term to alleviate a sector still decimated by Covid."

SDLP leader and MP Colum Eastwood said the budget was a "grim spectacle".

"Now we have some certainty on multi-year funding the onus is on Conor Murphy to actually take responsibility and deliver a multi-year plan to tackle our waiting list crisis and present a credible plan for our economy," he said.

Ulster Unionist Party (UUP) assembly member Steve Aiken said the extra £1.6bn a year "underlines the advantage of being part of the fifth largest economy in the world".

"We still have a long way to go to emerge fully from the Covid pandemic but this budget, if properly used to support the needs of Northern Ireland, gives us a good chance," he said.

Democratic Unionist Party (DUP) MP Sammy Wilson said the multi year budget should help devolved finance ministers plan spending better.

"The last two years have been unprecedented, and the Treasury responded in an unprecedented manner to protect jobs and safeguard employers," he said.

Strong drink

The system of taxing alcohol is changing, meaning customers will pay more for products with stronger alcohol content

Buckfast tonic wine faces a significant tax increase under government plans to reform alcohol duty.

The new system, due to start in 2023, will mean higher duty for stronger alcohol, the chancellor said.

A Treasury fact sheet suggests a 75cl bottle of Buckfast will face additional tax of 81p.

The fortified wine is popular in some areas of Northern Ireland and is sometimes called Lurgan Champagne.

It has been made by Benedictine monks at Buckfast Abbey in Devon for almost 100 years.

Chancellor Rishi Sunak said he was proposing the "most radical simplification of alcohol duties for over 140 years".

"To radically simplify the system, we are slashing the number of main duty rates from 15 to just six," he said.

"Our new system will be designed around a common-sense principle: the stronger the drink, the higher the rate.

'This means that some drinks, like stronger red wines, fortified wines, or high-strength 'white ciders' will see a small increase in their rates because they are currently undertaxed given their strength."

Mr Sunak said many lower alcohol drinks were "currently overtaxed", adding: "Rose, fruit ciders, liqueurs, lower strength beers and wines - today's changes mean they will pay less."

Related topics

- Published25 October 2021

- Published26 October 2021

- Published25 October 2021