Budget 2015: Reaction in quotes

- Published

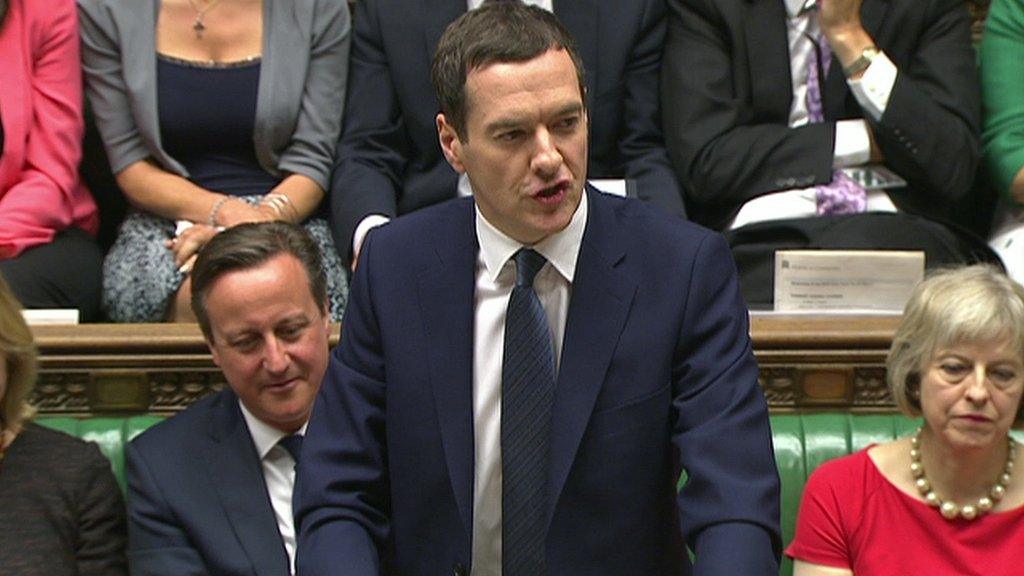

"This will be a Budget for working people," George Osborne told the House of Commons as he delivered the first all-Conservative Budget since 1996.

"A Budget that sets out a plan for Britain for the next 5 years to keep moving us from a low wage, high tax, high welfare economy; to the higher wage, lower tax, lower welfare country we intend to create," he said.

But how have his tax and spending announcements gone down?

Acting Labour leader Harriet Harman

He's making working people worse off by cutting tax credits and scrapping grants for the poorest students, and families will still suffer despite the new national living wage. This Budget is less about economic strategy, more about political tactics designed by the chancellor to help him move next door [to 10 Downing Street].

Labour leadership contender Yvette Cooper

Working parents are being really hard hit because the level of the cuts to their tax credits is far bigger for most of these families than the increase in the minimum wage. So you've got some families who are going to be losing thousands of pounds. The prime minister promised not to cut child tax credits and instead he's hitting working people very hard.

SNP deputy leader Stewart Hosie

George Osborne's Tory Budget will hit hard working families, the poorest and young people the hardest. He has continued with his harsh austerity agenda - particularly the savage cuts in tax credits. Any increase in the living wage is of course welcome, but the reality is that the good will be undone by the Tory cuts to the incomes of people who can least afford it. And the living wage in Scotland is currently £7.85 - George Osborne is proposing to see it effectively lowered to £7.20.

Lib Dem leadership contender Tim Farron

For all its talk about striving, aspiration and creating a Northern Powerhouse, this budget has delivered none of it. It shows that the Conservatives, devoid of fresh ideas, have simply rehashed old ones that were rejected over the last few years.

Plaid Cymru Treasury spokesman Jonathan Edwards

It was a typical Conservative Budget, earmarking massive cuts in public investment - £37bn, with £20bn yet to be accounted for. It will hit the very poorest in society and have a significant impact in Wales. This is a budget that will increase wealth and income inequalities.

Work and Pensions Committee chairman Frank Field

The national living wage initiative could be a game changing move. What's crucial now is to ensure that the level at which it's set by the end of the parliament is matched by productivity increases so it is sustainable. The immediate issue, however, is how many strivers will be made worse off by the other announcements the chancellor has made and what moves should we initiate to ensure that our constituents' wish that work will pay is fulfilled.

