May defends 'fair' National Insurance rise amid criticism

- Published

Theresa May says the rise in National Insurance for the self-employed will make things fairer

Theresa May has said the National Insurance increase for self-employed workers will make the system "fair", amid criticism from some Conservatives.

The Budget change broke a manifesto pledge - with one Conservative whip saying ministers should apologise.

But Mrs May said the poorest workers would pay less and the change would "close the gap in contributions".

She said a bill to bring in the change would come in the autumn - not the summer as the Treasury earlier briefed.

The change will see millions of self-employed workers pay an average of £240 a year more but ministers say those earning £16,250 or less will see their NI contributions fall.

Labour and the Liberal Democrats criticised the change - as did more than a dozen Conservative MPs, including Iain Duncan Smith, John Redwood, Anna Soubry and Dominic Raab.

At a press conference following the EU summit the prime minister rejected suggestions the policy had broken a manifesto commitment, arguing the legislation brought in to "honour" that pledge related only to "class one" NI contributions, covering 85% of workers.

"We did make some difficult decisions in the Budget yesterday," she said, adding that those decisions had allowed them to fund technical education, to open more than 100 new free schools, as well as meeting social care demands and investing in the long-term productivity of the economy.

The shift towards self employment was "eroding the tax base", she argued.

"Is it fair? I think it is fair to close the gap in contributions between two people doing the same work and using the same public services to make the same contribution to wider society."

'Better off'

The prime minister said the "full effects" of the change would be set out in a paper in the summer alongside "some changes we plan to make on rights and protections for self-employed workers and people would be able to look at the paper and "take a judgement in the round". The chancellor would "listen to the concerns" raised by MPs and business.

BBC political editor Laura Kuenssberg said that, while the Treasury had briefed on Thursday morning that legislation to enact the National Insurance change would be brought forward in the summer, Downing Street was now saying it would be in the autumn.

The change was supported by some economic commentators. The Resolution Foundation think tank called it "welcome and progressive", while the Institute for Fiscal Studies suggested further rises were needed.

But among Conservative MPs criticising the measure was Guto Bebb, a government whip and minister in the Wales Office.

He told BBC Radio Cymru: "I believe we should apologise. I will apologise to every voter in Wales that read the Conservative manifesto in the 2015 election."

