Covid support measures 'saved 40,000 jobs'

- Published

- comments

Northern Ireland would have 40,000 fewer people in work if pandemic support measures had not been introduced, economists have estimated.

Ulster University's Economic Policy Centre has attempted to quantify what would have happened if businesses and consumers were not helped.

It estimates the output of the Northern Ireland economy would be 4.3% below its current level.

It adds the economy would take a further two years to recover.

The research is not intended to be a value-for-money assessment of individual measures.

During the pandemic, the UK government and the Northern Ireland Executive introduced a range of supports.

These included the furlough scheme where the government initially paid 80% of the wages of people who could not work due to pandemic restrictions.

Almost 140,000 workers were furloughed in Northern Ireland at the scheme's peak.

There were also various cash grant and tax reliefs for businesses and enhanced social security benefits.

The Ulster University Economic Policy Centre (UUEPC) constructed a "counterfactual" with no government supports and with all public health restrictions being strictly enforced.

It did this by drawing on previous research by the Organisation for Economic Cooperation and Development and others and by comparing Northern Ireland to economies which had fewer supports.

However, the counterfactual estimates do not include the economic effects associated with the war in Ukraine.

Gareth Hetherington, director of the UUEPC, said its analysis suggested that although the support was expensive "the economic outcome in the absence of supports would have been much worse".

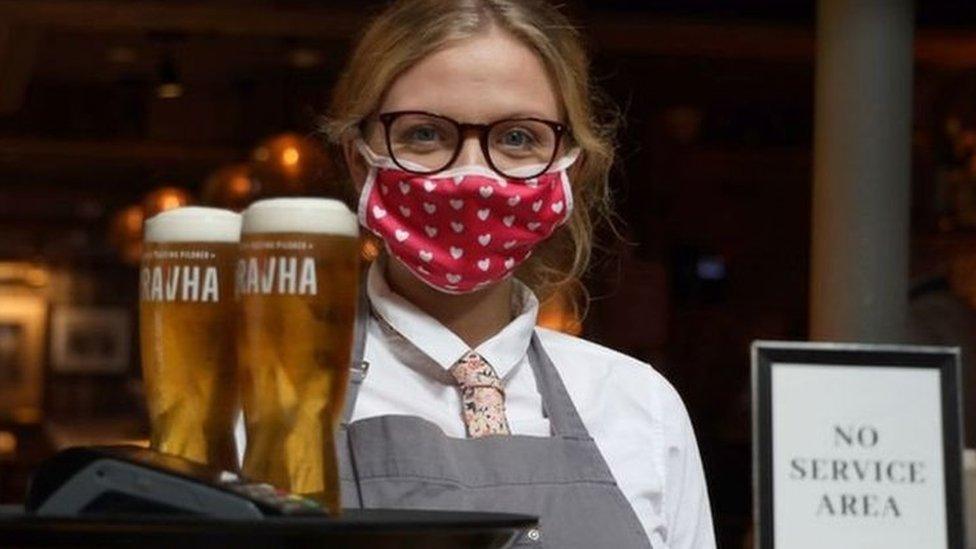

He added this was "particularly so for sectors such as hospitality, arts and leisure and non-food retail".

But he said the patchy support for people in self-employment could have negative long-term consequences.

This is because "the furlough scheme was more effective at supporting employees than the Self-Employed Income Support Scheme (SEISS) was at supporting the self-employed".

"The analysis suggests many self-employed individuals ceased trading to be employed in larger businesses," he said.

"This may have a longer term impact on business start-up activity and entrepreneurialism."

The UUEPC is also sceptical of claims that the furlough and similar schemes have contributed to higher inflation.

It said while the evidence was limited it was "difficult to conclude that overgenerous schemes had a significant impact on inflation in late 2021".

"It is more likely the impact of lockdowns on global supply chains had a more significant role in raising inflation prior to the energy and food price issues currently being experienced," he said.

It also points to Bank of England data which suggested by the second quarter of 2022 much of the £200bn excess savings accumulated during lockdown remained unspent.

Related topics

- Published8 December 2022

- Published30 September 2021

- Published30 September 2021