Stamp Duty: Labour condemns 'huge bung' in chancellor's changes

- Published

Labour has criticised the government's move on stamp duty, saying it gives a "huge bung" to second homeowners.

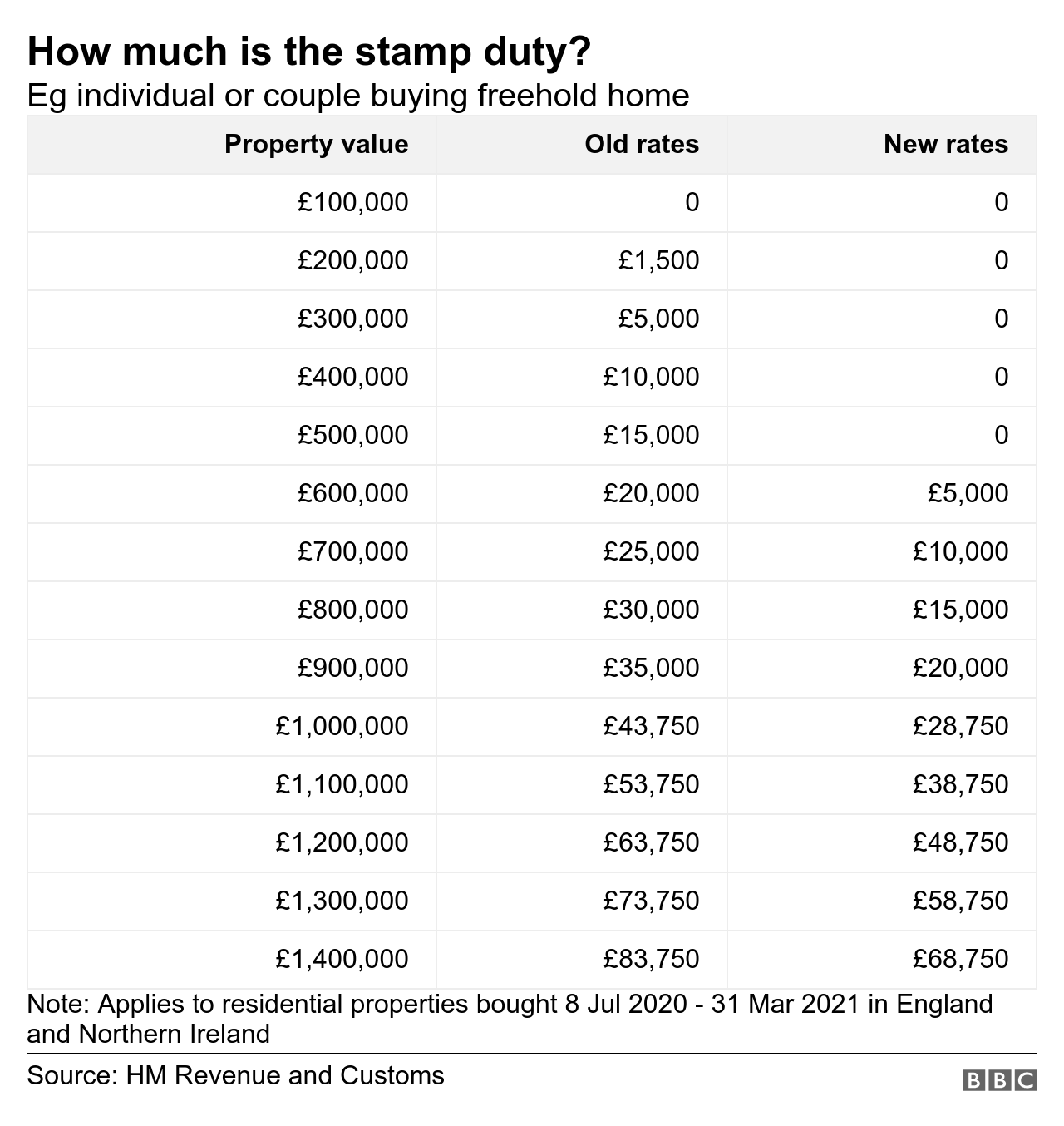

Chancellor Rishi Sunak announced a rise in the threshold on Wednesday - meaning people would not have to pay stamp duty for properties under £500,000.

Second homeowners will also benefit from the cut, although they will still pay stamp duty at 3% up to £500,000.

Labour said including the group would cost the taxpayer £1.3bn, which could be better spent elsewhere.

The party has written to Housing Secretary Robert Jenrick, calling for him to exclude second properties from the cut and use the money to fund local councils

A Treasury spokesman said the move would "help drive growth and support jobs across the house building and property sectors".

Mr Sunak announced a raft of measures during his summer statement, which he said would help boost the economy in the wake of the coronavirus crisis.

But Labour leader Sir Keir Starmer said some elements - such as the job retention bonus - should be "targeted in the areas which most need it, not across the piece".

Stamp duty holiday

Before Wednesday's announcement, stamp duty in England and Northern Ireland was paid on land or property sold for £125,000 or more, while first-time buyers did not pay on property up to £300,000.

Anyone buying a property higher than those prices would have to pay stamp duty, but people buying a second home - such as a rental or holiday property - would be charged an extra 3%.

Until 31 March 2021, stamp duty will now be axed for any buyer purchasing a property under £500,000 - but second home owners will still need to pay the 3% surcharge.

The next portion of the property's price (£500,001 to £925,000) will be taxed at 5%, and the £575,000 after that (£925,001 to £1.5 million) will be taxed at 10% - with the additional 3% added if it is a second home.

Labour said the new rules meant a "major reduction" in stamp duty for second homeowners at a cost of £1.3bn to the taxpayer.

The party said the money should be used to help cover gaps in local council funding, which the Local Government Association predicts will be £1.2bn by the end of 2020.

Shadow housing secretary Thangam Debbonaire said: "It is unacceptable that the chancellor tried to sneak out this huge bung to second homeowners and landlords while many are desperate for support.

"He should be targeting support to those who need it, not helping people invest in buy-to-let properties and holiday homes."

She added: "An unnecessary subsidy for second homeowners will only worsen the housing crisis by reducing the supply of homes overall."

'Drive growth'

A spokesman for the Treasury said the housing market had been "hit hard by the outbreak", adding: "We are doing everything we can to get the country moving again.

"Our cut in stamp duty will help drive growth and support jobs across the house building and property sectors.

"Those buying second homes or buy-to-let properties will continue to pay an additional 3% on top of the standard SDLT (Stamp Duty Land Tax) rates."