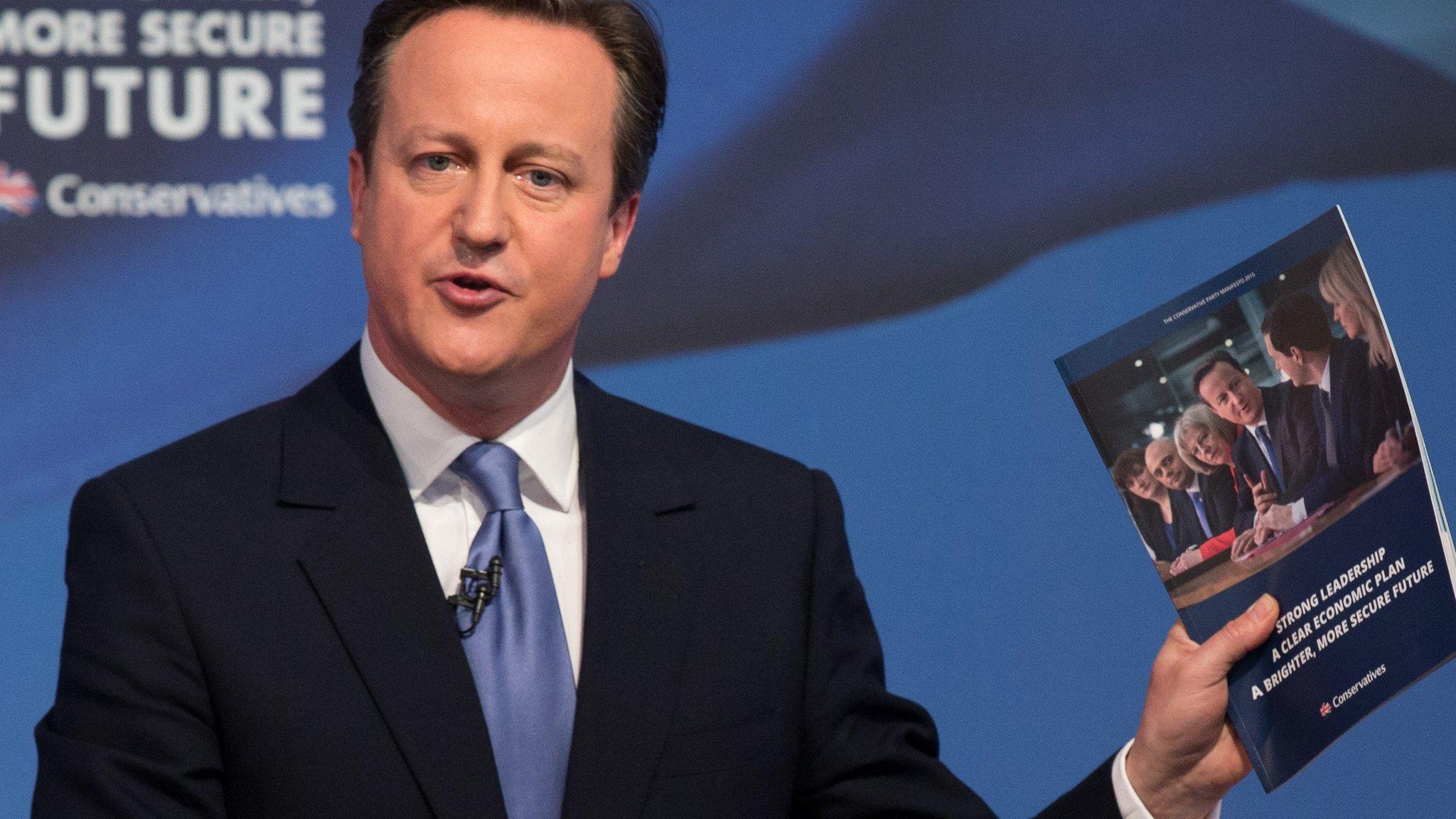

The Conservatives' last general election manifesto explicitly ruled out rises in National Insurance, VAT and income tax during the lifetime of the current Parliament.

During the campaign, then Prime Minister David Cameron continually repeated the commitment in public and contrasted it with the "jobs tax" which he said people could expect under Labour.

What is National Insurance?

National Insurance contributions go into a fund that pays for the state pension and some other benefits

They also help pay for the NHS

National Insurance is deducted automatically from employees' salaries

There are different classes of National Insurance payments, depending on people's employment status and how much they earn

The self-employed currently pay a lower rate than those in employment

The government says this was traditionally down to a lesser entitlement to benefits and pensions, but that these disparities have mostly been removed, so the difference in rates is unfair

But critics say it is justified because self-employed people are not entitled to things like paid holiday and sickness leave

Conservative MP Anne Marie Morris wrote in the Telegraph, external: "The changes to National Insurance defy belief! What did the chancellor think he was doing? Increasing the rate of 'Class 4' contribution from 9 per cent to 11 per cent over two years!

"At least he kept his word and abolished 'Class 2' contributions which was unfair, not well understood and not related to income or profit.

"But while Class 4 contributions are profit related and therefore 'fairer', this was I suspect not the reason for the change but a post-decision marketing strap line.

