Free childcare expanded to try to help parents back to work

- Published

Free childcare for working parents in England will be expanded to cover all children under five by September 2025, as the chancellor looks to get more parents back to work.

The move could allow 60,000 more parents of young children to enter the workforce, according to the government's independent forecaster.

Some 1.3 million people in the UK were unemployed in December 2022.

The new help for parents will be introduced in stages.

Eligible working parents of two-year-olds will get 15 hours of free childcare per week from April 2024

Children between nine months and two years old will get 15 hours of free childcare from September 2024

All eligible under-5s will get 30 hours of free childcare from September 2025

The plans are part of a government drive to boost economic growth.

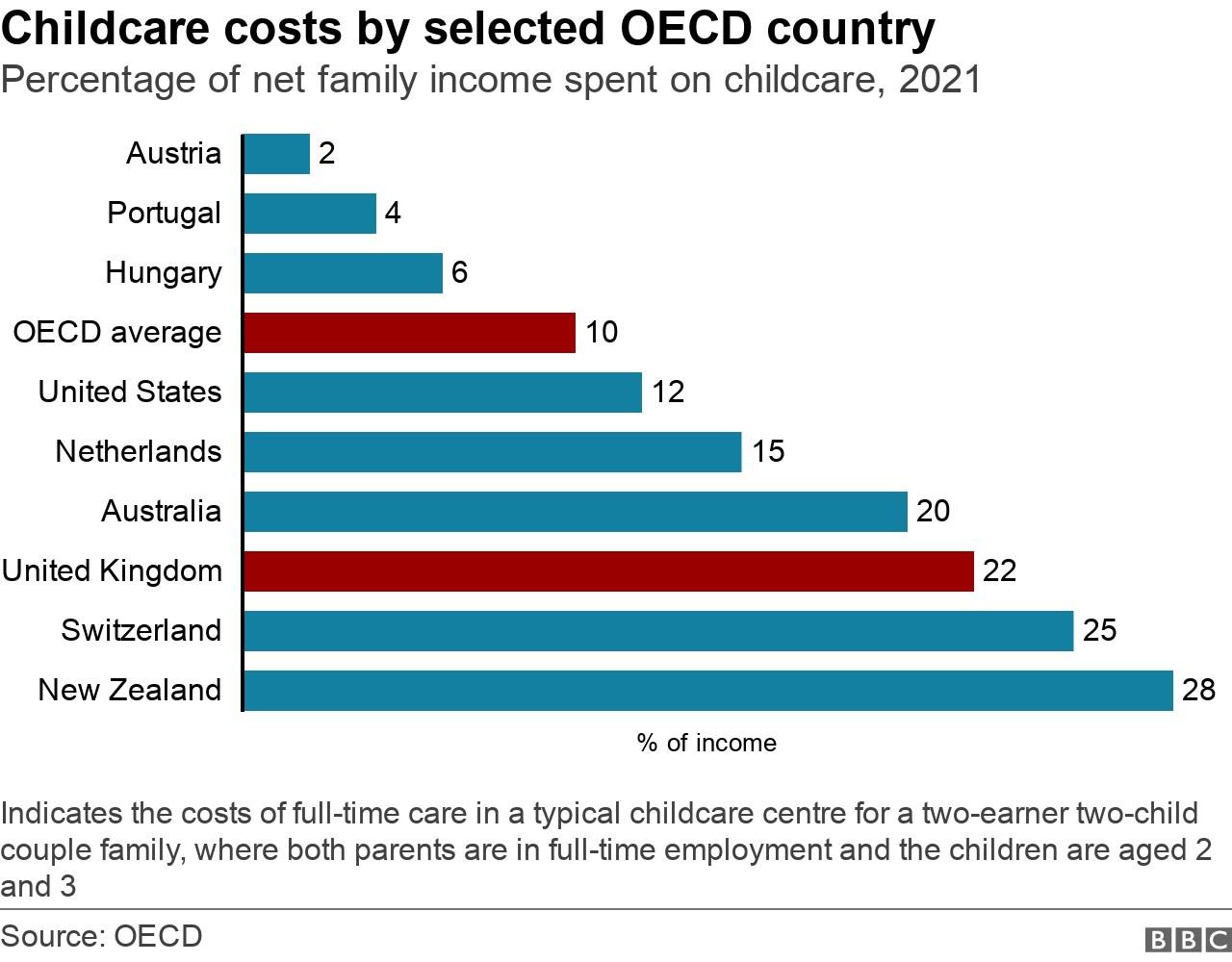

Childcare in the UK is among the most expensive in the world and the government has been under pressure, including from some of its own MPs, to provide more help for parents.

The rising cost of childcare has been widely seen as a deterrent for some parents to go back to work or work full time.

The extension of free childcare has been lobbied for by business group the CBI, which calculates that while it will cost several billion pounds, it could raise up to £10bn in further revenue by increasing the number of parents able to work.

However, Paul Johnson, director of the Institute of Fiscal Studies (IFS), doubted it would make "a big difference".

"The childcare package is expected to only get a few tens of thousands more mothers, mostly, back into work," he told the BBC.

"We know a lot of people don't even take up what they're entitled to among the three and four-year-olds."

While the chancellor has increased the amount of free childcare available for pre-school children, nurseries have been calling for more money to pay for those children who already get government-funded provision.

Jeremy Hunt said he would increase that funding "by £204m from this September rising to £288m next year. This is an average of a 30% increase in the two-year-old rate this year".

We got in touch with the Treasury to ask for more details and they told us that the amount paid for two-year-olds is going up from £6 to £8 an hour, which is what the chancellor was referring to.

But funding for three and four-year-olds is going up from £5.29 to £5.50 an hour, which is only about 4%.

The IFS estimated this afternoon that the extra £288m is about a 7.5% increase in the current budget.

The government will also introduce changes to the staff-to-child ratios - moving from one carer for every four children to 1:5 to align with Scotland.

Supporters of the idea say it could help cut costs for parents.

However, the Early Years Alliance, which represents around 14,000 childcare providers in England, said relaxing ratios was a "shameful decision" which risked compromising safety and quality of care, as well as putting more pressure on the workforce during "a severe staffing crisis".

The organisation's chief executive, Neil Leitch, also raised concerns about whether there would be enough childcare places to meet increased demand.

"At a time when settings are closing at record levels and early educators are leaving the sector in their droves, unless the proper infrastructure is put in place by the time the extended offers are rolled out, many parents of younger children expecting funded places to be readily available to them are likely to be left sorely disappointed," he said.

Other measures announced by Chancellor Jeremy Hunt included:

Extending support for energy bills at current levels for a further three months

The cap on how much workers can accumulate in their pensions savings over their lifetime before having to pay extra tax will be abolished

The 5p cut to fuel duty on petrol and diesel, due to end in April, will continue for another year

A planned increase in the main rate of corporation tax, paid by businesses on taxable profits over £250,000, will go ahead - from 19% to 25%

How will you be affected by the issues in this story? Share your experiences by emailing haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.

Related topics

- Published12 March 2023

- Published15 March 2023

- Published16 March 2023