Tax energy bosses' bonus 'bonanza', say Lib Dems

- Published

Oil and gas bosses should face a one-off "bonanza bonus" tax on the millions they have made from high energy bills, the Liberal Democrats say.

The party is also calling for a £500 hike in household energy bills to be dropped and for them to be cut instead.

The government's Energy Price Guarantee goes up from £2,500 to £3,000 in April.

Chancellor Jeremy Hunt has said extra support is unlikely because the government does not have enough "headroom" with the public finances.

Mr Hunt has rejected calls to halt the increase in energy bills when he delivers his Budget on 15 March.

A government spokesperson said: "The typical household has received £1,300 to help with energy bills this winter, and we are focusing support on the most vulnerable with hundreds of pounds in direct cash payments to millions of vulnerable households this year and next, a record increase in the National Minimum Wage, and a 10% uplift in working-age benefits and the state pension."

Labour has called on the government to freeze energy bills through to July. to be funded through an increased windfall tax on energy company profits.

But the Lib Dems are arguing that bills should be cut, with leader Sir Ed Davey saying further increases would be a "hammer blow" for struggling families.

Recent sharp falls in wholesale gas and electricity prices have raised hopes that the worst of the energy crisis could be receding.

'Super-profits'

Last week, energy analysts Cornwall Insight forecast that a typical household bill would fall to £2,153 in July.

The Liberal Democrats have previously called for a windfall tax on what they called the "super-profits" of oil and gas companies, which they say would raise at least £15bn more than the government's current Energy Profits Levy.

They are now arguing for a one-off-levy on the bonuses awarded to oil and gas executives, similar to the bankers' bonuses tax in 2009/10 in the aftermath of the financial crisis. This taxed bank bonuses over £25,000 at 50%.

According to the party, senior executives at BP and Shell received more than £17m in salaries, bonuses and pensions last year, and BP chief executive Bernard Looney received bonuses and benefits totalling nearly £3m.

The government spokesperson said there was already a 75% corporate tax rate,"which strikes a balance between funding significant cost of living support for families and businesses, while encouraging investment into the North Sea to bolster the UK's energy security".

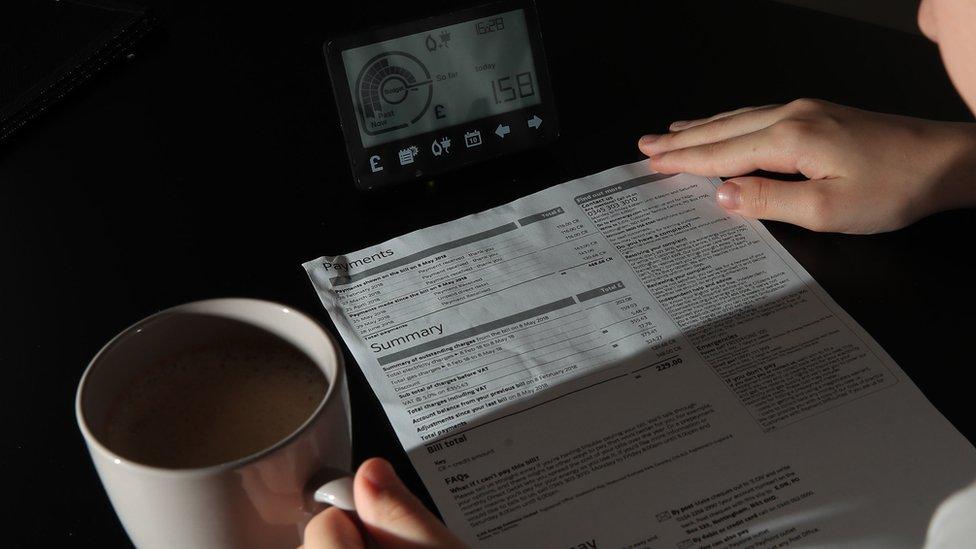

Under the current Energy Price Guarantee (EPG), a household using a typical amount of gas and electricity pays £2,500 a year.

It was launched in October by then-prime minister Liz Truss and was intended to last for two years, before the government said it would end in April.

Mr Hunt then said it would continue, but at £3,000 a year from that date until April 2024.

Liberal Democrat leader Sir Ed Davey is urging the government to cut energy bills, instead of increasing them in April

Instead of raising the level of the EPG, the Lib Dems say average energy bills should be reduced to £1,971 - their level in April 2022 - saving the average household an estimated £400 over the next 12 months.

They want extra support for the least well-off, including doubling the Warm Homes Discount to £300.

Additional funds

The party is also calling on the government to abandon its plans to slash energy bill support for businesses, schools and hospitals by 85%, and to extend current levels of support for another six months.

The Lib Dems say their plan would mainly be funded by money already budgeted for energy support, but not spent because wholesale energy prices have since fallen.

Additional funds would be raised, they say, by their proposed windfall tax on oil and gas companies' record profits.

Sir Ed said: "If there's no extra energy help for businesses, it will be more than salad and vegetables in short supply as firms as well as farms are forced to close.

"To add insult to injury, it's just obscene that Rishi Sunak is happy for energy bosses to rake in millions of pounds in bonanza bonuses, while families struggle to put food on the table or heat their homes."

- Published10 February 2023

- Published22 January 2023