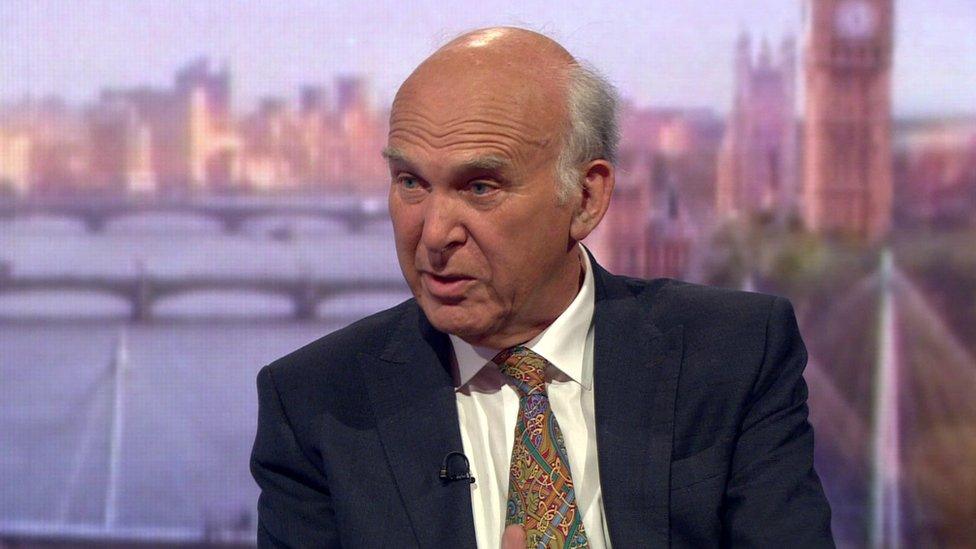

Vince Cable warns inherited wealth is fuelling inequality

- Published

- comments

The way "inherited wealth" is taxed must be overhauled to tackle widening inequalities and improve social mobility, Sir Vince Cable has said.

In his first big speech since becoming Lib Dem leader, he called for a review of taxes on property and other assets passed down the generations.

While taxing income more would be counter-productive, he said council tax is "outdated" and needs reform.

His comments come amid warnings that the UK's economic model is "broken".

In a new report, the IPPR Commission on Economic Justice - whose members include the Archbishop of Canterbury Justin Welby - is proposing a sweeping overhaul of corporate taxation and the role of the City in society, arguing structural change on the scale seen after World War Two and in the 1980s is now needed.

In a separate speech to the Resolution Foundation think tank in London, Sir Vince - who became leader in July - warned the tax system was entrenching inequality over generations.

'Jarring difference'

Citing this summer's Grenfell Tower fire as an event which illustrated the gap between rich and poor in the UK, he warned of a "new and worrying" pattern of worsening inequality which has halted the social mobility enjoyed by his and his parents' generations.

Sir Vince said that growing inequality of income, wealth and opportunity between classes, generations and regions of the country is damaging the UK's economy and fuelling social tension.

"Too much inequality is bad for us all," he argued. "Growing inequality is linked to poor economic performance, greater instability, more social tension, insecurity and unhappiness."

He suggested that inherited wealth - most overtly in the form of high-value properties passed down through generations of the same family - serves to "perpetuate inequality and inhibit social mobility".

"A serious review is needed of the set of taxes which are there to mitigate the sharp, jarring difference brought about by asset inflation and unearned income," he said. "We must tax wealth effectively."

The Lib Dems originally put forward the idea of a "mansion tax" on properties valued at more than £1m before abandoning the idea after going into coalition with the Conservatives in 2010.

The Conservatives have sought to ameliorate the tax burden on children inheriting homes from their parents, increasing inheritance tax relief earlier this year amid complaints that thresholds had remained static for a decade and many family homes were facing punitive charges.

Sir Vince, who served under former Conservative Prime Minister David Cameron as business secretary for five years, will make his first address to his party's annual conference as leader later this month.

- Published5 September 2017

- Published6 August 2017

- Published9 July 2017