George Osborne proposes two year benefits freeze

- Published

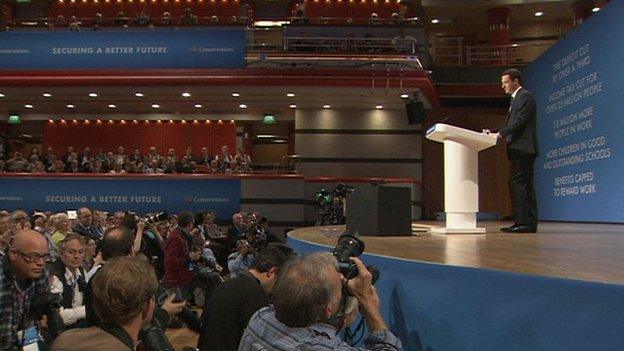

George Osborne MP: "This freeze will save £3bn a year"

A future Conservative government would freeze benefits paid to people of working age for two years, Chancellor George Osborne has told the Conservative Party conference.

Mr Osborne said the proposed freeze, which would not include pensions, disability benefits and maternity pay, would save £3bn.

It would come into effect in 2016, if the Tories win the next election.

Labour said Mr Osborne was standing up "for the very wealthiest few".

About 10 million households would be affected, roughly half of which are working, the Treasury said.

Extra savings

In his speech to the conference, Mr Osborne said the welfare freeze would be "a serious contribution to reduce the deficit".

The chancellor also pledged to scrap the 55% tax rate on inherited pension funds.

And he said he would "put a stop" to the "extraordinary lengths" to which he said some technology companies went in order to avoid paying tax.

"If you abuse our tax system, you abuse the trust of the British people," he said.

"And my message to those companies is clear. We will put a stop to it. Low taxes, but low taxes that are paid."

Details of the measure will be announced in the Autumn Statement in December.

Also announced on the second day of the Conservative conference was a plan to give welfare claimants pre-paid benefit cards that cannot be used for alcohol, drugs or gambling.

The cards were unveiled by Work and Pensions Secretary Iain Duncan Smith, who said they would help families break a "cycle of poverty".

'Dangerously high'

In his speech, Mr Osborne said an extra £25bn of permanent savings would be needed to eliminate the UK's deficit.

He told delegates: "The option of taxing your way out of a deficit no longer exists, if it ever did."

Britain had the fastest-growing economy of any developed nation, the chancellor said, but he was not "marvelling" at what had been done.

"We here resolve that we will finish the job that we have started," he said, saying Britain's national debt was still "dangerously high".

Analysis: Nick Robinson, BBC political editor

There is nothing George Osborne likes more than making twin pack announcements designed to make him look tough but fair.

So it is that he has just announced that a future Conservative government would freeze benefits paid to people of working age for two years at the same time as what will quickly become known as the "Google Tax" - a crackdown on what accountants and tax lawyers call the double Irish arrangement - a tax avoidance strategy that multinational corporations use to lower their corporate tax liability first used by Apple.

Mr Osborne said it was a "dangerous fallacy" that the link between economic prosperity and people's personal finances had been broken.

He reaffirmed the government's determination to press ahead with the HS2 rail link between London, the Midlands and the North, and said that on issues like this, deciding on a future runway for the South East of England and developing shale gas fracking, Britain faced a choice to "decide or decline".

The welfare freeze would include Jobseeker's Allowance, Income Support, Child Tax Credit and Working Tax Credit, Child Benefit and Employment Support Allowance, paid to those judged capable of work.

Tax credits

The £3bn saving is part of £12bn in welfare reductions previously floated by the chancellor. He also said there would be £13bn of Whitehall savings, which will include public sector pay restraint.

A Liberal Democrat source said the party had "consistently blocked" Conservative plans to freeze working-age benefits, and described the measure as a "crowd-pleasing punch line for a conference speech".

For Labour, Chris Leslie, shadow chief secretary to the Treasury, said Mr Osborne had "failed to balance the books in this Parliament".

Mr Leslie said: "He is choosing to give the richest one per cent a £3bn-a-year tax cut and opposing a mansion tax while cutting tax credits which make work pay for millions of striving families.

"While working people have seen their wages fall by £1,600 a year since 2010, the Tories have once again shown they are the party of a privileged few at the top."

UKIP spokesman Patrick O'Flynn MEP said Mr Osborne should have raised the inheritance tax threshold and said "millions of middle earners" paying 40% income tax would feel the government was "not on their side".

Business minister Matthew Hancock is pushed on the number of people who would be affected by a benefits freeze

The 55% pension tax currently applies to untouched "defined contribution" pots left by those aged 75 or over, and to pensions from which money has already been withdrawn.

Inheritors will now only pay the marginal income tax rate, or no tax at all if the deceased was under 75 and the pension is left untouched.

The Treasury predicts the new policy will cost approximately £150m per year.

The idea was first floated in July, when a consultation was launched.

Analysis: Simon Gompertz , BBC personal finance correspondent

The end of the 55% tax charge will be a significant gain for some.

But the question Mr Osborne will have to answer is whether he is creating a way for better-off savers to escape tax.

They will have an incentive to use money stored in bank accounts and investments before dipping into the pension pot.

The reason? The pension will become a way of protecting up to £1.25m from some or all tax after death.

Those on lower incomes, who can't save much, and need the money during retirement, have not been in danger of paying the 55% and are unlikely to benefit from its removal.

Some experts say the Osborne reforms turn pension saving on its head.

The point used to be to spread your income over your lifetime.

In future, pensions could become a method of preserving savings beyond the grave.

The government estimates that the scrapping of the 55% rate is likely to affect 320,000 people. It is the latest in a string of changes to pension regulations introduced by George Osborne.

In March's Budget, the chancellor announced that pensioners would have the freedom to cash in as much or as little of their pension pot as they wanted, removing the need to buy an annuity.

The latest measure will apply to all inherited pensions received from April 2015.

'Extremely concerned'

The beneficiaries of anyone who dies before that date may also benefit from the tax cut, if payment is delayed until after the new policy comes into effect.

It says 12 million Britons have some form of defined contributions pensions saving.

Spouses and financially dependent children under the age of 23 are already exempt from the 55% tax, but the new policy introduces the following changes:

When the deceased is 75 or over, beneficiaries will only have to pay their marginal income tax rate, and only when they take money out of the pension. There will be no restrictions on how much of the fund can be withdrawn at any one time.

Tax-free access to the pension pot of those who die under 75, to any beneficiary, including if the pension is already in "drawdown", meaning income has been drawn from the fund while it is still being invested.

Commenting on Mr Osborne's speech, the Chartered Institute of Housing said it was "extremely concerned" by the benefit freeze proposal, and the Child Poverty Action Group said it was "bad news for working parents struggling on low wages".

TUC General Secretary Frances O'Grady said it put working families "at greater danger of destitution if they become sick or lose their job", while Friends of the Earth criticised Mr Osborne for "promising more roads, more airports and more fracking".

Green Party leader Natalie Bennett accused Mr Osborne of "an attack on the vulnerable".

But John Cridland, director general of the CBI business group, said Mr Osborne should be "credited for sticking to his guns on deficit reduction", saying this had to include welfare.

He said businesses would be "buoyed" by commitments to invest in infrastructure.

The Taxpayers' Alliance said freezing welfare was a "necessary step" but that "much more" was needed on deficit reduction.

- Published29 September 2014

- Published28 September 2014