Budget 2020: Chancellor pumps billions into economy to combat coronavirus

- Published

- comments

The chancellor says his 2020 Budget offers the “largest sustained fiscal boost for nearly 30 years”

Chancellor Rishi Sunak has unveiled a £30bn package to boost the economy and get the country through the coronavirus outbreak.

He is suspending business rates for many firms in England, extending sick pay and boosting NHS funding.

In his first Budget speech, he warned of a "significant" but temporary disruption to the UK economy but vowed: "We will get through this together."

The Bank of England has announced an emergency cut in interest rates.

Mr Sunak, who was promoted to chancellor just four weeks ago after Sajid Javid quit the government, has had to hastily re-write the government's financial plans to deal with coronavirus.

"We are doing everything we can to keep this country and our people healthy and financially secure," he told MPs.

Of the £30bn in extra spending, £12bn will be specifically targeted at coronavirus measures, including at least £5bn for the NHS in England and £7bn for business and workers across the UK.

This is on top of other spending pledges that will amount to £18bn next year, and even more in following years.

The Office for Budget Responsibility (OBR) said extra spending on government departments and investment represented the biggest Budget "giveaway" since 1992, and will add around £100bn to public borrowing by 2024.

Labour leader Jeremy Corbyn said he welcomed many of the measures to "head off the impact" of coronavirus, which has now been labelled a pandemic by the World Health Organization.

But he said the extra money for the NHS was "too little, too late" and the UK was going into the crisis with its public services "on their knees" after years of Conservative cuts.

Measures to mitigate the effect of the coronavirus outbreak include:

Statutory sick pay for "all those who are advised to self-isolate" even if they have not displayed symptoms

Business rates for shops, cinemas, restaurants and music venues in England with a rateable value below £51,000 suspended for a year

A £500m "hardship fund" to be given to local authorities in England to help vulnerable people in their areas

A "temporary coronavirus business interruption loan scheme" for banks to offer loans of up to £1.2m to support small and medium-sized businesses

The government will meet costs for businesses with fewer than 250 employees of providing statutory sick pay to those off work because of coronavirus

Plans to make it quicker and easier to get benefits for those on zero hours contracts

Benefit claimants who have been advised to stay at home will not have to physically attend job centres

The number of coronavirus cases in the UK reached 460 on Wednesday, with an eighth person confirmed to have died after contracting the virus.

The chancellor said that without accounting for the impact of coronavirus, the Office for Budget Responsibility has forecast growth of 1.1% in 2020, the slowest rate since 2009.

EASY STEPS: How to keep safe

A SIMPLE GUIDE: What are the symptoms?

GETTING READY: How prepared is the UK?

MAPS AND CHARTS: Visual guide to the outbreak

TRAVEL PLANS: What are your rights?

PUBLIC TRANSPORT: What's the risk?

Despite speculation that he would ditch the framework on spending set by predecessor Mr Javid, Mr Sunak said his Budget is delivered "not just within the fiscal rules of the manifesto but with room to spare".

The chancellor has scrapped a planned cut in corporation tax and scaled back a tax break for entrepreneurs, saving £6bn over the next five years.

