HMRC celebrity 'blacklist' over tax avoidance backed by Cable

- Published

HM Revenue and Customs' reported policy of advising against giving honours to tax-avoiding celebrities has been backed by Sir Vince Cable.

Celebrities who use lawful but controversial schemes are being "blacklisted" to protect the reputation of the honours list, says the Times, external.

A Freedom of Information request showed a traffic light system was used to identify an individual's suitability.

The Liberal Democrat leader said HMRC's tough stance was perfectly reasonable.

"The principle is right, I think the public is fed up with abusive tax avoidance by individuals and companies," Sir Vince told the BBC.

He said: "It seems perfectly reasonable to me that the Inland Revenue should be taking a tough line on tax avoidance."

Sir Vince, a former business secretary, added that some celebrities may "wonder why they've been caught up in it" as they may be unaware they have been involved in "aggressive tax avoidance" because accountants handle their affairs.

HMRC analyses nominees for honours to check the risk of them being exposed over their tax affairs.

The FOI response revealed that people are categorised as green if they are low risk, amber for medium risk and red for high risk.

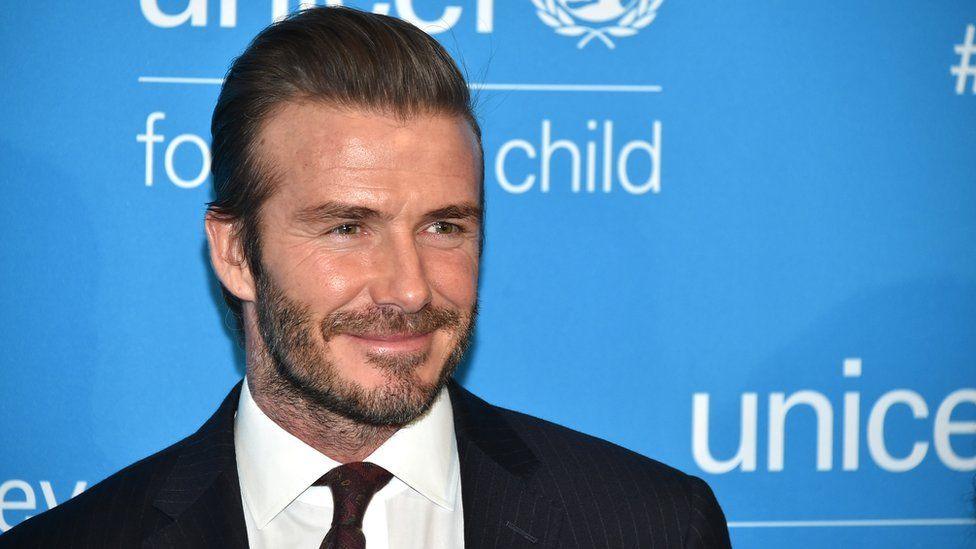

David Beckham is one of a number of celebrities who invested in a tax avoidance scheme which was successfully challenged by HMRC

The list is then sent back to the Cabinet Office honours committee and the prime minister via secure email.

An amber rating - given to individuals whose tax affairs would be "likely to cause adverse comment" - would damage their chance of receiving an honour, said the Times.

It added that the system was a "rare exception to the principle of taxpayer confidentiality".

A government spokesman said it was a "longstanding policy... to protect the integrity of the system".

Last year, leaked emails appeared to reveal David Beckham's frustration at missing out on a knighthood in 2013.

The 43-year-old was one of a number of celebrities who invested in a tax avoidance scheme which was successfully challenged by HMRC.

It is not known whether he was among the celebrities blocked by HMRC from receiving an honour as the Times describes.

How does the UK honours system work?

British honours are awarded on merit, for exceptional achievement or service.

The honours list, announced twice a year, consists of knights and dames, appointments to the Order of the British Empire and gallantry awards to servicemen and women, and civilians.

Anybody can nominate someone , external living in the UK that he or she judges to be deserving of an honour - but must provide a detailed explanation and submit two supporting letters.

Whether someone gets an honour - and at what level - is decided by a committee specialising in that field (eg sport, business, education etc) which sends its recommendations to the main honours committee, and then on to the prime minister and the Queen.

A document seen by the Times - which sets out the agreement between the Cabinet Office and HMRC - said that "poor tax behaviour is not consistent with the award of an honour".

It continued: "Trust would likely be lost if an honour was awarded to someone with negative tax behaviours and those behaviours became linked to the positive recognition that accompanies the award of an honour."

A government spokeswoman said: "Honours are given to reward outstanding service in a given field or area and each nomination is rigorously assessed.

"As a matter of longstanding policy, in order to protect the integrity of the system, government departments which may have an interest in a particular nomination - including HMRC - are invited to contribute their views during this process."

Nominees who are approved for honours meet the Queen or another senior member of the Royal Family at an investiture ceremony

This arrangement with HMRC was already highlighted on the gov.uk website , externalwhen the Times put in an Freedom of Information request to the government in January to seek more details.

Its question, submitted just after the publication of the New Year's Honours list, asked: "What rules and/or guidance are there in the honours system regarding the awarding of honours to people with criminal convictions and/or other potential flaws in their character, such as cheating at sport, drug taking, offensive behaviour?"

The Cabinet Office refused to give the paper the information and argued releasing vetting agreements with HMRC and the police could hinder the system.

Sir Vince said it was "reprehensible" that the government had resisted releasing the documents.

He said he was "surprised and disappointed" by the government's actions, which showed "it isn't too keen on transparency and that is clearly wrong".

After appealing to the Information Commissioner's Office, the Times was eventually given the documents.

The Cabinet Office has, however, refused to give copies of letters and forms sent to lord lieutenants - the Queen's representative in each county - who also take part in the vetting process when someone from their area is nominated.

Honours expert Richard Fitzwilliam said celebrities who may have been blacklisted over tax avoidance still deserved to be honoured for excelling in their particular fields as well as their charity work.

"No-one is condoning tax avoidance," the former editor of International Who's Who told the BBC.

He said: "There's nothing unlawful apparently in what has happened, clearly the honours system ought to take this into account."