Green Party MP Caroline Lucas

Today's Budget will go down as a pivotal moment in the dismantling of the welfare state, where the government's own advisers saying that slashing the benefits cap will throw 40,000 more children into poverty.

GMB union leader Paul Kenny

On the one hand he offers a vision of a living wage which is welcome. He confirms what GMB has being saying for some time - the vast majority of employers can afford pay rises and no amount of howling from the CBI will alter that fact. On the other hand he is taking away money from working families without any guarantee that they will be better off.

PCS union general secretary Mark Serwotka

Cutting social security support from the unemployed, the low paid, and sick and disabled people must rank among the lowest and most despicable acts of any government in recent times. Osborne hypocritically talks about cutting tax credits to increase wages while the last government cut living standards for civil servants by up to 20% and he now plans four more years of pay caps.

TUC general secretary Frances O'Grady

For young people, it was all bad news as they will not get the minimum wage boost and will suffer from cuts to higher education grants and housing benefit. And it was not a one-nation budget for public sector workers who will face years more of cuts to real wages. Massive tax cuts for the wealthiest show the Conservatives are still the party of the inheritors, rather than the workers.

CBI director general John Cridland

This is a double-edged budget for business. Firms will welcome measures to balance the books and boost investment, but they will be concerned by legislating for wage increases they may not be able to deliver... This is taking a big gamble that the labour market can absorb year-on-year increases of an average of 6%.

British Chambers of Commerce chief economist David Kern

The chancellor is right to persevere with his programme for restoring stability to public finances, and has now adopted a more realistic timetable in line with our own forecast. A slightly later budget surplus means more support for economic growth in the meantime - ensuring that deficit reduction does not hit economic activity, business confidence, or job creation.

Local Government Association chairman Gary Porter

It is right that the chancellor has not used his summer budget to further reduce in-year local government funding. Councils already have to find £2.5bn in savings this financial year and these are proving the most difficult savings to find yet. Councils will now be looking to the spending review in the autumn which will decide the future of our public services over the next decade. It is likely to see councils continue to face challenging funding reductions and spending pressures over the next few years.

Federation of Small Businesses chairman John Allen

We agree with the focus on productivity but need to see the details to raise skills through the apprenticeship levy on large firms. Planning reforms are also critical to raising productivity and again we look forward to seeing the proposals on Friday. However, even though offset by a welcome increase in the employment allowance, some will find the new national living wage challenging. Changes to the treatment of dividends will also affect many of our members.

Manufacturers' organisation EEF chief executive Terry Scuoler

The chancellor has served up a number of aces in supporting business investment allowances, plans to cut employer national insurance contributions, phased reductions in corporation tax and funding for road improvements... However he has double faulted on the training levy which manufacturers will be sceptical about. Until we see the detail it is not clear how this will help deliver the high quality apprenticeships we urgently need.

National Association of Local Councils chief executive Dr Jonathan Owen

There was much talk of creating 'northern powerhouses' but we'd like to see 'localist powerhouses' too, with parishes and their volunteer support running a range of local services to reflect local circumstances. From providing shuttle buses to reduce traffic in towns, to building dementia friendly communities and supporting older people.

Association of Chartered Certified Accountants head of taxation Chas Roy-Chowdhury

We are disappointed with the chancellor's decision to restrict pension tax relief at higher incomes. This constant tinkering and toying with people's life-time plans is the wrong approach. This policy is at odds with both his and the prime minister's claims that they want to create 'a nation of savers'... This is a short-term tax grab that will have long term detrimental effects.

KPMG's head of living wage Mike Kelly

The new compulsory national living wage is very welcome news for the more than two million of the working poor who will get a significant pay rise. Enshrining the living wage in regulation is a brave move... For employers who are concerned at whether the increased payroll costs will be fully offset by reduced corporation tax and national insurance contributions, our experience has seen lower absence, increased productivity and a more engaged workforce.

Joseph Rowntree Foundation chief executive Julia Unwin

The £12bn cuts to welfare have been targeted at low-income working families, most of whom rely on tax credits to make work pay. Higher income from increasing the national minimum wage and the personal tax allowance will go some way towards closing the gap, but cutting support before the jobs market has had the chance to respond is a dangerous gamble.

- Published8 July 2015

- Published8 July 2015

- Published8 July 2015

- Published8 July 2015

- Published8 July 2015