Tax officials defended over HSBC claims

- Published

The BBC's Nick Robinson: ''This tax bombshell has been ticking since 2007''

The government has defended its record on dealing with tax evasion, amid reports that HSBC helped its wealthy clients to evade UK taxes.

Treasury Minister David Gauke said HM Revenue and Customs had recouped £135m from tax dodgers after an investigation into the claims, dating back to 2005.

Labour wants to know why there has been just one UK prosecution as a result.

And MPs have said they will compel senior HSBC executives to appear before them to answer questions.

Former HSBC boss Stephen Green, who was made a trade minister in 2010, has come under pressure to say what he knew about the claims that Britain's biggest bank helped wealthy clients cheat the UK out of millions of pounds in tax.

The Commons Public Accounts Committee is to hold an inquiry into the allegations, saying that it will "order HSBC to give evidence if necessary".

'Progress'

The BBC's Panorama and other media organisations have seen thousands of accounts from HSBC's private bank in Switzerland leaked by a whistleblower in 2007.

Treasury minister David Gauke defended the government's actions on tax avoidance, saying its record proved it ''was willing to address this problem''

The documents include details of almost 7,000 British clients - and many of the accounts were not declared to the taxman.

HMRC was given the leaked data in 2010 and has identified 1,100 people who had not paid their taxes. One tax evader has been prosecuted.

HSBC admitted that some individuals took advantage of bank secrecy to hold undeclared accounts, but it said it has now "fundamentally changed".

The opposition tabled an urgent question in the House of Commons which forced Mr Gauke to make a statement to MPs on HSBC.

Mr Gauke told MPs that HMRC had consistently used civil penalties as the most "cost-effective way" of collecting revenue and "changing behaviour" but he expected the number of prosecutions to increase significantly.

Addressing the House of Commons, Mr Gauke told MPs that HMRC had looked at 6,800 cases relating to HSBC, and found a number of duplications.

The cases left numbered 3,600, he said, of which 1,000 were investigated, while the remainder had "no case to answer".

He said that, as a result, HMRC recouped £135m "that would not previously have been raised".

"This is further evidence of progress made by this government in tackling tax evasion and indeed tax avoidance," he told MPs.

Civil penalties

Mr Gauke said HMRC had received the data under "very strict conditions" which limited the department's use of it.

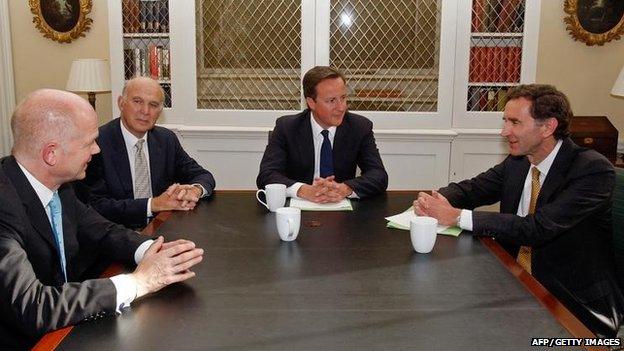

Mr Green (right) served as a minister of trade and investment until 2013

"Under these restrictions, HMRC has not been able to seek prosecution for other potential offences, such as money laundering," he added, but said French authorities had agreed to aid investigations.

In addition, new "international common reporting standards" would also play a role in tackling any further allegations of aiding tax avoidance, Mr Gauke added.

He confirmed there had been one prosecution as a result of the HSBC data, but said prosecutions were set to increase "five fold" over the lifetime of the Parliament.

Green role

But Labour's Shabana Mahmood accused the government of having "apparently failed to act" when it was made aware of the claims back in 2010.

She pressed Mr Gauke to say who saw the information, and what was done with it, as well as what communications there had been - if any - within government.

Ms Mahmood also demanded to know what information the government had sought from Lord Green about the claims of tax avoidance before he was made a minister.

Lord Green was made a Conservative peer and appointed to the government eight months after HMRC was given the leaked documents.

"Any failure to question Stephen Green before his appointment would be an inexplicable and inexcusable abdication of responsibility," she told the government.

Ms Mahmood said many questions still remained unanswered:

Responding, Mr Gauke said: "There is no evidence to suggest he was involved in or complicit with tax evasion activities."

He told MPs that Lord Green - who was in his post until 2013 - had been "a very successful minister".

Launching an attack on the previous government's record on tackling tax evasion, he noted that much of the data related to the period between 2005 and 2007, when Labour was in power.

"If we are talking about complicity ... what about the city minister (now shadow chancellor) Ed Balls?

"The reality is it is this government that has consistently cleared up the mess that we inherited," he said.

'Sophisticated global business'

Earlier, Labour leader Ed Miliband said the government had "serious questions to answer" over the HSBC tax claims.

"We cannot have a country where tax avoidance is allowed to carry on and where government just turns a blind eye," he said.

Margaret Hodge MP: "If you were a benefits scrounger, you'd be queuing round the court"

Prime Minister David Cameron said no government had done more to tackle tax evasion and "regressive" tax avoidance than his, pointing out that tax transparency was at the top of his G8 agenda.

For the Lib Dems, Deputy Prime Minister Nick Clegg said the HSBC scandal demonstrated that tax avoidance was a "sophisticated global business", adding that tax evaders needed to feel "the full force of the law".

Labour MP Margaret Hodge, chair of the Public Accounts Committee, also weighed into the row, criticising HMRC for inaction against tax avoiders.

"You are left wondering, as you see the enormity of what has been going on, what it actually takes to bring a tax cheat to court," she told the BBC.

Watch Panorama: The Bank of Tax Cheats on February 9 at 20.30 GMT on BBC1.

- Published10 February 2015

- Published9 February 2015

- Published9 February 2015