Reality Check: Are lower earners bearing the tax burden?

- Published

The claim: Low and middle earners are bearing the burden of the tax take.

Reality Check verdict: The government is very reliant on richer people for its funding. More than a quarter of income tax is paid by the 1% of taxpayers with the highest incomes.

Shadow chancellor John McDonnell kicked off his election campaign on Wednesday by talking about increasing taxes on the rich and on corporations.

"The burden in terms of the tax take is falling on middle and low earners," he told BBC Radio 4's Today programme.

In fact, the tax base is very reliant on rich people, with income tax becoming increasingly reliant on them.

The Resolution Foundation, which does a great deal of work on inequality, says that the income tax system is relying too much on the richest 10%, which is a problem because their earnings are volatile.

It also pointed out that the combined effect of tax and benefit changes was hitting the poorest people the hardest, but Mr McDonnell was not talking about benefits.

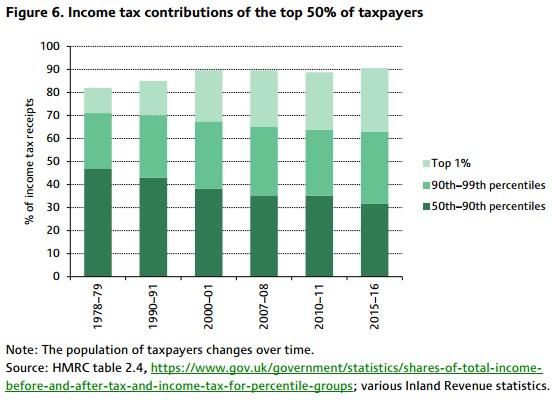

This chart from the Institute for Fiscal Studies shows that about 90% of income tax is paid by the 50% of taxpayers with the highest incomes, while more than a quarter is paid by the richest 1%.

Indirect taxes such as VAT and fuel duty are not progressive though - people with lower incomes do not pay lower rates - so we need to consider all taxes.

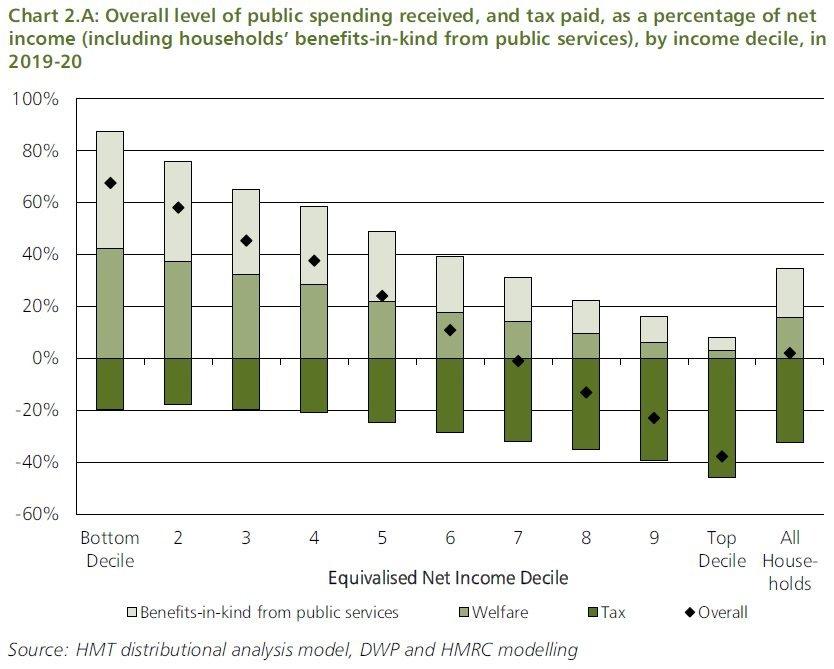

The Treasury published analysis at the time of the Budget predicting what proportion of incomes people would be spending on all taxes by 2019-20.

The result is in the darker green bars below the line in this chart, with the poorest households on the left and the richest on the right.

The proportion of income spent on taxes does appear to be increasing as income increases throughout the distribution. The exception is for the poorest 10%, who seem to be spending slightly more than the next 10%, although the IFS says that is probably due to people misreporting their incomes in the survey from which this analysis is taken.

There is more on the impact of taxes on income in this ONS report, external, which calculates it in a different way, flattening the increase in the proportion of income spent on taxes as households get richer.

Later in the interview, John McDonnell also said: "Middle and low earners are being hit very, very hard by... income tax rises."

The basic rate of income tax has been 20% since 2008 and the higher rate has been 40% for longer than that. There have been additional rates introduced but they do not affect middle and low earners.

In 2010, the income tax personal allowance, which is the amount you are allowed to earn before paying any income tax, was £6,475. This year it is £11,500. That has clearly risen considerably faster than inflation, so for people paying the basic rate of income tax there has been a tax cut, while a higher proportion of low earners are not paying income tax at all.

The level of income at which people start paying the higher rate of income tax has not been rising as fast as the personal allowance, in fact it has fallen in some years since 2010, but only about 15% of income taxpayers pay higher rate, so they probably do not count as being low or middle earners.

- Published19 April 2017