Is Rishi Sunak a tax-cutter?

- Published

The chancellor is preparing for Wednesday's Spring Statement

Boris Johnson and Rishi Sunak have proudly described themselves as "tax-cutting Conservatives".

They claim, like most members of their party and its supporters, that as far as possible individuals and not the government should decide how to spend their own money.

As the chancellor gives an update on the economy in the Spring Statement, while households face acute financial pressure, there is an expectation on him to match his words with actions.

But the government's record so far suggests that cutting taxes is not always Mr Sunak or the prime minister's first instinct.

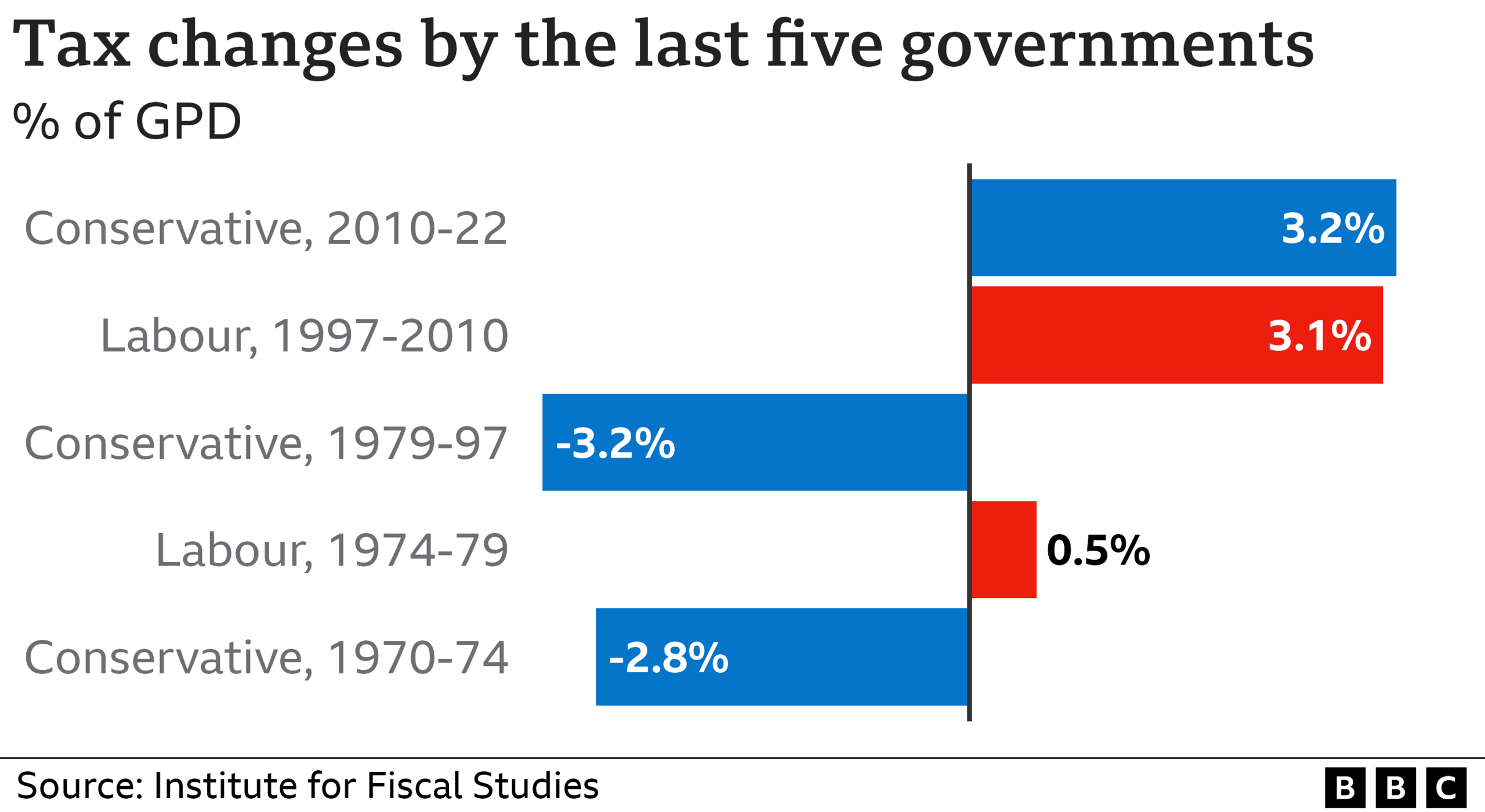

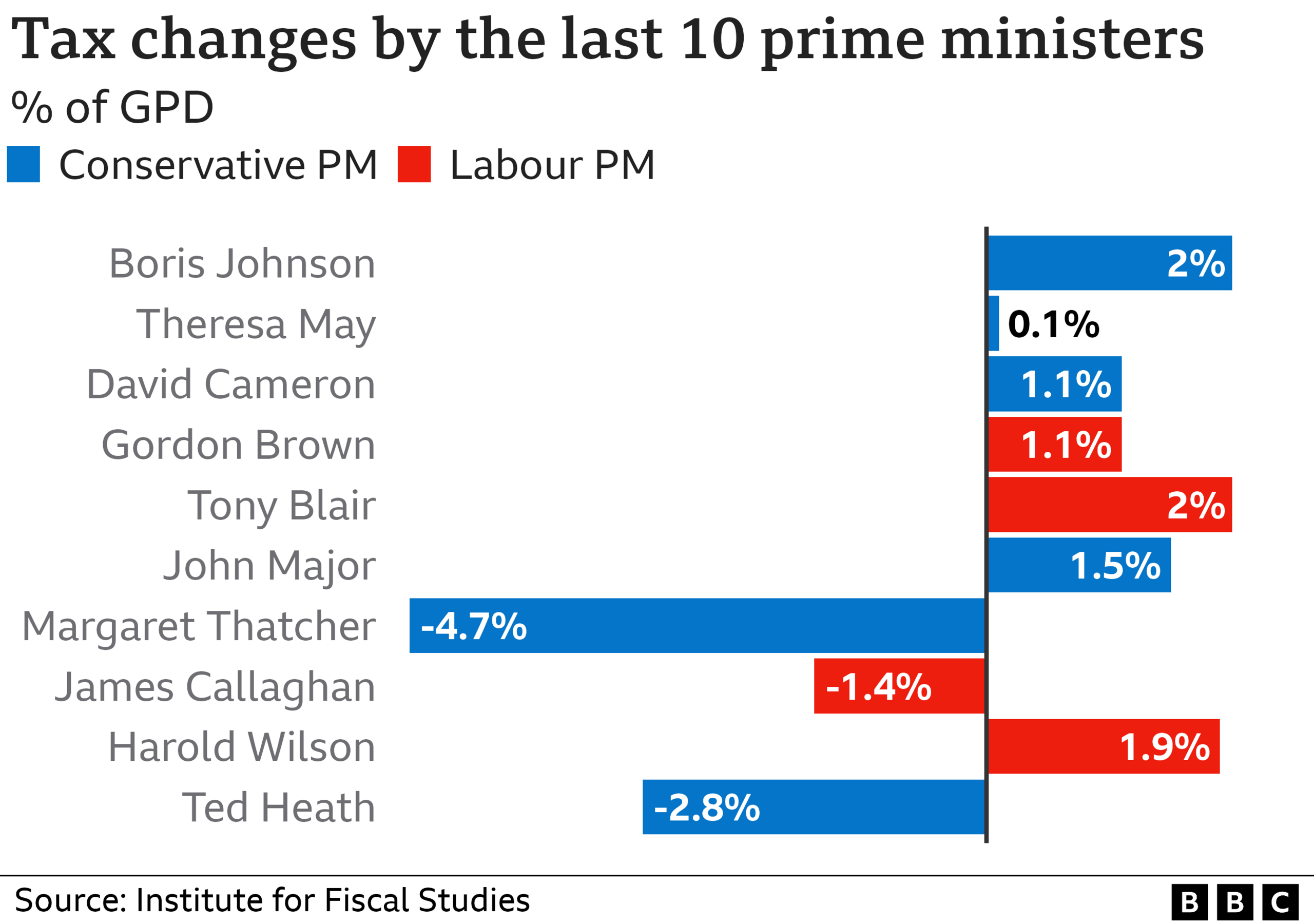

Figures compiled by the Institute for Fiscal Studies, external show how far taxes have risen under Boris Johnson as prime minister and during the Conservatives' time in power since 2010.

As a proportion of the economy, taxes have gone up as much as they did during Labour Prime Minister Tony Blair's time in power and more than the previous three Conservative leaders.

Tax rises under the Conservatives since 2010 have outstripped the previous Labour government's and contrast starkly to an overall reduction during Margaret Thatcher's tenure.

There are many caveats to these broad headline figures, not least the pandemic which prompted huge state intervention - and the fact that Boris Johnson's government may yet cut taxes on several fronts.

But as the IFS notes, the trajectory for now is upwards: "If the chancellor's plans remain unchanged, next month will mark the beginning of a steep ascent in the path of UK taxation."

Both the chancellor and prime minister have cited the pandemic as justification for an increase in taxes.

