Key points of Budget 2014: At-a-glance

- Published

Here are the key points of Chancellor George Osborne's Budget.

Taxation

Point at which people start paying income tax will be raised to £10,500 from April 2015

Threshold for 40p income tax to rise from £41,450 to £41,865 next month and by a further 1% to £42,285 next year

Inheritance tax waived for members of emergency services who give their lives in job

Tax on homes owned through a company to be extended from residential properties worth more than £2m to those worth more than £500,000

All long-haul flights to carry lower rate of air duty currently charged on flights to US

VAT waived on fuel for air ambulances and inshore rescue boats

George Osborne says he is "incredibly proud" of his increase in the personal tax allowance to £10,500

Savings

Cash and shares Isas to be merged into single New Isa with annual tax-free savings limit of £15,000 from 1 July

The 10p tax rate for savers abolished

Cap on Premium Bonds to be lifted from £30,000 to £40,000 in June and £50,000 next year

George Osborne announces changes to help savers and pensioners

Pensions

All tax restrictions on pensioners' access to their pension pots to be removed, ending the requirement to buy an annuity

Taxable part of pension pot taken as cash on retirement to be charged at normal income tax rate, down from 55%

Increase in total pension savings people can take as a lump sum to £30,000

New Pensioner Bond, paying "market-leading" rates, available from January to over-65s, with possible rates of 2.8% for one-year bond and 4% for three-year bond - up to £10,000 to be saved in each bond

Alcohol, tobacco and gambling

Beer duty cut by 1p a pint

Duty on spirits and ordinary cider frozen

Tobacco duty to rise by 2% above inflation and this escalator to be extended beyond the next general election

Bingo duty will be halved to 10%

Duty on fixed-odds betting terminals increased to 25%

George Osborne announces freeze on duty on whisky and ordinary cider

Energy and fuel

Fuel duty rise planned for September will not happen

£7bn package to cut energy bills, including £18 per ton cap on carbon price support, predicted to save medium-sized manufacturers £50,000 and families £15 a year

State of the economy

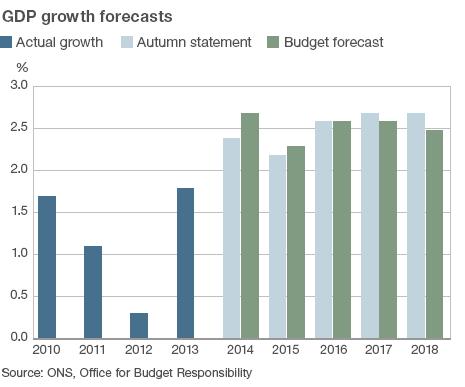

GDP forecast to grow by 2.7% this year and 2.3% next year, then by 2.6% in 2016 and 2017 and by 2.5% in 2018

Coinage

Twelve-sided £1 coin to be introduced in 2017

Welfare

Budget to be capped at £119bn for 2015-16, rising in line with inflation to £127bn in 2018-19. The cap includes child benefit, incapacity benefit, winter fuel payment and income support - but does not include state pension and Jobseeker's Allowance

Public borrowing/deficit

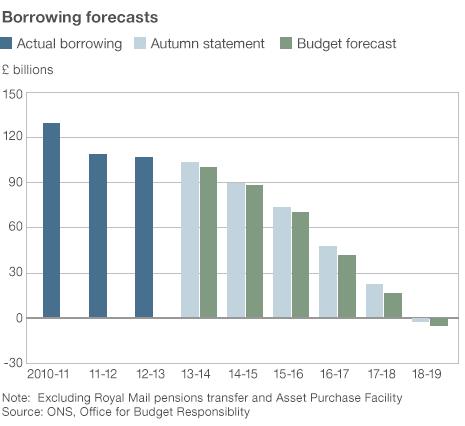

Deficit forecast to be 6.6% of GDP this year, 5.5% in 2014-15 then falling to 0.8% by 2017-18 with a surplus of 0.2% in 2018-19

Borrowing forecast to be £108bn this year and £95bn next year, leading to a surplus of almost £5bn in 2018-19

A new charter for budget responsibility to be brought in this autumn

Promises to make permanent £1bn reduction in government department overspends

Business

Direct lending from government to UK businesses to promote exports doubled to £3bn and interest rates on that lending cut by a third

Business rate discounts and enhanced capital allowances in enterprise zones extended for three years

Housing/infrastructure

Help to Buy equity scheme for new-build homes extended to 2020

Support for building of more than 200,000 new homes

£270m guarantee for Mersey Gateway bridge

A "new garden city" at Ebbsfleet in Kent

Legislation to give Welsh government tax and borrowing powers to fund infrastructure needs, including improvements to M4

£140m extra for flood defence repairs and maintenance

£200m made available to fix potholes