Brexit: 'No alignment' with EU on regulation, Javid tells business

- Published

Sajid Javid said Brexit would impact businesses "one way or the other"

The chancellor has warned manufacturers that "there will not be alignment" with the EU after Brexit and insists firms must "adjust" to new regulations.

Speaking to the Financial Times, external, Sajid Javid admitted not all businesses would benefit from Brexit.

The Food and Drink Federation said it sounded like the "death knell" for frictionless trade with the EU and was likely to cause food prices to rise.

Mr Javid declined to specify which EU rules he wanted to drop.

The automotive, food and drink and pharmaceutical industries all warned the government last year that moving away from key EU rules would be damaging.

But Mr Javid told the paper: "There will be an impact on business one way or the other, some will benefit, some won't."

He said Japan's car industry was an example of a manufacturing sector which found success without following EU rules.

Asked how differing regulations between the UK and EU may impact industries such as automotive and pharmaceuticals, he said: "We're also talking about companies that have known since 2016 that we are leaving the EU.

"Admittedly, they didn't know the exact terms."

Deprived regions

Tim Rycroft, chief operating officer of the Food and Drink Federation, told BBC Radio 4's Today programme that "it sounds awfully like the death knell for the concept of frictionless trade with the EU".

He said it probably meant that food prices would rise when the transition period finishes at the end of this year.

Mr Rycroft acknowledged that some other industries might benefit from UK-specific trade rules. But he said: "We also have to make sure the government clearly understands what the consequences will be for industries like ours if they go ahead and change our trading terms."

The Confederation of British Industry (CBI) said it welcomed the chancellor's "ambitious" vision but said government should not feel it has an "obligation" to depart from EU rules.

Carolyn Fairbairn, CBI director-general, said for many companies, "particularly in some of the most deprived regions of the UK", keeping the same rules would support jobs and maintain competitiveness.

The Society of Motor Manufacturers and Traders said the automotive industry in the UK and EU was "uniquely integrated" and its priority was to avoid "expensive tariffs and other 'behind the border' barriers".

It said it was vital to have "early sight" of the government's plans so companies could evaluate their impact.

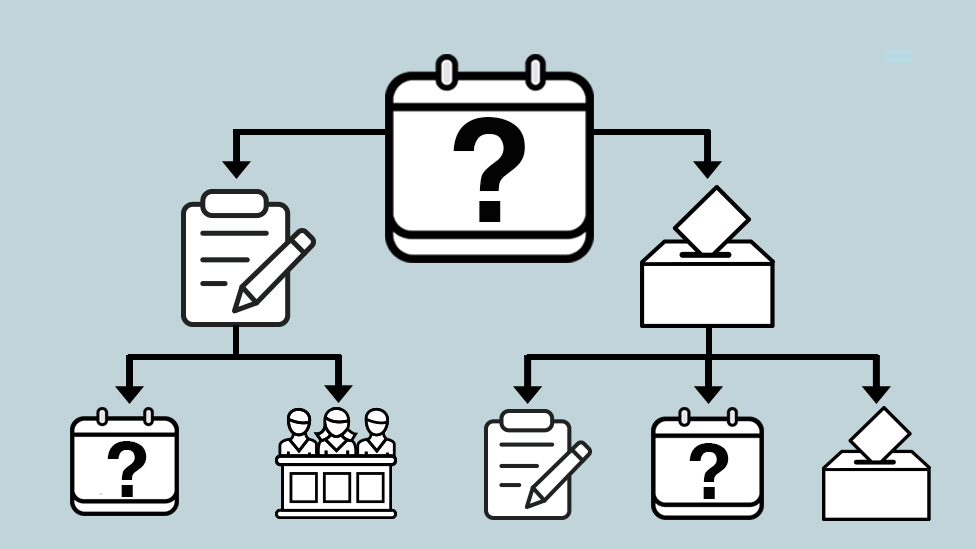

The government has not yet agreed a future trading relationship with the EU - it plans to do so in the 11-month transition period which begins after the UK leaves the bloc on 31 January.

During the transition period the UK will continue to follow EU rules and contribute to its budget.

'Here's the cash, use it'

The chancellor also said he wanted to double the UK's annual economic growth to between 2.7 and 2.8%.

However, the outgoing governor of the Bank of England, Mark Carney, told the Financial Times, external last week he thought the UK's trend growth rate was much lower, at between 1 and 1.5%.

Mr Javid said the extra growth would come from spending on skills and infrastructure in the Midlands and the north of England - even if they did not offer as much "bang for the buck" as projects in other parts of the country.

Historically low interest rates, which allow the government to borrow money relatively cheaply, were "almost a signal to me from the market - from investors - that here's the cash, use it to do something productive", Mr Javid said.

He pledged to rewrite Treasury investment rules, which have tended to favour government investment in places with high economic growth and high productivity.

Mr Javid said the rules had helped to "entrench" inequality and insisted weaker parts of the country would have first call on the new money.

In November, the Bank of England said a weaker global economy and its new assumptions about Brexit would knock 1% off UK growth over the next three years compared with its previous August forecast.

- Published3 December 2019

- Published13 July 2020

- Published17 January 2020