Will people already paying for care get extra help? And other questions

- Published

The government has set out its plans to fund social care and the NHS in England, with a new UK-wide health and social care tax.

The BBC's social affairs correspondent, Michael Buchanan, answers your questions about the proposals.

We have already spent more than £150,000 on my mother's social care after she was diagnosed with dementia in 2015, and have run through all her savings. She is physically well, aged 94, and is currently in a residential home which costs £5,500 per month. Will the new cap count for my mother? Or will we have to sell her house to continue funding her care? - Jane Russell

Under the government's proposals, people in England will no longer pay any more than £86,000 in care costs over their lifetime.

However, the cap will not be introduced until October 2023.

That means anyone currently in the care system will not benefit from these changes, as they will not be backdated.

So, if you cannot afford to keep paying for your mother's care from her savings - and no-one else lives in her house - then you may indeed have to sell it.

In fact, even once the cap has come into effect, people may still end up having to sell their house in the future. If they cannot pay the first £86,000 of care costs from their income or cash savings, it may be their only option to fund their share of the cost.

However, to avoid people being forced to sell their property during their lifetime, the government wants to extend the use of so-called deferred-payment agreements (DPAs).

A DPA is a loan that covers care costs up front. It is only paid back when the person dies and their home is sold to repay the loan. However, the loan is usually paid back with interest, and other fees - such as administration costs - may also apply.

Under the new proposals, will I have to pay National Insurance if I work after state retirement age? - Mary Petchey, Suffolk

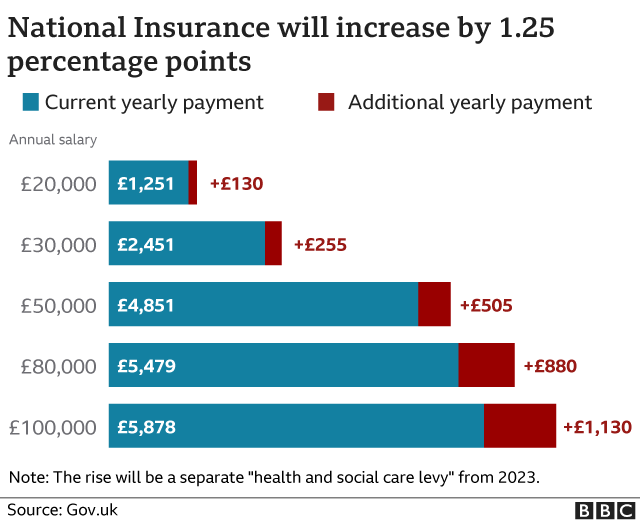

In the year from April 2022, everyone in the UK who currently pays National Insurance will have to pay an extra 1.25% contribution. Under the current system, people over retirement age who are still working, don't have to pay this.

However, from April 2023, this extra contribution will no longer be taken from National Insurance, but will be part of a new separate tax called the Health and Social Care Levy.

From that point, anyone working after pension age will have to pay the extra tax. The government will bring in new legislation for this change to happen.

Meanwhile, at the same point, National Insurance rates will revert to their current levels.

Will the 1.25% national insurance contribution rate increase announced today apply to both employees' and employers' contributions? - Alex Tottle

Reality Check's Tom Edgington writes:

Yes, the new Health and Social Care Levy will apply to employees and employers - they will each pay an extra 1.25%.

The changes will take effect from April 2022, and for the first year this extra amount will appear as an increase in National Insurance.

From April 2023, the extra amount will appear as a separate "Health and Social Care Levy" deduction on payslips, and will be paid by both employees and employers.

The government says the changes will cost £255 a year for someone earning £30,000, and £505 a year for someone on £50,000.

We are being told that the new 'lifetime' ceiling of £86,000 for care costs does not include accommodation. So are we expected to continue paying for accommodation at care homes and, if so, what is this likely to cost? - Peter Harrison

The £86,000 cap is indeed solely focused on care costs. Under the new system care home residents in England will be expected to contribute towards their accommodation, food, water and energy costs.

The government hasn't announced yet if these will be capped.

When the independent Dilnot Commission made very similar social care proposals in 2011, it suggested these additional costs should be in the range of £7,000 to £10,000 per year, which, accounting for inflation, would be up to £12,500 today.

So social care in England is going to be funded by Welsh and Scottish taxpayers? - Wayne Putterill

The tax rises will apply across the UK, and will raise £12bn a year. However, £2.2bn a year will then be given to the governments in Scotland, Wales and Northern Ireland - that's 15% more than what each nation will raise through the levy.

The Institute for Fiscal Studies says this is because earnings in the devolved nations are lower than England.

It will be up to each government in Edinburgh, Cardiff and Belfast to decide how to spend their share of the tax raised. Health and social care are devolved matters, so it's not up to Westminster to tell the other nations how they have to use the money.

The UK government says the £5.4bn investment in England's social care system announced alongside the care changes will be paid for by taxpayers in England.

Under current social care rules an individual is permitted to retain around £23,000. Under the new arrangements is this level protected, reduced, increased or gone? - Roger Smith

Under the current English system, people pay their care costs in full if they have savings or other assets worth over £23,250.

Under the new system, if someone is assessed as having care needs, then the government will pay all costs if the person has £20,000 or less.

If people have between £20,000 and £100,000, they will have to make a tapered contribution.

What would the impact be for people with both physical and hidden disabilities such as mental health, in particular on families who may have to work part-time due to an illness? - Rebecca Daunt

The cap on care costs of £86,000 is a lifetime cap, applying to young disabled people who may need decades of care, as well as those perhaps nearing the end of their lives.

A person of working age who has a job will have to pay the extra levy if they earn more than £9,568 (in 20212/22), but they could benefit from other aspects of the changes if they need care.

We have been paying for social care through our Council Tax. Will the Adult Social Care Precept disappear or will we be paying twice? - Henry Mason

The social care precept was introduced in 2016. It allows councils in England to charge an additional amount of council tax to pay for social care costs.

Between 2016/17 and 2020/21, they could add 2% to council tax bills to pay the costs. For 2021/22, councils could add 3%. The government says it will publish details on the precept in the Spending Review next month.

Is it going to be mandatory for Health and Social Care staff working in care homes to be vaccinated? - Adam Lee, Spixworth, England

In England, it will be mandatory for all care home staff to be vaccinated from 11 November, 2021.

The other nations do not have similar plans.

Do you have any questions about the announcement? Please email haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.

Related topics

- Published20 November 2022

- Published6 November 2022

- Published28 June 2021