Danske Bank: Closures a 'major concern' for small businesses

- Published

David Kelly said many customers do not use cashless payment options

An independent County Down business owner has said the closure of the town's last bank is a "major concern".

Danske Bank has announced it will close four of its branches in Northern Ireland this summer.

The branches are in Carrickfergus, County Antrim; Knock in east Belfast, Saintfield in County Down, and Shipquay Place in Londonderry.

David Kelly, who owns Tribe Coffee House in Saintfield, said a lot of his sales are in cash.

The banks will close on 7 June and the bank said there will be no job losses.

Danske said it was responding to changing banking habits and had to make "difficult decisions" to shut branches that are used less than others.

It advised customers that external cash machines attached to the branches will also be removed on 7 June.

After these latest closures, Danske Bank will be left with a remaining network of 24 branches across Northern Ireland.

Where do we go?

Unlike many other towns of its size, Saintfield's Main Street currently boasts near full occupancy.

The overwhelming bulk of the businesses are independent and locally owned.

Mr Kelly has invested heavily in his business with his wife Paula to make it a success.

He said: "People travel here, they maybe need to use the cash machine or for locals who want to lodge something in their account. For us it is simple things like getting change. It just makes it harder.

"You have to keep trying but this is just another thing that is going to hinder us. It is actually quite a big deal for us and for everybody who needs to use a bank - never mind small businesses."

Mr Kelly said that many customers do not use cashless payment options.

"Where do you go? Our local bank is closing in Ballynahinch (as well) so where do we lodge money?

"There has to be a commitment of where people go to lodge cash. There has to be something for everybody to use."

Shift towards digital banking

Aisling Press, Danske Bank's managing director of personal banking. said: "The world around us is always changing, and alongside that we've seen changes to how people choose to do their banking."

"Many of our customers are now using alternative ways to bank with us, like through our digital solutions, banking on the phone or in the Post Office."

Ms Press added that over the past two years, Danske had seen a 25% increase in customer logins to the bank's digital services.

"We have to respond to these changes, and a key part of that is reviewing and adapting how we invest in our customer solutions for the future," she explained.

Ms Press said Danske's response to change has included investing more in some branches, including its Forestside branch in Belfast and Abbeycentre branch in Newtownabbey.

"Sometimes it also means we need to make difficult decisions to close certain branches that are being used less," Ms Press added.

"This isn't an easy decision to make, and we consider lots of factors including the customer impact of the closure and alternative services nearby."

The Danske Bank in Saintfield is among the branches due to shut in June

On its website, the company has published guides for affected customers, external which include details of their closest free-to-use cash machines and the addresses of their nearest post offices and alternative Danske branches.

Danske Bank is the trading name of Northern Bank Limited.

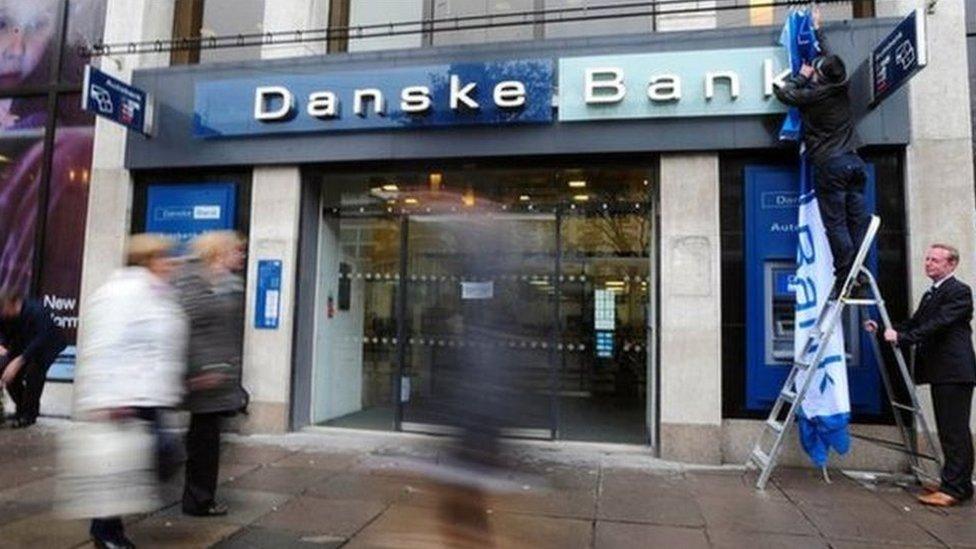

When it rebranded the old Northern Bank business after its Danish-based parent company in 2012, there were 63 branches in Northern Ireland.

Several high street banks have closed dozens of local branches over the past few years, citing changing consumer behaviour and a move to mobile banking services.

Ulster Bank announced it was shutting 10 branches last November while in 2021 Bank of Ireland said it was closing more than half of its 28 branches in Northern Ireland.

Last week, Danske Bank reported an 80% rise in pre-tax profit to £186m in 2023.

Over the past eight years, it has invested about £8m in "transformational upgrades" to a number of branches, most recently at Forestside and the Abbeycentre.

- Published9 December 2023

- Published2 February 2024

- Published9 July 2021