Minister denies 'sweetheart' tax deal with Surrey

- Published

Surrey County Council's decision not to raise council tax by up to 15% "was theirs alone", Local Government Secretary Sajid Javid has said.

Jeremy Corbyn had claimed text messages showed ministers were prepared to offer a "sweetheart deal" to the council to avoid a referendum on the rise.

But Mr Javid insisted there was "no memorandum of understanding" between the government and the council.

And Surrey County Council said "no deal" had been offered.

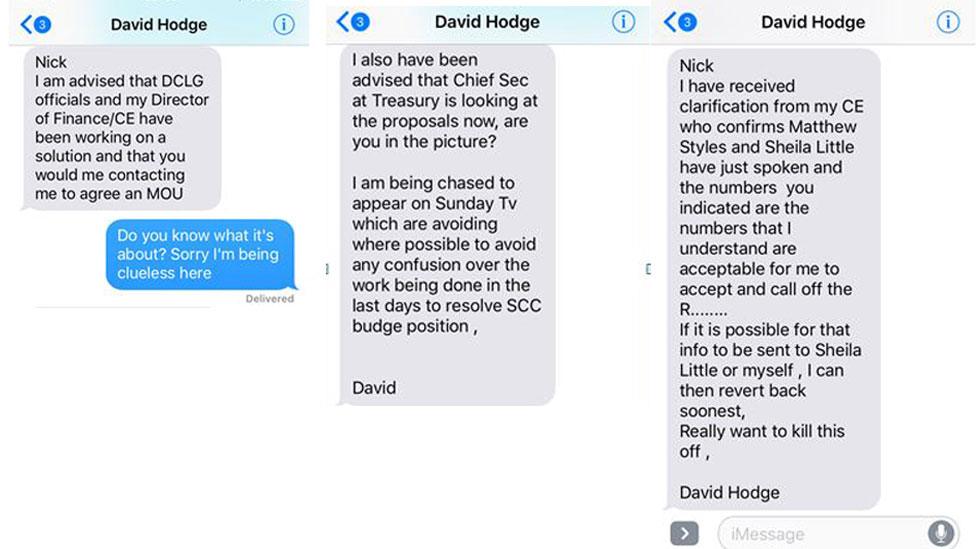

Labour released screenshots of the text exchange

The Labour leader raised the issue during Prime Minister's Questions, claiming he had seen leaked text messages intended for a Department for Communities and Local Government official called "Nick" from the leader of Surrey County Council, David Hodge.

"These texts read, 'I am advised that DCLG officials... have been working on a solution and... you [will be] contacting me to agree [a memorandum of understanding],'" he said.

He asked: "Will the government now publish this memorandum of understanding and, while they're about it, will all councils be offered the same deal?"

Noting that Chancellor Philip Hammond and Health Secretary Jeremy Hunt are both Surrey MPs, Mr Corbyn said: "But there was a second text from the Surrey County Council leader to Nick - and in the second text it says, 'The numbers you indicated are the numbers I understand are acceptable for me to accept and call off the R.'

"Now, I've been reading a bit of John le Carre and apparently 'R' means referendum. It's very subtle all this."

He added: "He goes on to say in his text to Nick, 'If it is possible for that info to be sent to... myself, I can then revert back soonest. Really want to kill this off.'

"So how much did the government offer Surrey to kill this off and is the same sweetheart deal on offer to every council facing the social care crisis created by this government?"

Business rate pilot

In a statement, Mr Javid said Surrey County Council's budget and council tax "is a matter for the council", adding it "had been clear that their budget decision (setting a level of council tax which is not above the referendum threshold) was theirs alone".

Under the Local Government Finance Settlement, the Department for Communities and Local Government discussed funding with councils across the country "of all types and all political colours", he said.

"Whilst the final settlement has yet to be approved, the government is not proposing extra funding to Surrey County Council that is not otherwise provided or offered to other councils generally," Mr Javid said.

"There is no 'memorandum of understanding' between government and Surrey County Council."

He said Surrey had asked to take part in the pilot of a new business rates scheme, adding that other councils could also apply to take part.

Authorities are required to hold a referendum for council tax increases of 5% or more

Downing Street said all conversations between the government and Surrey had been "entirely appropriate" and there was no "sweetheart deal".

The proposed 15% rise was mooted by Surrey Council to cover what it said were shortfalls in funding to cover the rising costs of social care.

But plans for a referendum - which are triggered if a local authority proposes a council tax rise of 5% or more - were dropped during a full council meeting on Tuesday.

Councillors will now consider an alternative budget.

Jeremy Corbyn reads out leaked texts about funding for Surrey County Council

Mr Hodge told the BBC: "There is no deal with government, there never was - end of story."

The prime minister said: "The deal that is on offer to all councils is the one that I have already set out."

Councils have been allowed to implement a 3% tax increase solely for social care over the next two years to plug the funding gap in this area.

That is on top of a discretionary general increase of 2%, making a total of 5% before a referendum is needed.

Liverpool Mayor Joe Anderson said he was "seeking urgent clarification" about whether Surrey had been "bought off" by the government, adding that cities such as Liverpool, Manchester, Newcastle and Birmingham had been hit "far harder" by funding cuts.

- Published6 February 2017

- Published7 February 2017

- Published1 February 2017

- Published2 February 2017

- Published19 January 2017

- Published6 January 2017

- Published14 December 2016

- Published13 December 2016

- Published12 December 2016

- Published12 December 2016