Chancellor Rishi Sunak defends wife Akshata Murty in row over non-dom status

- Published

Rishi Sunak has defended his wife's tax affairs, calling reports on her non-domicile status "unpleasant smears".

Akshata Murty opted to claim non-dom status, meaning she does not have to pay UK tax on her overseas income.

The BBC estimates she would have avoided £2.1m a year in UK tax.

The non-dom scheme is legal but Labour says it would be "breathtaking hypocrisy" if the chancellor's wife had reduced her tax bill as he raised taxes for millions of workers.

In an interview with the Sun newspaper, external, Mr Sunak said he believed he was the victim of a campaign to discredit him, saying: "To smear my wife to get at me is awful."

No 10 has rejected newspaper reports that its staff are leaking damaging material about the chancellor to the media.

And Prime Minister Boris Johnson, holding a joint Downing Street press conference with German Chancellor Olaf Scholz, said: "If there are such briefings, they are not coming from us in No 10, and heaven knows where they are coming from. I think that Rishi is doing an absolutely outstanding job."

Ms Murty, an Indian citizen, owns a 0.9% stake in Infosys, the software giant founded by her billionaire father. Her stake fluctuates in value but is estimated to be worth more than £500m.

She receives annual dividend payments on the shares, which last year were reported to be worth £11.6m , external.

On Thursday, it emerged that Ms Murty pays £30,000 a year to maintain her non-domicile status, meaning she does not pay tax in the UK on her overseas earnings.

Under the rules, people can be granted non-dom status if they live in the UK but intend to return home.

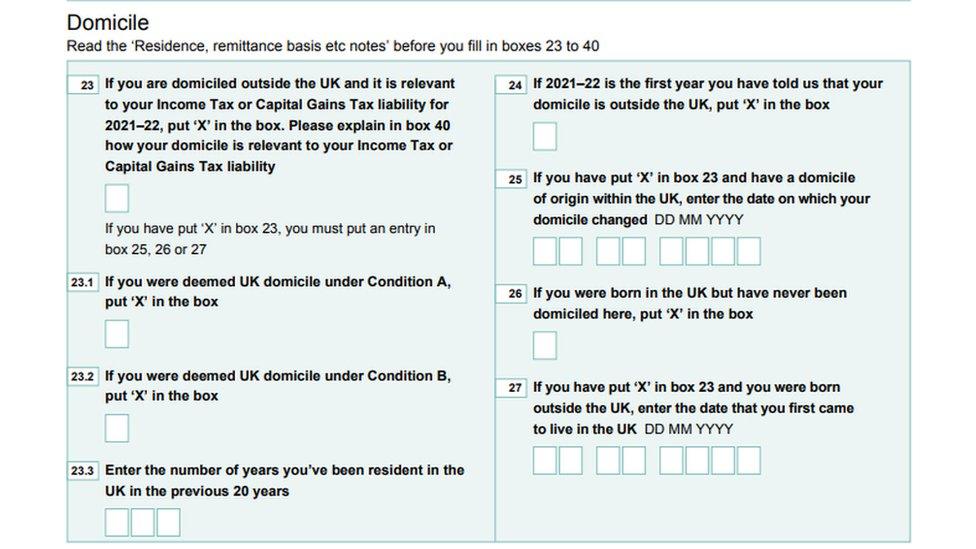

This is the government form people use to apply for non-dom status

Mr Sunak insisted his wife had not broken any rules, telling the Sun: "Every single penny she earns in the UK she pays UK taxes on... and every penny that she earns internationally, for example in India, she would pay the full taxes on that," he said.

He said it was unfair to attack his wife when she was a "private citizen", adding: "I'm an elected politician. So I know what I signed up for."

Mr Sunak said his wife was domiciled in India and would eventually return there to care for her parents as they got older.

Labour has written to the chancellor to ask if his wife paid all foreign tax in India or in a tax haven such as the Cayman Islands. The party has also asked the chancellor if he benefits from his wife's tax arrangements.

The Liberal Democrats have urged Mr Sunak to ban the partners of ministers from claiming non-dom status, calling it a "loophole".

How much tax might Akshata Murty have avoided?

As the owner of a 0.93% stake - thought to be worth around £700m - in her father's company, Askshata Murty would receive £11.5m in annual dividends from her investment.

The UK normally taxes such dividends at 39.5%, but because Infosys has its headquarters in India and Ms Murty herself is an Indian citizen, the Indian government would levy a 20% tax of its own.

As you can't be double taxed, that would leave HM Treasury with the right to demand a remaining 19.5%, or £2.1m a year.

Ms Murty has had shares in the company since at least 2015 and so may have avoided £15m in UK taxes.

Non-dom status expires after 15 years, but thanks to a treaty signed between the UK and India in the 1950s, Indian citizens can still be considered non- domiciled when it comes to inheritance tax, levied on someone's estate.

The treaty stopped Indians from being double-taxed when they died.

In the 1980s, India abolished inheritance tax, but this treaty was never changed. This means Ms Murty can expect to pay no inheritance tax at all on her father's multi-billion-pound fortune.

Meanwhile, the Treasury has not denied suggestions that Mr Sunak used to hold a US green card, allowing people to live and work permanently in that country.

It has been reported he had a green card - the holder of which must pay US tax on their worldwide income - when he joined the government in 2017 and did not relinquish it until after he became chancellor in 2020.

A Treasury source would not say when Mr Sunak gave up his card.

The chancellor graduated from Oxford University in 2001 and then worked for investment bank Goldman Sachs until 2004.

After that, he studied for a master of business administration (MBA) post-graduate degree at Stanford University, California, from 2004 to 2006, where met fellow student Ms Murty. The couple married in 2009 and have two daughters.

What is a non-dom?

A non-dom is a UK resident who declares their permanent home, or domicile, outside of the UK.

A domicile is usually the country his or her father considered his permanent home when they were born, or it may be the place overseas where somebody has moved to with no intention of returning.

For proof to the tax authority, non-doms have to provide evidence about their background, lifestyle and future intentions, such as where they own property or intend to be buried.

Those who have the status must still pay UK tax on UK earnings but do not need to pay UK tax on foreign income. They can give up their non-dom status at any time by stating on a tax return that they intend to live in the UK and wish to be considered British for tax purposes.

Ms Murty has chosen to be domiciled in India via her father, the billionaire Narayana Murty, which means she doesn't need to pay taxes in the UK on dividends she receives from her stake in his company.

Related topics

- Published7 April 2022