Tax credits: Lords vote to delay controversial cuts

- Published

Chancellor George Osborne: "This raises constitutional issues"

The government has been dealt a major blow after the House of Lords voted to delay tax credit cuts and to compensate those affected in full.

Peers voted by 289 votes to 272 to provide full financial redress to the millions of recipients affected.

They earlier inflicted a second defeat by backing a pause until an independent study of the impact was carried out.

George Osborne said he would heed the outcome of the vote, but said it raised "constitutional issues".

The chancellor criticised "unelected Labour and Lib Dem lords" for defying the will of the elected House of Commons, but said he would set out how the proposed changes to tax credits would be modified in response in next month's Autumn Statement.

"I said I would listen and we will listen to the concerns that have been raised," he said.

"I believe we can achieve the same goal of reforming tax credits, saving the money we need to save to secure our economy, while at the same time helping in the transition.. I'm determined to deliver that lower welfare economy the British people want to see."

But the BBC's political editor Laura Kuenssberg said it was a "very bad result" for the government but it was not clear what it meant for recipients of tax credits.

Labour reacted by calling for a "full u-turn" over the tax credit changes.

'Powerful message'

On a dramatic evening in the House of Lords, peers threw out a "fatal motion" tabled by the Lib Dems, which would have blocked the changes entirely.

If it had passed, the Lib Dem motion would have stopped the £4.4bn cuts to tax credits in their tracks and sent the proposals back to the drawing board.

One Conservative MP said the Lords' actions were a "constitutional outrage"

But peers backed calls, by 307 votes to 277, led by crossbench peer Baroness Meacher for the cuts to be put on hold pending an independent analysis.

They also supported a Labour plan to provide transitional financial support for at least three years for those likely to be affected.

Baroness Meacher told Sky News that the government was "pulling the rug" from under the feet of working people, saying the outcome sent a "powerful message" to MPs to think again.

Ministers argued peers did not have the right to block financial measures approved by the House of Commons, with Lords leader Baroness Stowell telling them the "financial primacy" of the Commons had been in place for 300 years and to ignore this would be an "unprecedented" challenge.

The ex-chancellor called for "aspects of this measure to be reconsidered and changed"

'Economic vision'

Urging peers to reject the critical motions, she said the squeeze on tax credits should not be treated "in isolation" but was part of the government's "economic strategy and vision for the country".

But speaking during a three-hour debate, former Conservative Chancellor Lord Lawson urged "tweaks" to the policy to reduce the "financial harm" to those on the lowest incomes, saying "it is not just listening which is required, but change".

What are tax credits and what are the changes?

How do tax credits work and how much can people get?

Tax credits are a series of benefits introduced by the last Labour government to help low-paid families. There are two types: Working Tax Credit (WTC) for those in work, and Child Tax Credit (CTC) for those with children.

Under government proposals, the income threshold for Working Tax Credits - £6,420 - will be cut to £3,850 a year from April.

In other words, as soon as someone earns £3,850, they will see their payments reduced. The income threshold for those only claiming CTCs will be cut from £16,105 to £12,125.

The rate at which those payments are cut is also going to get faster. Currently, for every £1 claimants earn above the threshold, they lose 41p. This is known as the taper rate. But from April, the taper rate will accelerate to 48p.

There will be similar reductions for those who claim work allowances under the new Universal Credit.

Read more:

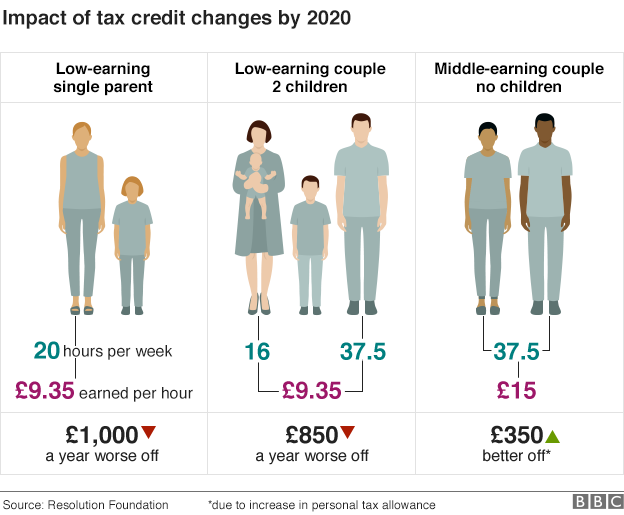

Opponents of the tax credit changes say they will leave millions of existing recipients - many of whom work but are on low incomes - some £1,300 a year worse off when they come into effect in April.

But ministers say that taking into account other changes, such as the introduction of the new national living wage, further increases in the personal tax allowance and an extension of free childcare, the majority of existing claimants will be better off.

The measures have been approved on three occasions by the Commons since June, but there has been growing unease on the Conservative benches about their impact and the government is more vulnerable to defeats in the House of Lords, where it has no majority.

Government 'in listening mode' on tax credits

Baroness Manzoor's so-called "fatal motion", external, a rarely used parliamentary device, would have "declined to approve" the plans.

Constitution wars

It should not really be much of a problem - the House of Lords is not traditionally supposed to block financial legislation that has the backing of MPs.

This principle was established in 1911 during the constitutional gridlock that followed a decision by peers to block the Liberal Party's "people's budget".

But nothing is ever cut and dried in Britain's fluid, unwritten constitution. And both sides are angrily trading precedents and claiming that their opponents are overstepping the mark. If they could only agree where the mark is.

The Lib Dems told their 111 peers to vote for the motion but it did not attract support from Labour and the 176 crossbench members of the Upper House.

Labour's motion, under the name of Baroness Hollis, called for the changes to be delayed until a three-year package of transitional financial help has been agreed upon.

Parent Katie Noble: Hard-working people "being punished" by the Conservatives

The Upper House, whose main function is as a revising chamber, has no powers to amend or block government money bills, but the tax credit changes are incorporated in a so-called statutory instrument rather than primary legislation.

According to parliamentary records, peers have killed off secondary or delegated legislation supported by the Commons on five occasions since 1945: in 1968, 2000 (twice), 2007 and 2012.

Conservative MP Michael Ellis told Sky News that it was a "constitutional outrage" for the Lords to defy the Commons over the issue, saying it should have "consequences" for the unelected chamber.

- Published5 October 2015

- Published24 November 2015

- Published25 October 2015