Car insurance: NI woman describes cost as a 'nightmare'

- Published

- comments

Rising car insurance costs in Northern Ireland, which have doubled for some drivers in a year, have been described as a "nightmare".

Naomi Morna, 26, said one quote was as much as her monthly rent.

The regulator, the Financial Conduct Authority (FCA), has said price increases are due to rising costs associated with vehicle repairs.

The FCA has said it hoped to meet the Treasury to discuss the matter.

Ms Morna had been sharing her grandfather's car to take her children to primary school.

"It was a nightmare because I would need it and he would need it straight after, back and forth - it made sense for me to try and get my own car and insurance," she told BBC News NI.

Naomi was receiving insurance quotes that are more than her monthly rent

After being a named driver on her grandfather's policy, she searched for her own.

"I was paying £60 a month on my granda's insurance," she said.

"The first quote I received on a comparison website for myself was £360 a month. That's as much as my rent.

"I can't afford that and paying the car on finance too," she added.

Ms Morna did find a cheaper quote of £187 a month.

NI highest rate

On some price comparison websites, rates for car insurance in Northern Ireland are higher than other parts of the UK.

Drivers under the age of 25 or over 70 usually face a bigger fee.

But some experts said it is not just age that can affect insurance premiums. Other factors such as job, address, where a vehicle is kept overnight, any previous claims and mileage are all considered.

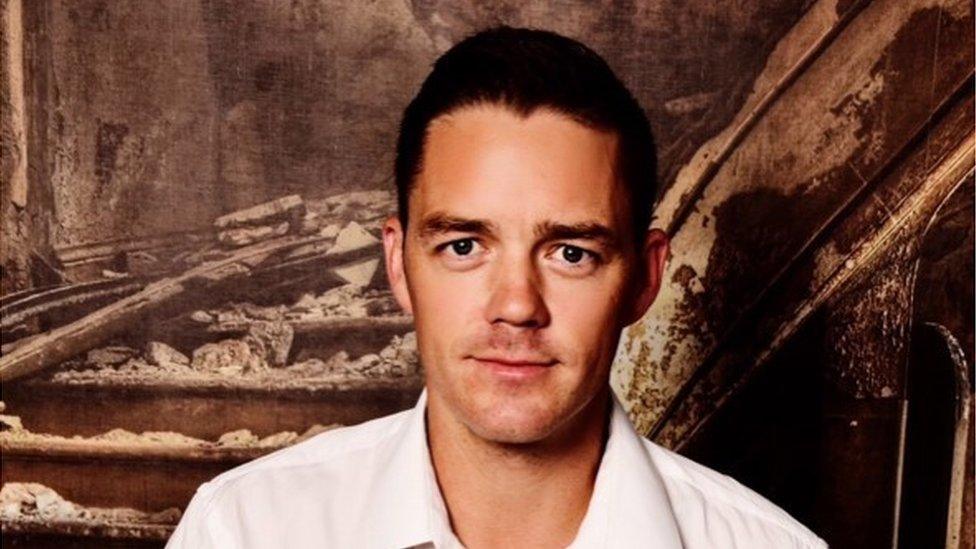

Samuel said his insurance had more than doubled in 2024

Samuel Ruddy, 38, from Hillsborough, had intended to automatically renew his insurance - but said the quote he received was double the amount he had been paying.

"It went from £315.73 in 2022/23 to £748.40 in 2024," he said.

"I asked [the insurance company] why such a large amount was added and I was told there are more young drivers on the road, more accidents also more claims had been put in from last year, therefore, to balance the books an increase was needed."

Paula said the cost of her son's insurance is astronomical

Paula Sloan was searching for insurance for her son who passed his driving test in 2023.

She found a quote of £1,800 with a telematics system which gathers information about driver behaviour, engine diagnostics and vehicle activity.

The 2024 renewal price is £2,900, despite what she described as her son's "impeccable telematics record".

She said some companies were quoting £4,000 to £6,000.

Ms Sloan said: "Much to my dismay, I was told there would be no light at the end of the tunnel and this will unfortunately be the new normal.

"My son is a full-time student with a part-time job, so this astronomical cost will badly impact him."

Specific challenges in NI

The spiralling insurance quotes were recently highlighted by East Belfast MLA Andy Allen, who has written to the FCA.

The FCA told BBC News NI it was "engaging closely with the insurance industry and the UK government" to understand any "specific challenges" with costs in Northern Ireland.

In response to Mr Allen, the regulator cited energy inflation, price rises for paint and materials and the cost of courtesy cars among the reasons for higher premiums.

In a letter, it said: "We recognise that motor insurance in Northern Ireland may be more expensive compared to other parts of the United Kingdom.

"There are a number of reasons for this, including fewer insurers offering cover in Northern Ireland, as well as a more rural landscape resulting in higher mileages and therefore an increased risk of accidents."

The FCA said it was having ongoing conversations with the Association of British Insurers and the British Insurance Brokers' Association "to see what can be done to improve access and affordability of insurance in Northern Ireland".

"We will also be speaking to HM Treasury about this issue," the regulator added.

Related topics

- Published30 January 2024