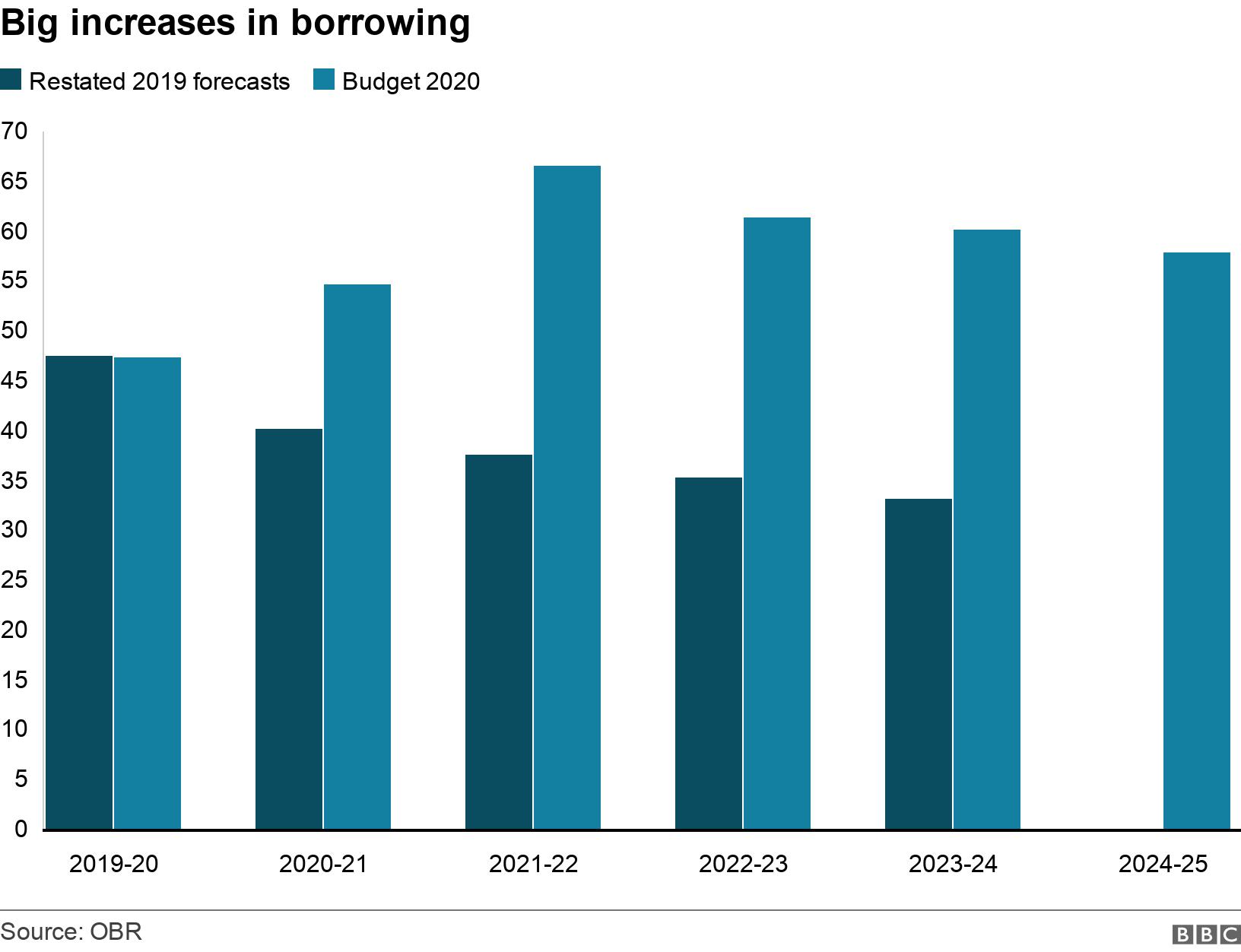

The spending in this Budget is being largely paid for with a big increase in government borrowing.

The government expects to borrow almost £100bn more in this Parliament (before mid-2024) than was expected the last time we had any forecasts.

And that figure does not include £12bn to be spent on getting the economy through the coronavirus outbreak.

The Treasury documents say that money will be accounted for in the next Budget in the autumn.

In other Budget measures, the chancellor announced that fuel duty would be frozen for another year.

A planned increase in spirits duty will be cancelled and duties for cider and wine drinkers in England will be frozen as well, but a packet of 20 cigarettes will cost 27p more.

The so-called tampon tax will be abolished, and VAT on books, newspapers, magazines and academic journals will be scrapped from 1 December.

And the chancellor pledged to more than double spending on UK government research and development by 2024.

Jeremy Corbyn: Talk of "levelling up" a "cruel joke"

The chancellor announced more than £600bn for road, rail, housing and broadband projects over five years, aimed at delivering on the Conservatives' election promise to boost economic growth outside of London and the south-east of England.

He announced plans for Treasury offices in Scotland, Wales and Northern Ireland and a "new economic campus in the north, with over 750 staff from the Treasury".

He also promised an additional £640m for the Scottish government, £360m for the Welsh government, £210m for the Northern Ireland executive and £240m for new city and growth deals.

Mr Sunak said he was providing £200m for local communities in England to build flood resilience and would double investment in flood defences.

The chancellor will deliver another Budget in the Autumn, with measures aimed at preparing the UK economy for post-Brexit trading arrangements with the EU.

Figures released by the Office for National Statistics found that the UK economy did not grow at all in January.

What questions do you have about the budget?

In some cases your question will be published, displaying your name, age and location as you provide it, unless you state otherwise. Your contact details will never be published. Please ensure you have read our terms & conditions and privacy policy.

Use this form to ask your question:

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or send them via email to YourQuestions@bbc.co.uk, external. Please include your name, age and location with any question you send in.

- Published11 March 2020

- Published11 March 2020