Council tax: Many households in England face rise

- Published

- comments

Many councils have frozen bills in recent years under pressure from government

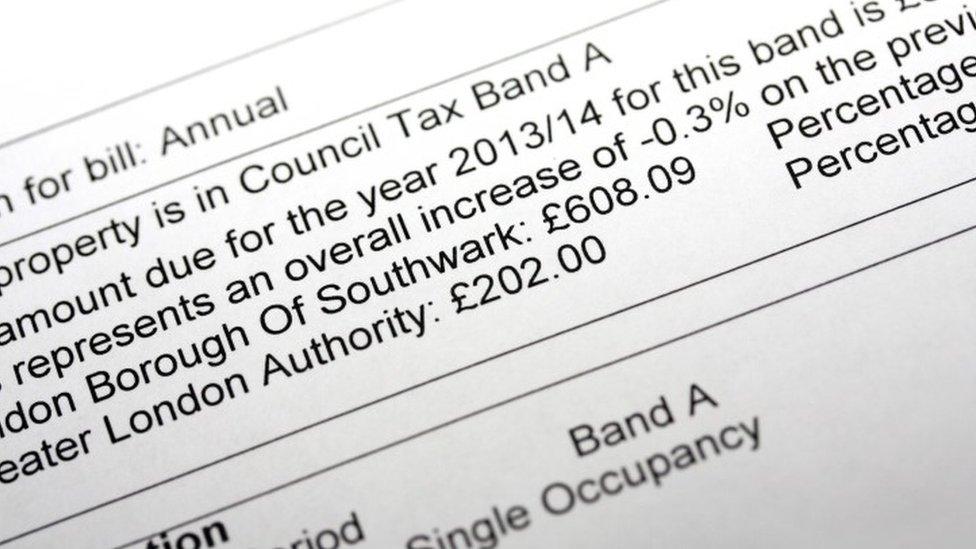

Scores of local authorities in England plan to increase council tax by up to 5% in 2017-8, according to research.

The Local Government Information Unit, external said 94% of the 131 councils it spoke to were intending to put up bills, with their finances at "breaking point".

A third of these, 34% in total, intend to hike bills by more than 2% in April.

Councils, many of whom have frozen bills in recent years, say it will not be enough to plug the funding "gap" exacerbated by the cost of social care.

But the government says council tax is expected to be lower in real terms at the end of this Parliament than it was in 2010.

Although councils in Wales were included in the survey, the Welsh government has said it will not allow councils to raise bills to pay for social care.

Ministers say they are bringing forward money to help councils pay for social care by increasing the "precept" - a supplement that councils are able to charge on bills - from 2% to 5% over the next two years.

Years of cuts to central government funding since 2011 have put pressure on the budgets of the 375 councils in England and Wales, with many paring back core services. Financial pressures on county councils and unitary authorities that provide adult social care have become particularly acute in the past year.

Referendums

Surrey County Council abandoned controversial plans this week to hold a referendum on a 15% rise in council tax which it said was needed to pay for social care. It will now increase bills by 4.99% - the maximum it can do without holding a public vote.

Labour have accused the government of doing a sweetheart deal with the Tory-controlled council to call off the referendum - claims it denies.

Publishing its research, the Local Government Information Unit said five district councils which do not provide social care had wanted to hold local referendums to sanction council tax rises above 2% but had "thought better" of it in recent weeks.

Council says they could struggle to fund core services in future

Inflation, as measured by the CPI index, currently stands at 1.6% but is projected to rise to 2.7% next year.

The LGIU said there was growing concern in town halls that the current system of funding local authorities - through a mixture of government grants, council tax and other income streams such as business rates and parking charges - would become unsustainable in the near future.

Of the 163 council chiefs - across 131 local authorities - which responded to its survey, 42% said future cuts would be "noticed" by residents while one in 10 feared the situation might become so serious that they would no longer be able to fulfil their councils' legal obligations to provide certain services.

A number of county councils - including Newcastle, North Tyneside, South Tyneside and Sunderland - have already said they will add the full 3% "social care precept" to council tax bills next year and many others are expected to follow suit.

'Breaking point'

Jonathan Carr-West, chief executive of the LGIU, said: "Local government finances are at breaking point."

"We see councils around the country patching their budgets by raising council tax, drawing on their reserves and increasing charging. They have very little confidence in the sustainability of the system.

"Councils are allowed to place a 3% precept on council tax to fund adult social care - nine out of 10 of them saying it is not enough money and won't meet the gap. Councils are going to retain 100% of the new business rates - half of councils tell us they think they will be worse off under that new system post-2020."

Councils are struggling to fund the costs of social care

He said councils were being frustrated in their efforts to address the problems themselves with revenue-raising measures such as greater scope for charging, local hotel taxes and a re-evaluation of council tax bands "off the government's agenda".

"None of these are wild and wacky ideas. They are things that are done in other countries, in the US, France and Spain and they work.

"Here they are not even part of the conversation. That needs to change."

A spokesman for the Department of Communities and Local Government said: "Council tax is expected to be lower in real terms at the end of this Parliament than it was in 2010 and we've protected residents by allowing them to veto excessive rises at a local referendum.

"Our historic four-year funding settlement gives local authorities the certainty they need to plan ahead, with almost £200bn available to provide the services that local people most value.

"We've also announced an additional £900m for social care, meaning councils will have £7.6bn of dedicated funding to spend over the four years."

- Published9 February 2017

- Published7 February 2017

- Published8 February 2017

- Published7 February 2017