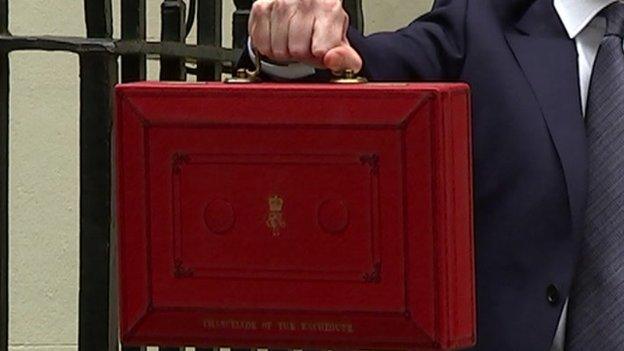

Budget 2015: Osborne unveils National Living Wage

- Published

The announcement of a £9 per hour living wage by 2020 came as something of a surprise

George Osborne has used his first Conservative Budget to slash benefits for low-paid workers - but will force businesses to pay them more.

The National Living Wage, starting at £7.20 and rising to £9 an hour by 2020, replaces the £6.50 minimum wage.

The chancellor scrapped student grants and froze working age benefits but increased the overall tax take to slow the pace of welfare cuts.

Labour leader Harriet Harman said the Budget made "working people worse off".

Measures announced in the Budget statement include:

An increase in the inheritance tax threshold to £1m for married couples by 2017

Working-age benefits to be frozen for four years - including tax credits and local housing allowance, but excluding maternity pay and disability benefits

Maintenance grants for students - paid to students with family incomes below £42,000 - to be scrapped and converted into loans from 2016/17

Scrapping housing benefit for under-21s

Corporation tax cut to 18% by 2020

Restrictions on tax breaks for "buy-to-let" landlords

A commitment to meeting the Nato target of spending 2% of national income on defence

Fuel duties frozen for the remainder of this year

New car tax bands with a standard charge of £140 - and new cars will not need MOTs for the first four years, rather than three

A fresh clampdown on public sector pay, which will be limited to 1% a year for the next four years

Pensions tax annual allowance to be tapered away to a minimum of £10,000 from next year

Confirmed that the BBC has agreed to absorb the £650m cost of providing free television licences for over-75s

Budget 2015

Key points

£47.2bn

raised through tax increases

£34.9bn

raised from cuts to welfare

-

Inheritance tax threshold rises to £1m

-

Corporation tax cut to 18%

-

Personal allowance rises to £11,000

-

National hourly "living wage" by 2020 of £9

Mr Osborne unveiled a downgraded growth forecast for the UK this year, of 2.4%, and pushed back the date at which the UK's public finances would move into surplus by a year to 2019-20.

The Office for Budget Responsibility said public spending would be £83bn higher over the next five years than Mr Osborne said in his March Budget - and the £24.6bn tax cuts announced in the Budget would be dwarfed by £47.2bn in tax rises, including the car tax changes and increasing the tax on insurance premiums from November.

Welfare cuts would add up to £35bn over the next five years.

Paul Johnson, of the Institute for Fiscal Studies, said Mr Osborne's package was "overall a tax-raising Budget" but he had not been "as harsh as he said he was going to be" on welfare cuts, which would be spread over a longer period.

Analysis by Economics Editor Robert Peston

So it turns out George Osborne did not need Lib Dems in government to tell him to take off his hair shirt.

Because today's Budget is massively less austere than the one forged with them in March, just before the election.

Nick Robinson: Osborne's 'big' Budget

Unveiling the first Conservative Budget since 1996, Mr Osborne said the UK economy today was "fundamentally stronger than it was five years ago", with living standards rising strongly.

And his Budget was "a plan for Britain for the next five years to keep moving us from a low wage, high tax, high welfare economy; to the higher wage, lower tax, lower welfare country we intend to create".

Chancellor George Osborne says that student maintenance grants will be replaced by loans from 2017

The chancellor announced a major shake up for Vehicle Excise Duty (VED)

In a surprise announcement at the end of his speech, he said workers aged over 25 would be entitled to a "national living wage" from next April, to soften the impact of in-work benefit cuts.

The current minimum wage, which applies to those aged over 21, is £6.50. Those entitled to the "living wage" will get £7.20 and that will rise to £9 an hour by 2020. Labour had vowed to increase the minimum wage to £8 by 2020 during the general election campaign.

The move is expected to boost the wages of six million people but may cause firms to recruit more under-25s, who will be on a lower rate, according to the Office for Budget Responsibility.

The Treasury confirmed the measure would apply to both the public and private sectors.

Mr Osborne announced that the £26,000 benefit cap - the amount one household can claim in a year - would be cut to £23,000 in London and £20,000 in the rest of the country.

The government will also make local authority and housing association tenants in England who earn more than £30,000 - or £40,000 in London - pay up to the market rent, but rents in the social housing sector will be reduced by 1% a year for the next four years.

The chancellor unveiled "just under half" of the £37bn in cuts he says are needed to clear the deficit, with the remainder to come from cuts to government departments to be announced in the autumn.

George Osborne was delivering his seventh Budget

Work and Pensions Secretary cheers the National Living Wage announcement

There was standing room only in the House of Commons

The chancellor announced an estimated £4.5bn cut to the £30bn-a-year tax credits system, which tops up the wages of low-paid workers, significantly reducing the amount someone can earn before they start losing benefit money.

Support for children through tax credits and universal credits will also be limited to two children, affecting children born after April 2017 unless the third child is the result of twins, triplets or other multiple birth.

Tax credits are a type of welfare payment, introduced by Gordon Brown in 2003, that allow unemployed people to keep some of their benefits when they get a low-paid job and are also paid to disabled workers and those responsible for children. They are due to be phased out when Universal Credit is introduced.

In other Budget announcements, the chancellor increased the personal allowance - the amount people can earn before they start paying tax.

He also tightened up eligibility for "non dom" tax status and said the NHS would receive a further £8bn by 2020, on top of £2bn already committed.

In her Budget response, Labour's acting leader Harriet Harman said: "The chancellor is said to be liberated without the ties of coalition holding him back but what we have heard today suggests his rhetoric is liberated from reality."

Harriet Harman said the Budget "will make working people worse off"

"A Budget for working people? How can you make that claim when you are making working people worse off," she said.

"You are making working people worse off by cutting tax credits and scrapping grants for the poorest students."

UKIP MP Douglas Carswell said it might become "politically unsustainable" to keep public sector pay rises frozen at 1% for four years if the economy grew.

But he welcomed cuts to tax credits, saying "we've got to unravel the disastrous system that Gordon Brown created" where public money subsidises big firms paying low wages.

The SNP's economy spokesman and deputy leader, Stewart Hosie, said the Budget would hit the "the poorest and the most vulnerable" and do nothing to improve productivity or encourage innovation.

A Lib Dem spokesman said: "Amongst the gimmicks and giveaways, the chancellor has hidden four more years of pain, austerity, and cuts."

Business groups gave Mr Osborne's Living Wage announcement a mixed reaction, with the Institute of Directors saying it was "time for companies to increase pay" but the CBI saying the government was taking "a big gamble" on wage increases industry might not be able to deliver.

The Living Wage Foundation director Rhys Moore said the proposed £9 rate was a "massive victory" for campaigners, but that it was "effectively a higher national minimum wage and not a living wage", due to the different ways the two rates are calculated.

The TUC welcomed the Living Wage announcement but said Mr Osborne was "giving with one hand taking with the other" and "massive cuts in support for working people will hit families with children hardest".

- Published8 July 2015