Rishi Sunak has said that while he "firmly believes in cutting taxes", he had to take "difficult decisions" to get the economy back on track post Covid.

But some argue that even before the pandemic there was clear evidence of political decisions being behind the trend toward higher taxation.

"The rising tax burden is not purely, or even primarily, a response to Covid. Mr Johnson had announced an end to austerity in 2019," Helen Miller, deputy director of the IFS told the BBC.

"There were already various pressures to spend more, including to provide more healthcare for an ageing population, to meet the net zero pledge and to achieve the levelling-up agenda.

"Mr Johnson has now chosen to permanently increase taxes in order to fund a permanently larger state."

The rise in National Insurance contributions due to take effect in April has become a test case for the tolerance of Conservative MPs to higher taxes.

While most agreed on the need to fund the NHS and social care, many have questioned the timing of the rise earmarked to pay for it and argued for the policy to be scrapped or delayed.

The chancellor and prime minister committed to going ahead with the rise, but it's possible that the threshold could be changed to protect those on lower incomes from paying it for now.

Among other things Tory backbenchers would like to see are a cut in fuel duty, a reduction in the rate of VAT or environmental taxes on energy bills being scrapped.

Rishi Sunak has pledged to "stand by" households feeling the squeeze, but the Spring Statement is not usually the time for big tax and spending decisions.

In fact, any major tax cuts are far more likely to come closer to a general election.

Related topics

- Published20 March 2022