Windsor Framework: Solar panels among green goods to see VAT cut

- Published

VAT on domestic green goods such as solar panels will be cut in Northern Ireland from 1 May.

The move is possible due to changes agreed in the Windsor Framework.

The tax cut was previously announced for other parts of the UK but did not apply in Northern Ireland due to the NI Protocol.

Victoria Atkins, financial secretary to the Treasury, said the framework enable the government "to share tax benefits with the people of Northern Ireland".

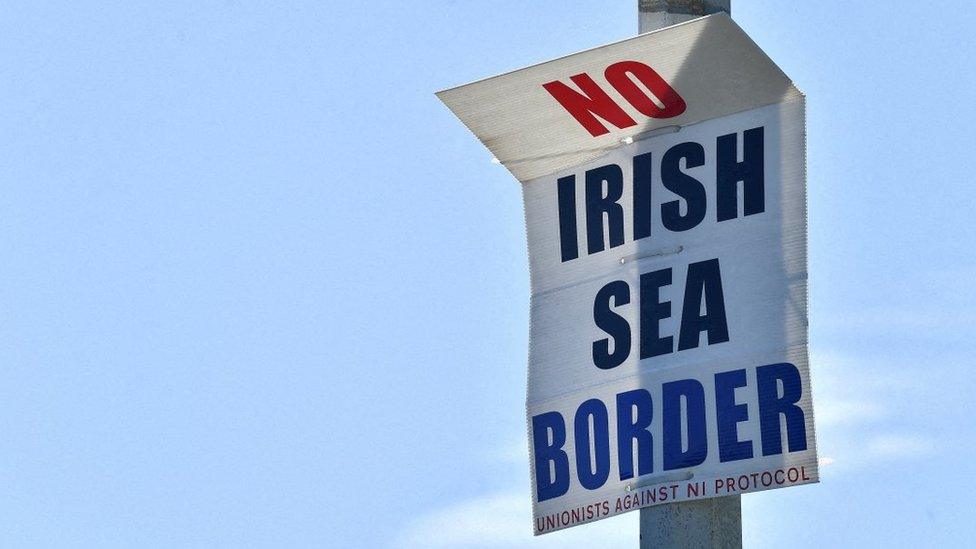

The protocol was agreed by the UK and EU in 2019 to set post-Brexit trading rules for NI.

It meant that Northern Ireland effectively stayed in the EU single market for goods which allowed a free flow of goods across the Irish border.

However it made trading from GB to NI became more difficult and expensive.

The Windsor Framework amends the protocol and is designed to ease those GB to NI trade flows.

In 2022 the then Chancellor, Rishi Sunak, reduced VAT on things such as solar panels and heat pumps from 5% to 0%.

He said that the fact it could not apply immediately in Northern Ireland highlighted the deficiencies of the protocol.

The Treasury said the move could result in a saving of about £2,000 for the typical heat pump installation and over £1,000 for a solar panel installation.

The VAT change will be given effect through a piece of secondary legislation, external known as a Statutory Instrument.

The "Stormont Brake" part of the deal was also implemented through an SI and further SI are expected to be used to implement other parts of the deal.

Related topics

- Published24 March 2023

- Published2 February 2024