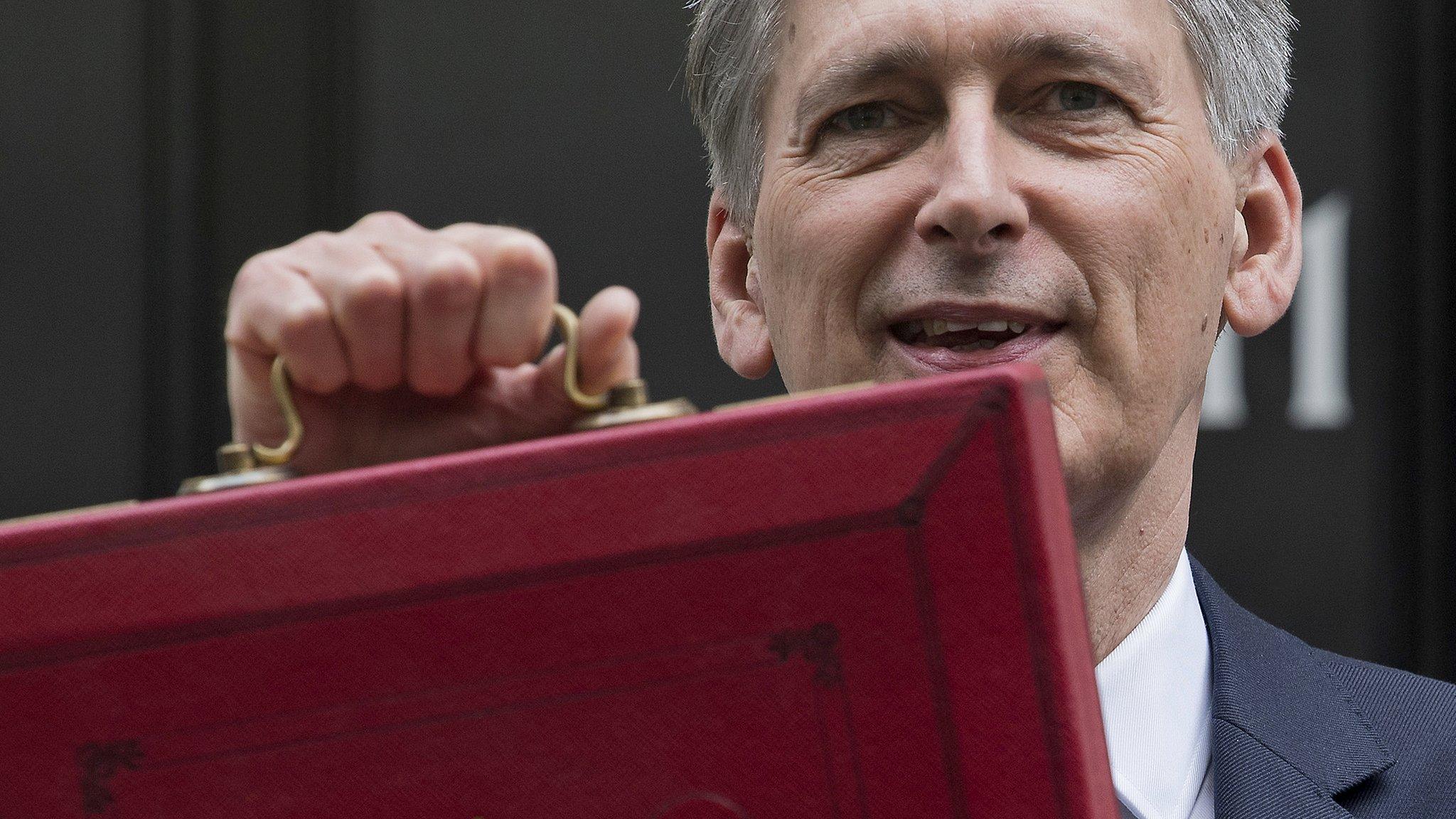

Shadow Chancellor John McDonnell tells Today Philip Hammond needs to "think again" on NI

"It has all the hallmarks of the 'pasty tax' own goal."

In the wake of Mr Hammond's Budget announcement, ministers argued that legislation enshrining the manifesto commitment in law - approved by Parliament in 2015 - only referred to National Insurance contributions paid directly by employers and their employees.

Wednesday's changes would see the 9% rate of Class 4 National Insurance contributions currently paid by those self-employed people earning between £8,060 and £43,000 go up to 10% in April 2018 and to 11% in April 2019.

Labour accused the government of "breaking their promises" and "clobbering" the self-employed, while the Lib Dems and UKIP also criticised the move.

- Published9 March 2017

- Published8 March 2017

- Published8 March 2017

- Published8 March 2017